Breaking: 21Shares to Launch Sixth Spot Solana ETF Today After Final SEC Filing

Highlights

- 21Shares has filed its final prospectus with the SEC, could see its Solana ETF launch today.

- This makes it the sixth Solana spot ETF in the U.S. market.

- Solana ETFs continue to see strong inflows despite SOL’s price dropping.

21Shares will launch its Solana ETF following a final filing with the SEC. It would be the sixth such SOL fund to hit the market after a recent spate of launches by other asset managers.

21Shares To Launch Sixth Solana ETF

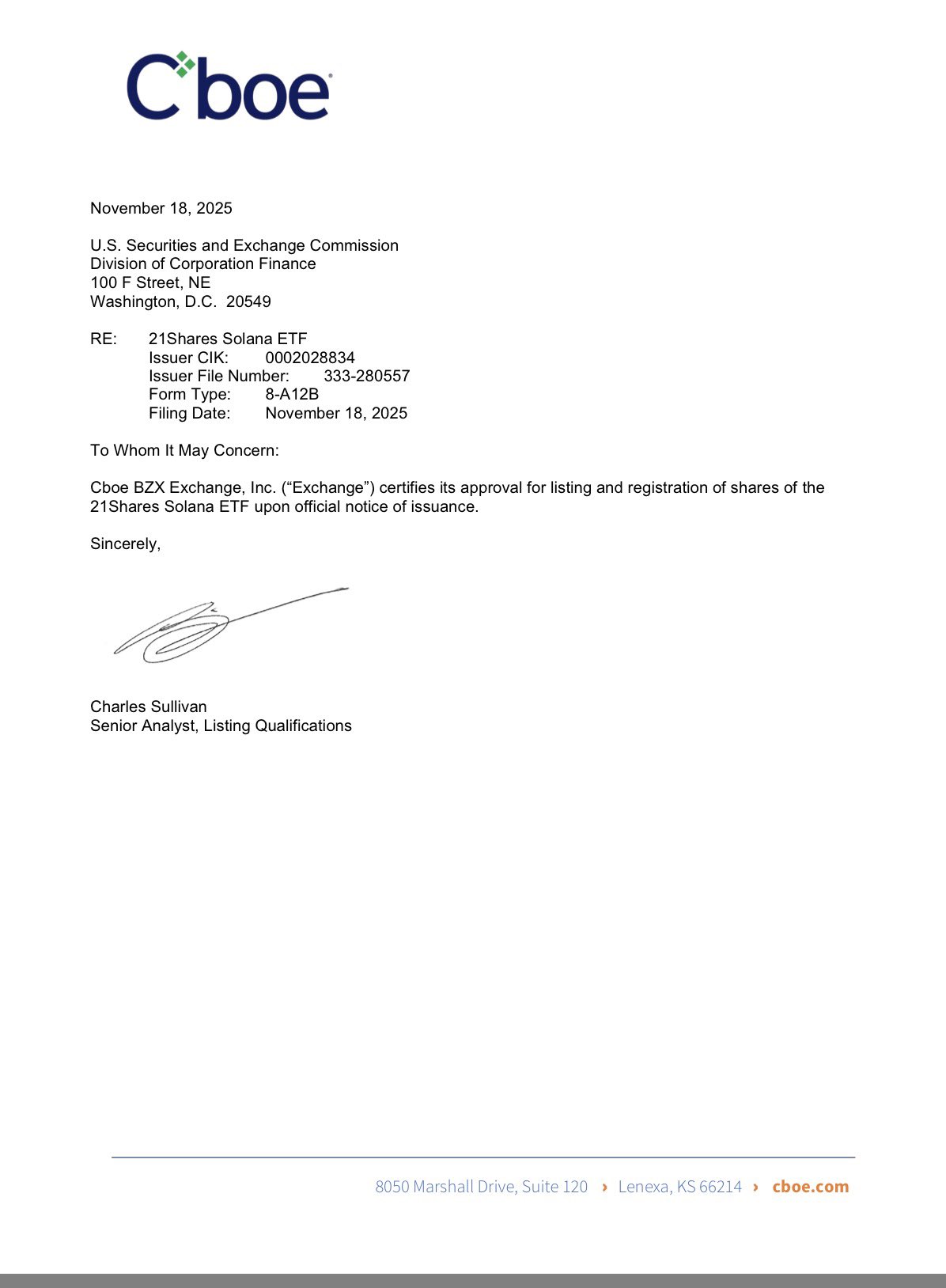

On Tuesday, 21Shares filed its final prospectus with the U.S. Securities and Exchange Commission for a new SOL ETF. This means the product could begin trading today. The fund will come with a 0.21% management fee.

Shortly after the filing, the website of the SEC showed that the exchange Cboe has approved the listing and registration of the fund. This basically allows the launch of the product.

This follows the introduction of two crypto index funds by 21Shares last week. Those products offer regulated exposure to Bitcoin, Ethereum, Solana, and Dogecoin. This makes them the first crypto index ETFs registered under the Investment Company Act of 1940.

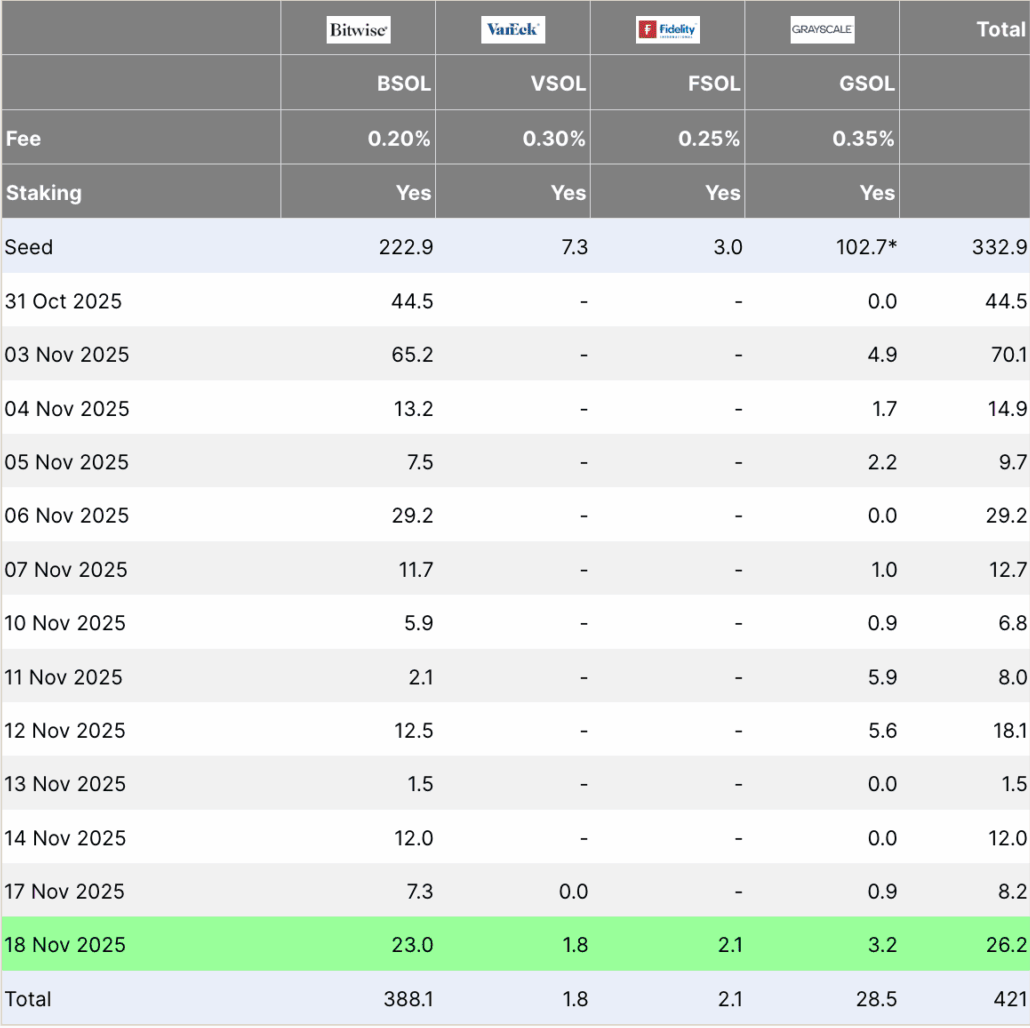

In other news, Fidelity Investments launched the Fidelity Solana fund under the ticker FSOL yesterday. The fund went live on NYSE Arca with a 0.25% management fee and a 15% charge on staking rewards. Fidelity now represents the largest asset manager offering the SOL fund.

Also, Canary Capital launched the Canary Marinade Solana ETF (SOLC) on Nasdaq. The fund is partnered with Marinade Finance. They will be the sole staking provider for at least two years. The fund plans to stake all its SOL holdings under normal market conditions.

SOL ETF Inflows Remain Strong Despite Price Weakness

Inflows for the token have continued despite the market dip. On November 18, SOL ETFs posted net inflows of $26.2 million. Bitwise’s BSOL led the flow with $23 million in inflows. This marks the 15th consecutive trading day of positive inflows. This is while both Bitcoin and Ethereum spot ETFs recorded new rounds of outflows.

The demand comes amid the decline in SOL’s price. The coin’s value has dropped more than 10% over the past week.

With Fidelity and Canary Capital now active, that means five Solana ETFs have launched in the U.S. market. 21Shares’ expected launch would take it to six. The different products offer a variety of staking strategies, fee models, and market exposures.

Meanwhile, VanEck also launched its VSOL fund on November 17. The asset manager started the fund with $7.32 million and will work with SOL Strategies for staking. The firm is offering a no-fee structure until the fund reaches $1 billion in assets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin & Gold Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs