Arthur Hayes Issues Dire Warning On Another Stock & Crypto Market Crash

Highlights

- Arthur Heyes predicts a second wave after the recent market crash.

- The second wave will follow due to problem of over-leveraged investors in the traditional markets.

- Ark Invest CEO Cathie Wood compares the situation to Black Monday in 1987 and Lehman shock in 2008.

Crypto billionaire Arthur Hayes surprises the crypto market with his yet another bold prediction that a second wave will follow soon after the recent crypto market crash. He believes the current respite is only temporary and market volatility will continue to persist in stocks and crypto markets.

Goldman Sachs Panic Index jumped to its highest level since 2020 amid huge volatility in the TradFi markets. Traders took wait-and-watch strategy awaiting stability in the broader markets.

BitMEX Co-Founder Arthur Hayes Predicts Another Market Crash

Global equity and crypto markets show signs of recovery today. Japan’s Nikkei rebounds 12% after losing 12% in previous sessions. The global crypto market and US stock market index futures are also rising higher.

However, BitMEX co-founder Arthur Hayes said “That was the first wave,” warning about a cautious outlook despite signs of recovery.

He asserts that the first wave of impact on the markets has passed, and now the problem of over-leveraged investors in the traditional markets will surface. It will lead to a second wave of correction in broader markets.

However, if the US Federal Reserve decides to bailout, the market may need to go through more pain by Friday. Moreover, Arthur Hayes adds that the current respite is only temporary, and market volatility will continue amid tensions in the Middle East.

Also Read: MicroStrategy’s Michael Saylor Says HODL Bitcoin Despite Sub $50K Crash

Cathie Wood Reflects on the Market Situation

ARK Invest CEO Cathie Wood shared that the VIX (Equity Volatility Index) increased to 65, the fourth-highest level in the past 40 years. She compares it to Black Monday in October 1987, Lehman shock in 2008, and COVID market crash in 2020. Investors relying on the carry trade with Japan cash out at the same time.

“The US statistics like employment and the PMI have disappointed expectations and, at the same time, the Bank of Japan has raised interest rates more than expected, investors and speculators have faced margin calls forcing them to unwind the yen carry trade,” said Wood.

She said the 10-year Treasury bond yield should be around 2% today, not where it is at 3.8% or last October’s 5%, as per metals to gold ratio. The US dollar index (DXY) has risen above 103 today, indicating pressure on Bitcoin amid high uncertainty in the markets turning investors cautious.

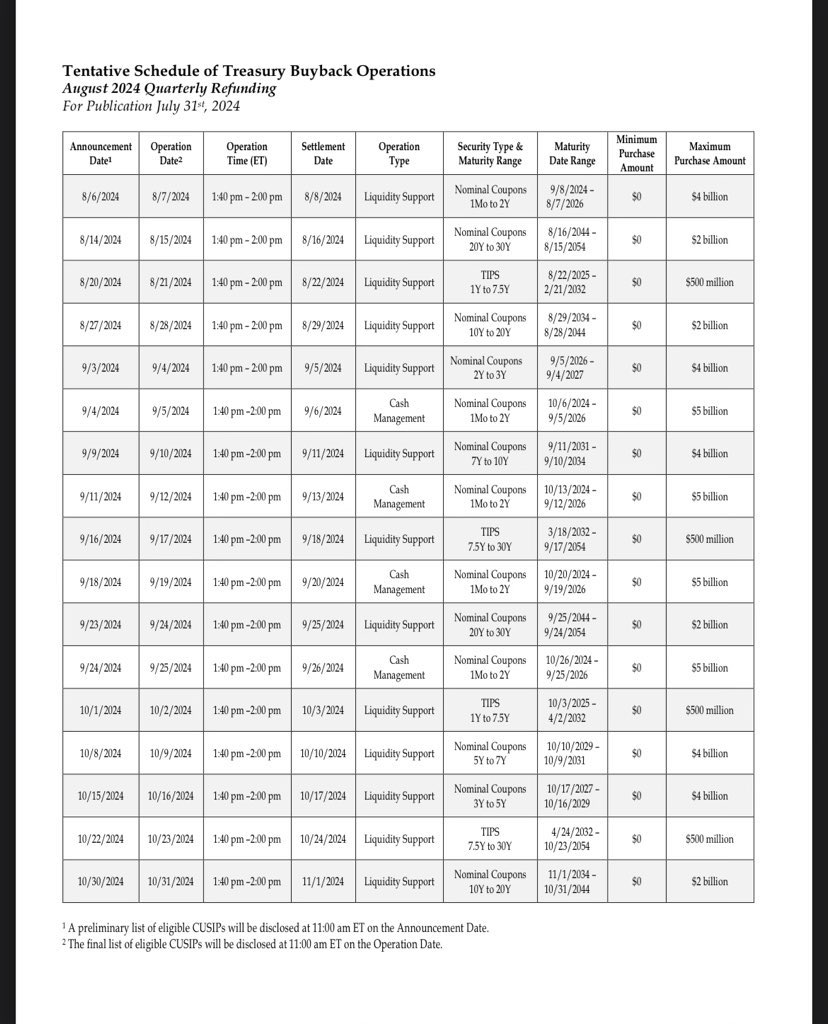

Meanwhile, the U.S. Treasury Dept. is to start Treasury buyback again with $30 billion a month. It could also help the crypto market to rebound further.

BTC price pares earlier gains and fell below $55,000. A BTC price analysis by CoinGape suggests a continuation of Bitcoin crash. If the $50,000 psychological level is breached again, chances of revisiting the $45,156 key weekly support level are high.

Also Read: JPMorgan Cites Buy-the-Dip Opportunity, Crypto Market Recovery Ahead?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs