96000 BTC Options Expiry Sets Max Pain Price At $61,000, What’s Next?

Highlights

- Over 96k Bitcoin options of $6.2 billion in notional value are set to expire.

- 990k Ethereum options of notional value $3.1 billion are set to expire

- BitMEX co-founder Arthur Hayes reveals a major bullish signal for the crypto and stock markets.

Almost $6.3 billion of BTC options are set to expire on April 26, signaling potential downside price volatility that could see Bitcoin fall to the $61,000 mark. Bitcoin and crypto market recovery is expected by traders after the crypto market expiry, likely stopping profit-taking on downside hedges.

Bitcoin Price Recovery After Options Expiry?

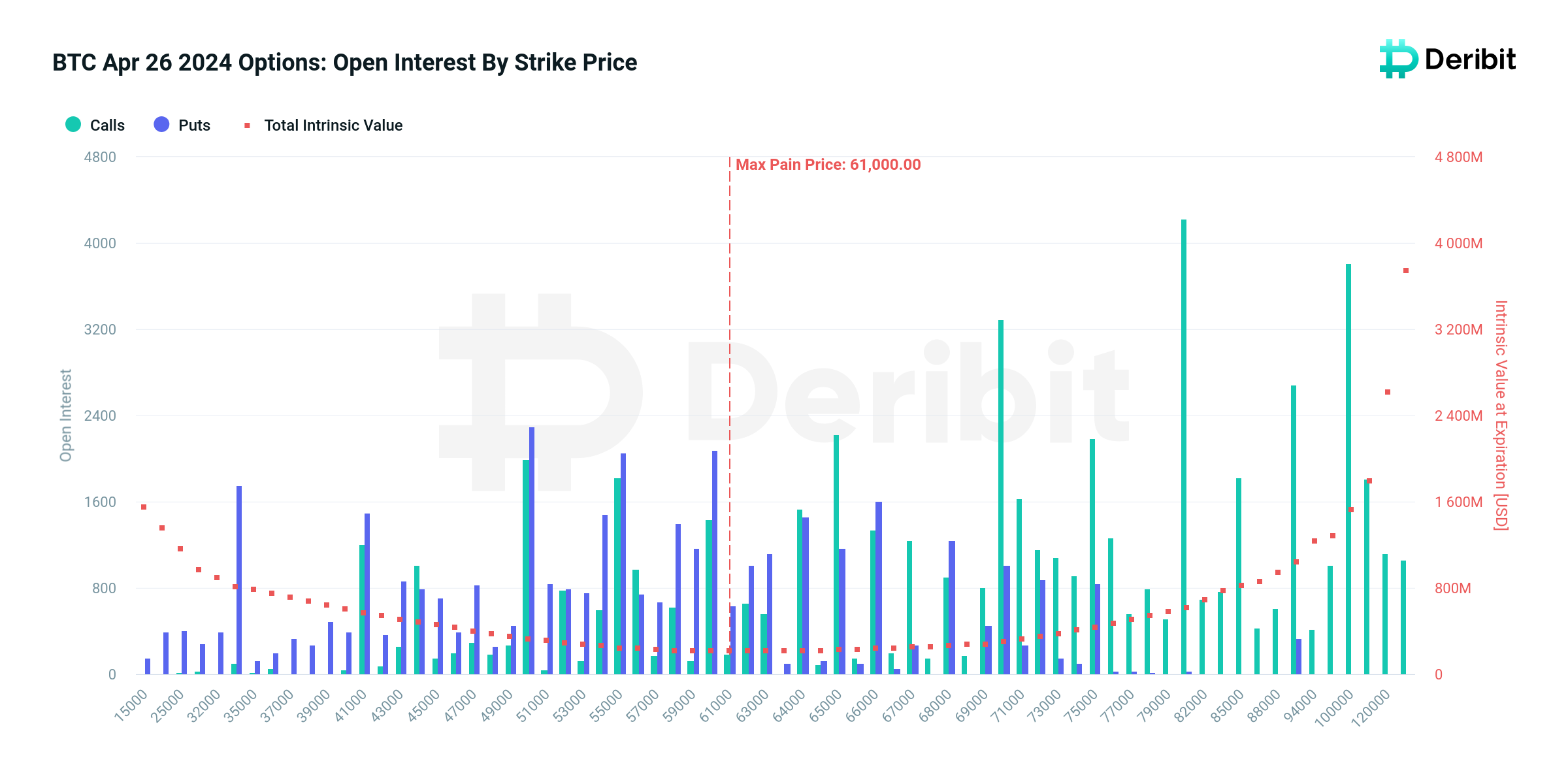

Over 96k Bitcoin options of $6.2 billion in notional value are set to expire on Deribit on April 26. The put-call ratio is 0.68, indicating a rise in put options recently as monthly expiry approaches. The max pain point is $61,000, below the current price. The market can expect huge volatility with a pullback in price expected on the expiry day.

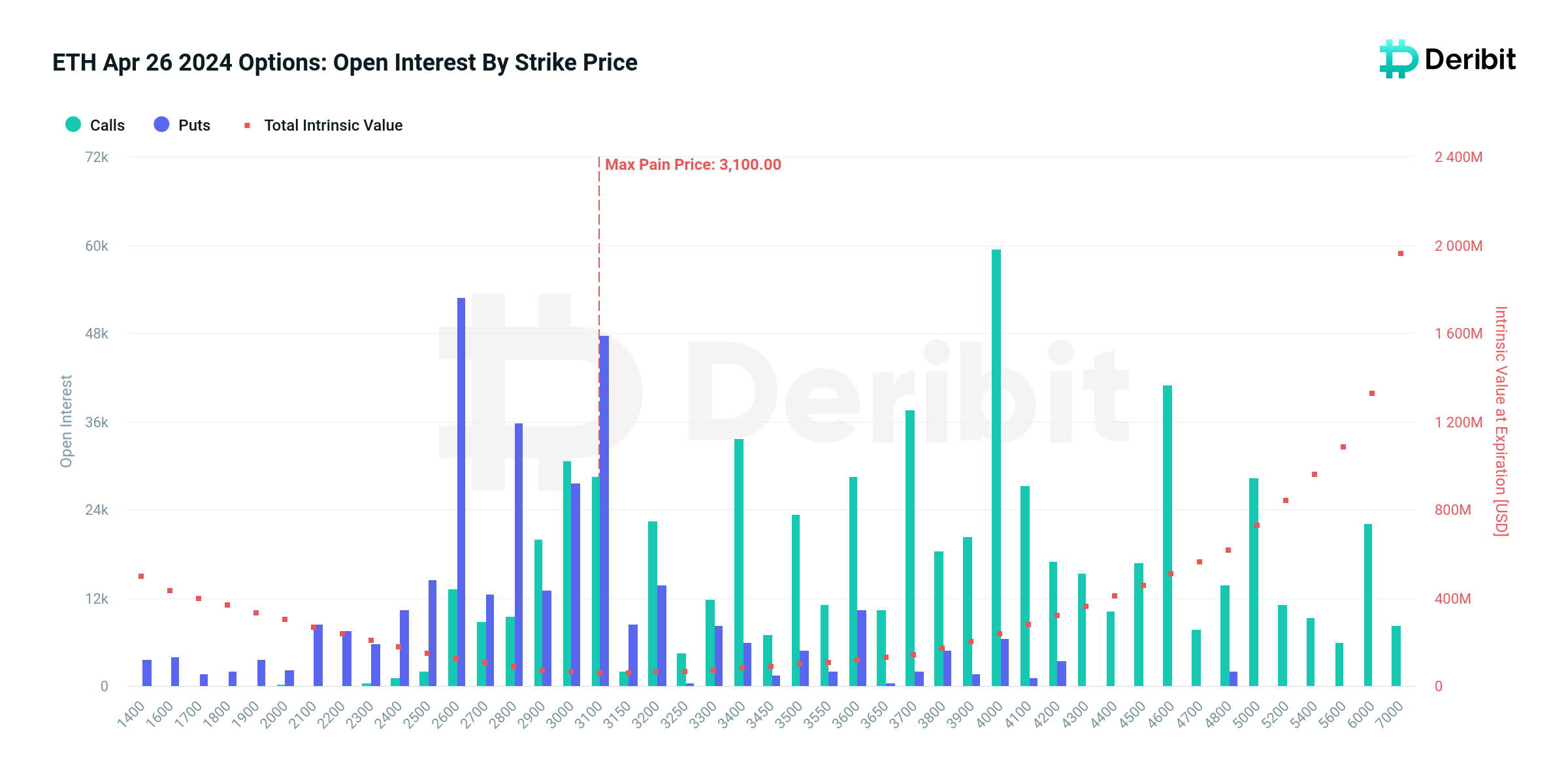

Moreover, 990k Ethereum options of notional value $3.1 billion are set to expire, with a put-call ratio of 0.51. The max pain point is $3,100, with the ETH price currently trading above the max pain point at also higher than the current price of $3,141.

Deribit revealed that realised volatility has surged as BTC Volatility Index (DVOL) saw a sharp increase as crypto options expiry comes near.

Options expert Greekslive said low crypto market volume this week pushed Bitcoin and Ethereum prices to trade near support levels. This weakness in the market caused significant declines in implied volatility (IV) across all major terms, with Dvol down as much as 15% since the halving. The lack of volatility in the market led to selling of large number of options.

Moreover, market sentiment remains subdued due to recent spot Bitcoin ETF outflow. The chance for BTC to return to its all-time highs is extremely low as it could face more resistance.

Also Read: 5 Reasons To Buy & Hold Pepe Coin Right Now

Arthur Hayes Predicts Crypto Market Recovery

BitMEX co-founder Arthur Hayes reveals a major bullish signal for the crypto and stock markets. As macro factors were the primary reasons behind a drop in sentiment in the crypto market recently, Hayes revealed tax receipts from US citizens added $200 billion to the Treasury General Account (TGA) of the U.S. Treasury Dept and the next steps can bring a recovery in the markets.

BTC price jumped 1% in the past 24 hours, with the price currently trading at $64,302. The 24-hour low and high are $62,783 and $65,275, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours.

The markets are also eyeing the Fed’s preferred measure to gauge inflation PCE inflation release today for further guidance on price direction in the next few weeks. The annual PCE rate is estimated to increased for a second straight month to 2.6% from 2.5% while the annual core PCE inflation likely fell to 2.6%, the lowest in three years, from 2.8%.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs