Just-In: Arthur Hayes Dumps More ETH, ENA, AAVE Amid Crypto Crash

Highlights

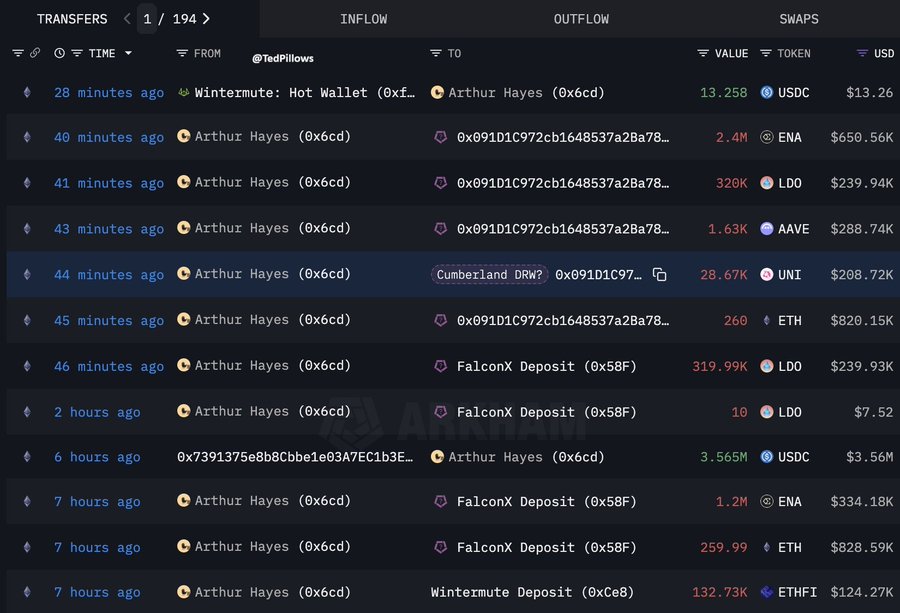

- Arthur Hayes sold $5M in tokens as crypto markets hit multi-month lows.

- Major altcoin sales included ETH, ENA, LDO, AAVE, UNI, and ETHFI.

- Hayes backed Zcash as it surged while most altcoins dropped.

Arthur Hayes sold nearly $5 million in digital assets within 24 hours after a sharp market drop. The BitMEX co-founder reduced his exposure to several major altcoins. These transactions followed a broader downturn that pushed key cryptocurrencies to multi-month lows across global markets.

According to analytical platform Lookonchain, Hayes dumped several of his positions through exchanges and OTC desks. He executed the sales on platforms including FalconX and Wintermute. His biggest sale was for $2.48 million worth of Ethereum. He also dumped $1.384 million in Ethena and $480,000 in Lido DAO. Other sales were of $289,000 worth of Aave and $209,000 of Uniswap and $124,000 of ether.fi.

Market Slide Deepens as Major Holders Cut Exposure

The sell-off followed asharp drop in the valuations of crypto. On Friday Bitcoin fell to $94,000, as the six-month low hit. Ethereum dropped to $3,100 in that time. The majority of the altcoins also went down. Traders were under added pressure as liquidity dried up and volatility spiked in the world’s biggest markets.

Market analysts noted that the drop was accelerated by large holders. Their actions just made a bad situation worse. Hayes’ move comes at a time when many investors are very wary. His departures from a number of projects corresponded with larger efforts to diminish risk as markets convulsed following swift losses.

Arthur Hayes Backs Zcash Amid Market Strain

He also reaffirmed his commitment to ZEC while markets have been volatile. Arthur Hayes stated that Zcash has more upside potential than XRP. He referenced their market caps: Zcash at $10 billion and XRP at $135 billion. He added that ZEC became his second-largest liquid asset alongside Bitcoin.

Hayes estimated the token could be worth 0.2 BTC. That value equals about $19,200. At that level, Zcash would have a market cap of around $313 billion. This would make it the third largest cryptocurrency after Bitcoin and Ethereum.

Over the past week, Zcash has seen a rise of 18.80%. It was also up more than 235.50% for the month. These gains were notable considering many altcoins also saw steep drops. It stood out in an otherwise broad swath of selling as risk assets, including stocks and commodities, struggled under heavy selling pressure.

Hayes’ actions are a sign that strategies ordered by leading market participants are changing. His broad token sell-offs, combined with his focus on Zcash, show targeted positioning in a shaky market. The market is still re-adjusting as traders re-evaluate their exposure after one of the sharpest sell-offs in months.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs