Breaking: $500 Million Crypto Asset Inflows Set Bulls Retaking $50K Bitcoin (BTC) Price

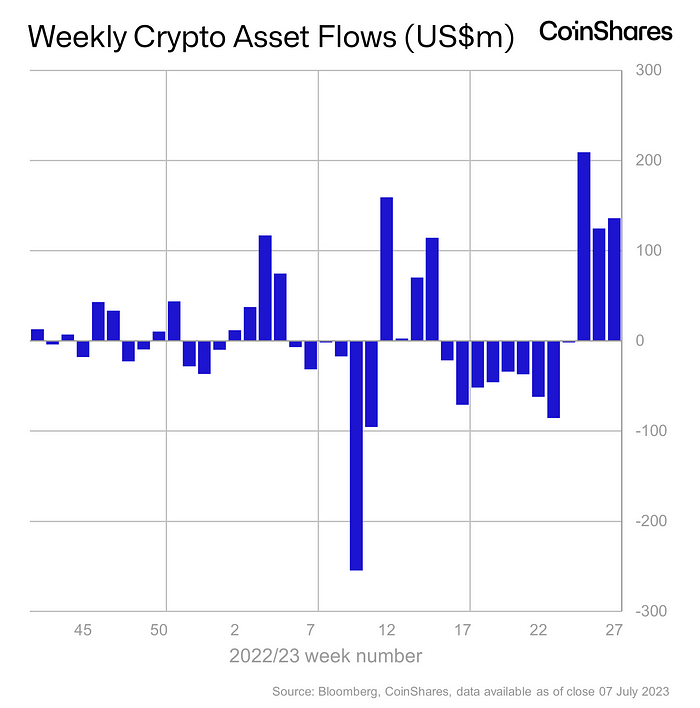

Crypto asset investment products recorded $136 million in inflows last week, reported CoinShares on July 10. Another week of high inflow indicates institutional and retail investors remain bullish on Bitcoin and other cryptocurrencies, as digital asset investment products saw three consecutive weeks of inflows after nine consecutive weeks of outflows.

Crypto Funds Record Third Week of Inflow

Crypto asset funds saw a total of $470 million of inflow in the last three weeks. Firstly, a $199 million inflow, followed by a $125 million inflow, and $136 million in the last week. Also, it has brought year-to-date flows to a net positive $231 million despite nine weeks of outflows.

Bitcoin again remains the favorite of investors, recording $133 million in inflows as compared to $123 million in an earlier week. It shows Bitcoin bulls are preparing to dominate and starting to trigger technical advantage this month. In addition, short Bitcoin investment products saw an 11th week of successive outflows despite a recent price jump, with this week’s outflow of $1.8 million.

Surprisingly, blockchain equities saw the largest inflows of $15 million yet recorded in a year.

Meanwhile, altcoins such as Ethereum, Solana, XRP, Polygon, Litecoin, and Aave saw inflows, while both Cosmos and Cardano saw minor outflows. Investors are also interested in investing in Ethereum (ETH) as inflows rise to $2.9 million last week from $2.7 million in an earlier week.

ProShares ETFs, ETC Issuance GmbH, CoinShares Physical, and 21Shares AG recorded the most inflows last week. Germany leads the United States in crypto funds inflows last week, with Canada in third place.

Also Read: Bitcoin, Ethereum, USDT Trade At Discount On BinanceUS, Arbitrage Opportunity Or Trap?

Bitcoin Price Set For $50000

According to a CoinGape Markets analysis, Bitcoin has a long-term bullish outlook of $48,000, it might first tag highs around $38,000, followed by a retracement to $35,000 before the ultimate rally to $50k expected by the end of 2023.

Spot Bitcoin exchange-traded fund (ETF) applications by BlackRock, Fidelity Investments, and Others remain the main area of discussion in the crypto sphere since June.

In fact, Standard Chartered Bank raise its forecasts for Bitcoin price to reach $50,000 this year and $120,000 by the end of 2024.

Read More: Standard Chartered Revises Bitcoin (BTC) Price Prediction To $50000, $120K In 2024

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Price Jumps 35% to $83 on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

Buy $GGs

Buy $GGs