Billionaire Arthur Hayes Reveals Major Crypto Bull Signal From US Treasury Dept

Highlights

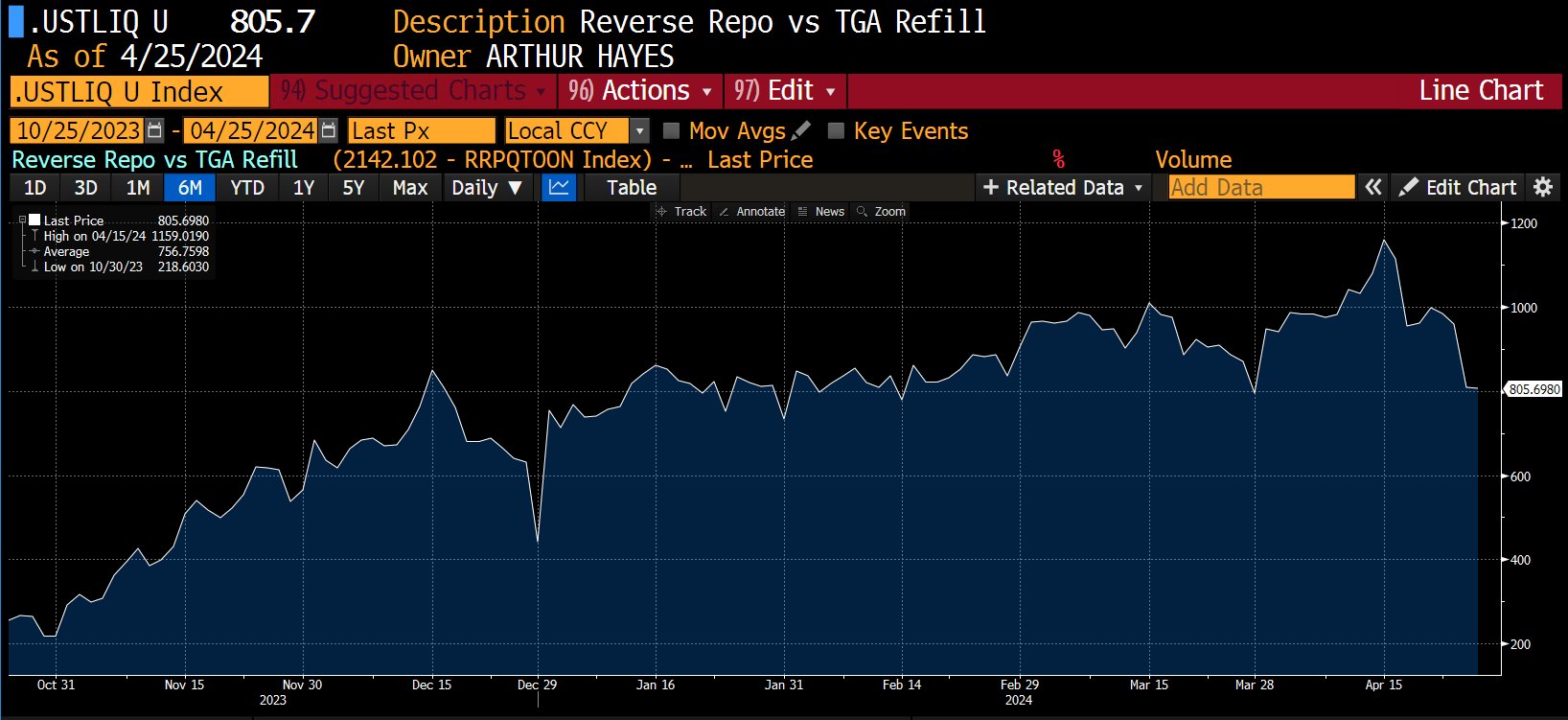

- BitMEX co-founder Arthur Hayes predicts a major bullish crypto market recovery signal.

- Tax receipts from US citizens added $200 billion to the Treasury General Account (TGA).

- Liquidity "boost" in the next coming weeks would be net positive for risk assets.

- Bitcoin price faces headwinds currently due to inflation data.

BitMEX co-founder Arthur Hayes reveals a major bullish signal for the crypto and stock markets. As macro factors were the primary reasons behind a drop in sentiment in the crypto market recently, Hayes revealed tax receipts from US citizens added $200 billion to the Treasury General Account (TGA) of the U.S. Treasury Dept and the next steps can bring a recovery in the markets.

Arthur Hayes Predicts Re-Acceleration of the Crypto Bull Market

BitMEX co-founder Arthur Hayes in a post on X shared three possible options Treasury Secretary Janet Yellen would consider as the Q2 2024 refunding announcement comes next week. The Treasury General Account (TGA) is restocked at $941 billion as US tax payments added $200 billion to the TGA.

Janet Yellen will trigger a rally in stocks and crypto markets if any of the below three options are considered:

- Stop issuing treasuries by reducing the TGA to zero, which will be a $1 trillion liquidity injection.

- Shifts more borrowing to Treasury bills to remove money from RRP, which is $400bn injection of liquidity.

- Combination of 1 and 2, which will be $1.4 trillion liquidity injection. Treasury could stop long term bonds and issue on bills while running down TGA and RRP.

“If any of these three options happen, expect a rally in stocks and most importantly a re-acceleration of the crypto bull market,” said Arthur Hayes.

The liquidity from people to the government is net negative for risk assets. Moreover, the expected liquidity “boost” in the next coming weeks would be net positive for risk assets. The stocks and crypto markets are anticipated to see a massive rally, especially as a post-halving rally is triggered.

Also Read: Shiba Inu (SHIB) Teases Hardfork To Unlock New Capabilities, Price Reacts

Bitcoin Price to Rally?

Currently, the major headwinds for the bitcoin price rally are crypto market expiry and PCE inflation data today. The crypto market is expected to see muted price action as traders watch out for these events.

BTC price jumped 1% in the past 24 hours, with the price currently trading at $64,302. The 24-hour low and high are $62,783 and $65,275, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours.

Coinglass data confirms muted action in derivatives trading ahead of $9.4 billion in Bitcoin and Ethereum options expiry on Deribit.

Also Read:

- Terra Luna Classic Community Revises LUNC Burn Tax

- Ripple vs. SEC: New Scheduling Order Issued by Judge Netburn

- FBI Issues Warning Against Non-Compliant Crypto Money Services

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible