Analyst Predicts Next Bitcoin Price Breakout Via Elliott Wave 5

Highlights

- Analyst Mikybull Crypto predicts that the Bitcoin price could witness a breakout late October following a wave 5 impulsive move.

- Analyst Ali Martinez warned that Bitcoin could drop to $57,000 if it doesn't hold above $60,000.

- BTC is already at risk of a price decline amid rising tensions in the Middle East while the Friday job reports could also determine its next move.

Crypto analyst Mikybull Crypto has provided a bullish outlook for the Bitcoin price, predicting that the crypto will, by late October, enjoy a breakout following a wave 5 impulsive move to the upside. His prediction comes amid a couple of external factors that threaten to send BTC below $60,000 as the negative start to ‘Uptober’ continues.

Bitcoin Price Breakout To Happen This Month

Mikybull Crypto predicted in an X post that the BTC price breakout will happen this month. Specifically, he stated that the breakout into wave 5 expansion should happen on the “estimated 22nd of this month.” He added that for now, market participants have to survive the wave 4 inconveniences of extended correction. He also advised investors not to get shaken out as the breakout is already near.

The accompanying chart he shared showed that Bitcoin could reach between $95,000 and $120,000 when this wave 5 expansion occurs. This means that the flagship crypto could be set to hit a new all-time high (ATH) this month. However, the analyst didn’t say if this will mark the cycle top for the Bitcoin price.

His prediction aligns with that of 10x Research founder Markus Thielen, who predicted that BTC will reach a new ATH by late October. However, Thielen gave a more conservative prediction, highlighting $75,000 as the price target that BTC could reach by late October. This is still above Bitcoin’s current ATH of $73,000.

The Wave 4 Extended Correction Could Lead To Lower Prices

The wave 4 extended price correction, which Mikybull Crypto mentioned, could lead to lower prices for BTC. The Bitcoin price is already at risk of dropping to $57,000 amid Israel’s imminent attack. Therefore, there is a likelihood that the flagship crypto could soon lose its crucial support level at $60,000.

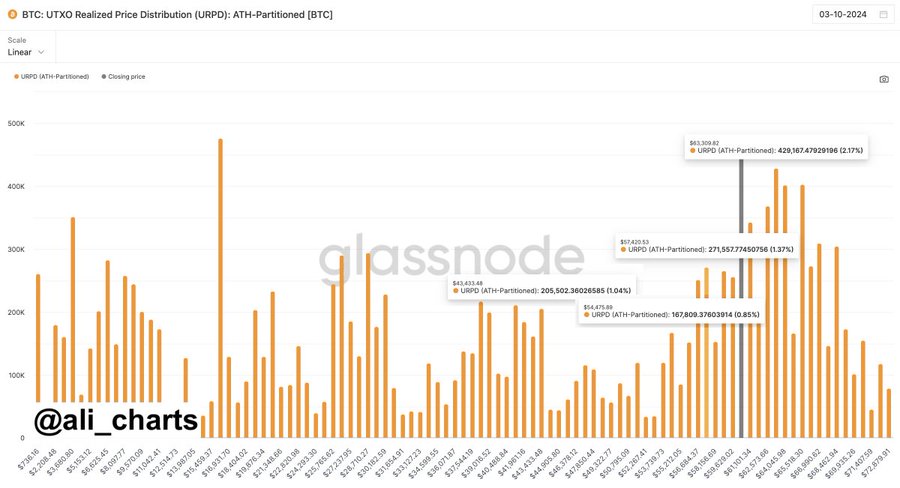

Crypto analyst Ali Martinez also provided insights into how BTC could drop to $57,000. The analyst stated that $60,365 is the key level to watch. He added that the crypto could fall to $57,420 if there is a breakdown below $60,365. However, if Bitcoin holds above this level, he remarked that a rebound to $63,300 is on the table.

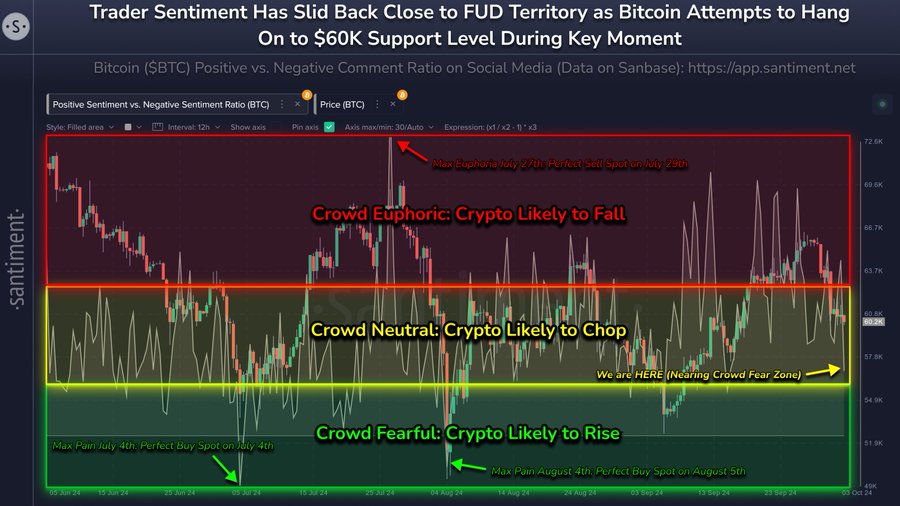

The on-chain analytics platform Santiment suggested that a further price correction could be good for the Bitcoin price. The platform noted that the crowd had considerably cooled its excitement toward the crypto market since BTC retraced from its local high of $66,400 recorded on September 27. According to Santiment,

This change in mood is encouraging, considering markets typically always move the opposite direction of the crowd’s expectation.

The Macro Side Is Still One To Keep An Eye On

Amid these projections for the Bitcoin price, the macro side is still one to keep an eye on as it could determine BTC’s trajectory. Market commentator The Kobeissi Letter recently mentioned that nothing adds up in the market at the moment because the data and the Fed’s narrative do not align. They also remarked that the market seems to be starting to price in another rebound in inflation.

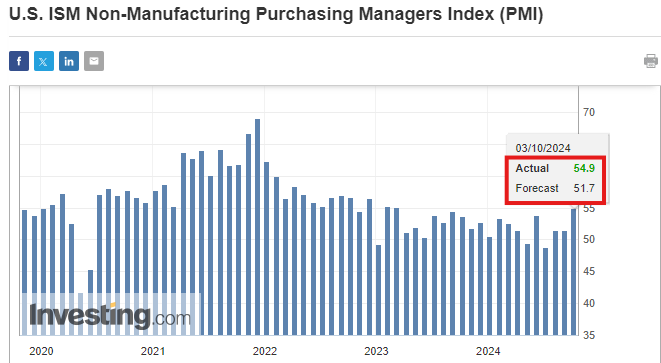

The Kobeissi Letter cited the ISM Non-Manufacturing PMI data, which came in hotter than expected. This was the hottest reading since January 2023. Therefore, there is the possibility that the US economy isn’t as healthy as Fed Chair Jerome Powell has made it look so far. All eyes will be on the Jobs report data, which will come out on October 4.

The jobs report will show if the labor market is indeed solid, as Powell has indicated so far. It will provide insights into the Fed’s likely steps during its next FOMC meeting in November.

The US Central Bank has hinted that there could be more rate cuts before year-end. However, they could still hold back if the incoming inflation data doesn’t align with their expectations.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs