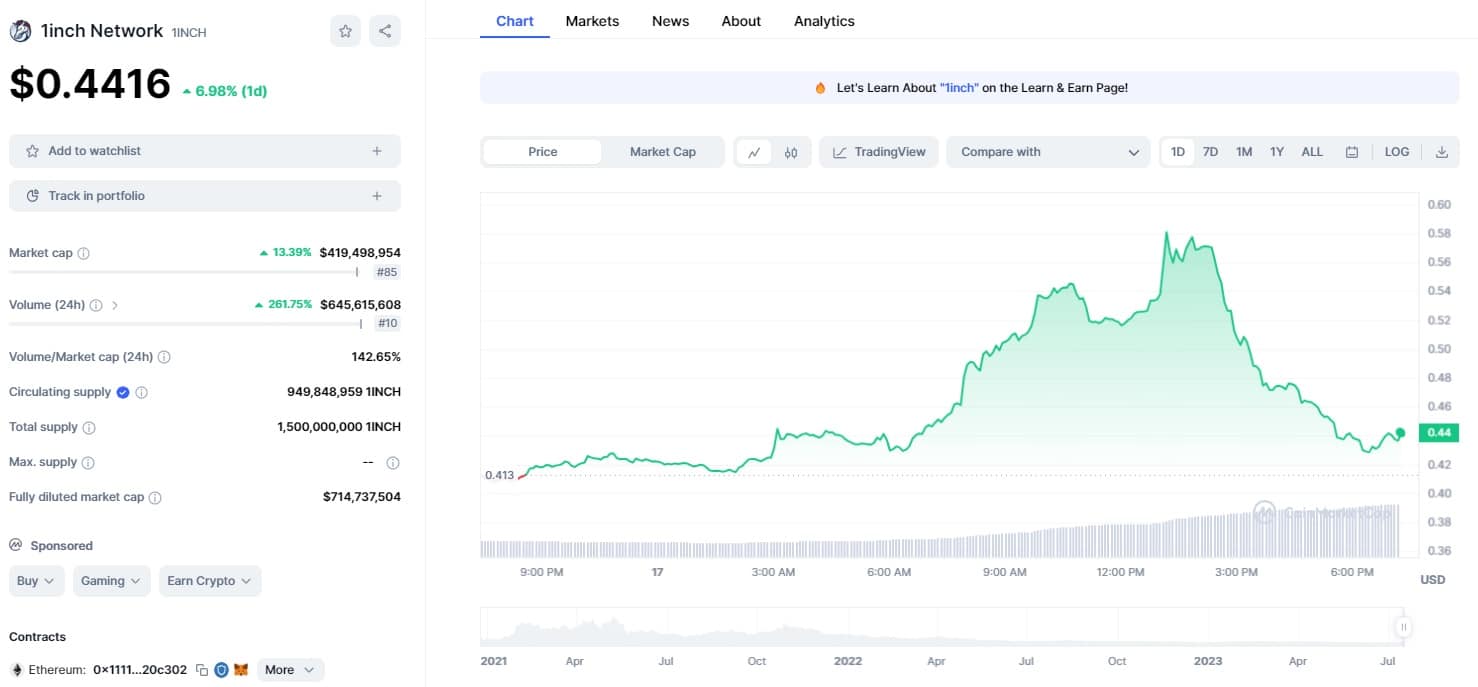

1Inch Network Token Surges 55% In One Week, Is Altcoin Season Back?

Price of (1INCH), the native token of the 1INCH Network increased by more than 58% before falling on Monday as trade volume reached $597 million, the biggest amount since October 2021. Leveraged 1inch short bets worth $3.37 million have been closed off over the last 24 hours, according to CoinGlass, along with a surge in trading volume.

1Inch Price Spikes Amid Market Correction

The price of the token is currently $0.439, up more than 6% in a single day. While Bitcoin continued to trade in a constrained band between $30,150 and $30,500 over the weekend, the rest of the market remained comparatively quiet with little activity.

The price of the 1INCH cryptocurrency has been progressively increasing over the last week, and it ended with a stunning increase of 42.3%. The primary declining trendline for the altcoin is marked on the chart, and that is what the bulls are presently attempting to surpass.

Bull Show All Over The Altcoin

The desire of buyers to acquire 1INCH tokens has generated a large increase in trading volume of around 400% overnight. The Correlation Coefficient indicator shows that BTC has less of a lead over 1INCH, with a 0.04 reduction in the CC indicator. Despite the sideways trend of BTC, purchasers are anticipated to increase the altcoin’s value.

The most recent rally coincides with a significant increase in trading volume in South Korea, a phenomenon seen during the price increases of both Bitcoin Cash (BCH) and Aptos (APT) in the previous two weeks.

According to CoinGecko data, 1inch was the second most traded coin on Upbit with a 24-hour volume of $360 million, which is more than 15 times the coin’s 30-day average trading volume.

Coinglass statistics show the price increase since yesterday led to short liquidations in the perpetual swap markets worth $2.49 million.

What Is Making The DeFi Bulls Come Out?

The surge is not being driven by any recent news, but 1inch’s rally seems to be continuing the upward trend that XRP started when it won its legal battle with the SEC last week. A day after XRP had a 102% increase, other assets including Solana, Cardano, and Polygon also moved.

According to Coinalyze, the open interest across 1inch trading pairs has increased from $14 million to $125 million, which indicates that the rally has been supported by futures markets. Open interest represents the nominal amount of open derivatives contracts

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs