Breaking: 21Shares Amends Sui ETF with Staking, Nasdaq Listing, Other Key Details

Highlights

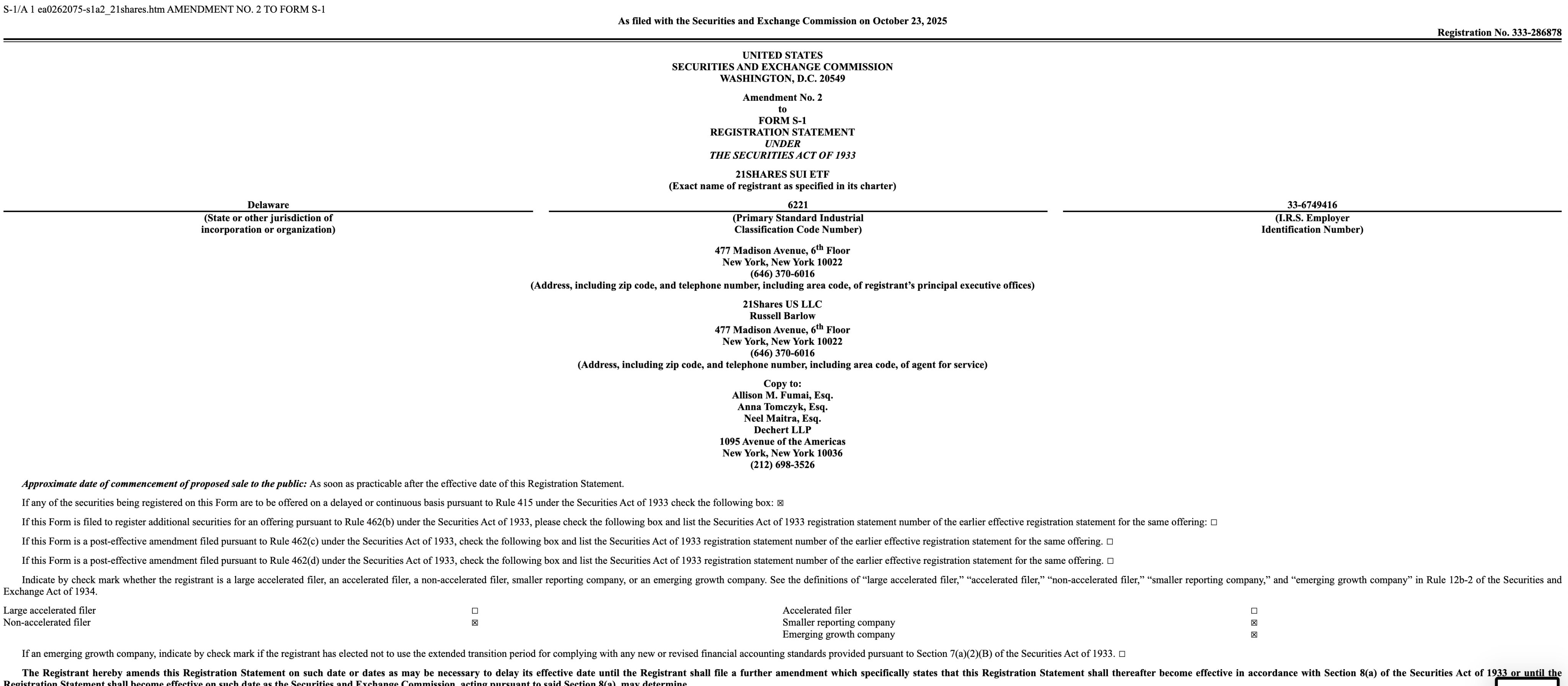

- 21Shares filed an amended S-1 for its spot Sui ETF application.

- The issuer updates its Sui ETF with staking details, along with confirmation on Nasdaq listing.

- SUI price jumps 2.50% in just an hour in response to ETF filing.

21Shares updates its Sui ETF application with the U.S. Securities and Exchange Commission (SEC). The issuer mentions several key details related to staking, Nasdaq as the exchange for listing and trading its shares, and a cash custodian, among others.

This comes amid the ETF buzz as the crypto market awaits the commission’s final decisions on various applications. The delay due to U.S. government shutdown wipes out positive sentiment.

21Shares Updates Staking Details in Sui ETF

According to a US SEC filing, 21Shares filed a second amended S-1 for its spot Sui ETF application after the market close on October 23. The issuer updates its Sui ETF with crucial information, but there is no mention of the ticker and fees.

The amended filing added a whole new section about staking. “Staking of Trust’s Assets” highlighted parameters of the trust’s staking model. This included staked assets’ unbonding period, redemption patterns, size of the trust & concentration, staking services provider performance, and market conditions monitoring.

Also, it pointed out that 21Shares US LLC has entered into a staking services agreement with Coinbase Crypto Services. The platform will handle staking, validating, generating or approving blocks of transactions for an initial term of two years for the 21Shares Sui ETF.

21Shares Sui ETF to List on Nasdaq

21Shares updated the filing by mentioning Nasdaq as the exchange for listing and trading shares. The issuer added The Bank of New York Mellon as cash custodian, with Coinbase Custody as custodian.

The details about the transfer agent, marketing agent, and others are yet to be revealed by the issuer. If approved, the Sui ETF will track the performance of SUI, as measured by the performance of the CME CF Sui Dollar Reference Rate.

As CoinGape reported earlier, the SEC delayed its decision on the 21Shares Sui ETF as the commission was working with major exchanges on generic listing standards for spot crypto ETFs.

SUI Price Pumps Over 2%

SUI price jumped 2.50% in just an hour in response to the amended S-1 ETF filing by 21Shares, with the price currently trading at $2.47. The 24-hour low and high are $2.40 and $2.50, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating interest among traders.

The derivatives market showed massive buying in the last few hours, as per CoinGlass data. At the time of writing, the total Sui futures open interest jumped 3% to $823 million in an hour. The 24-hour Sui futures OI was up more than 7%. This confirms positive sentiment among derivatives traders.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- TRON Price Bounces as SEC Drops Lawsuit Against Founder Justin Sun

- Top Crypto Exchanges to Trade Tokenized Real World Assets – Best Picks Reviewed

- Arthur Hayes Says Rising Oil Prices to Trigger Fed Money Printing, How Bitcoin Could Move?

- Crypto Market Bill Eyes Late March Markup as Key Senate Roadblocks Begin to Clear

- U.S. Federal Reserve, OCC Approves Banks to Handle Tokenized Securities With New Capital Rules

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs