Over $4 Billion In OI Cleared As BTC Price Falls to $42k, Are Bears Back in Game?

A major bloodbath has ensued on Satoshi Street on Tuesday, September 7, as the overall cryptocurrency market loses over $200 billion in a matter of a few hours. Bitcoin (BTC), the world’s largest cryptocurrency corrected 12% after making a move above $51,500 levels.

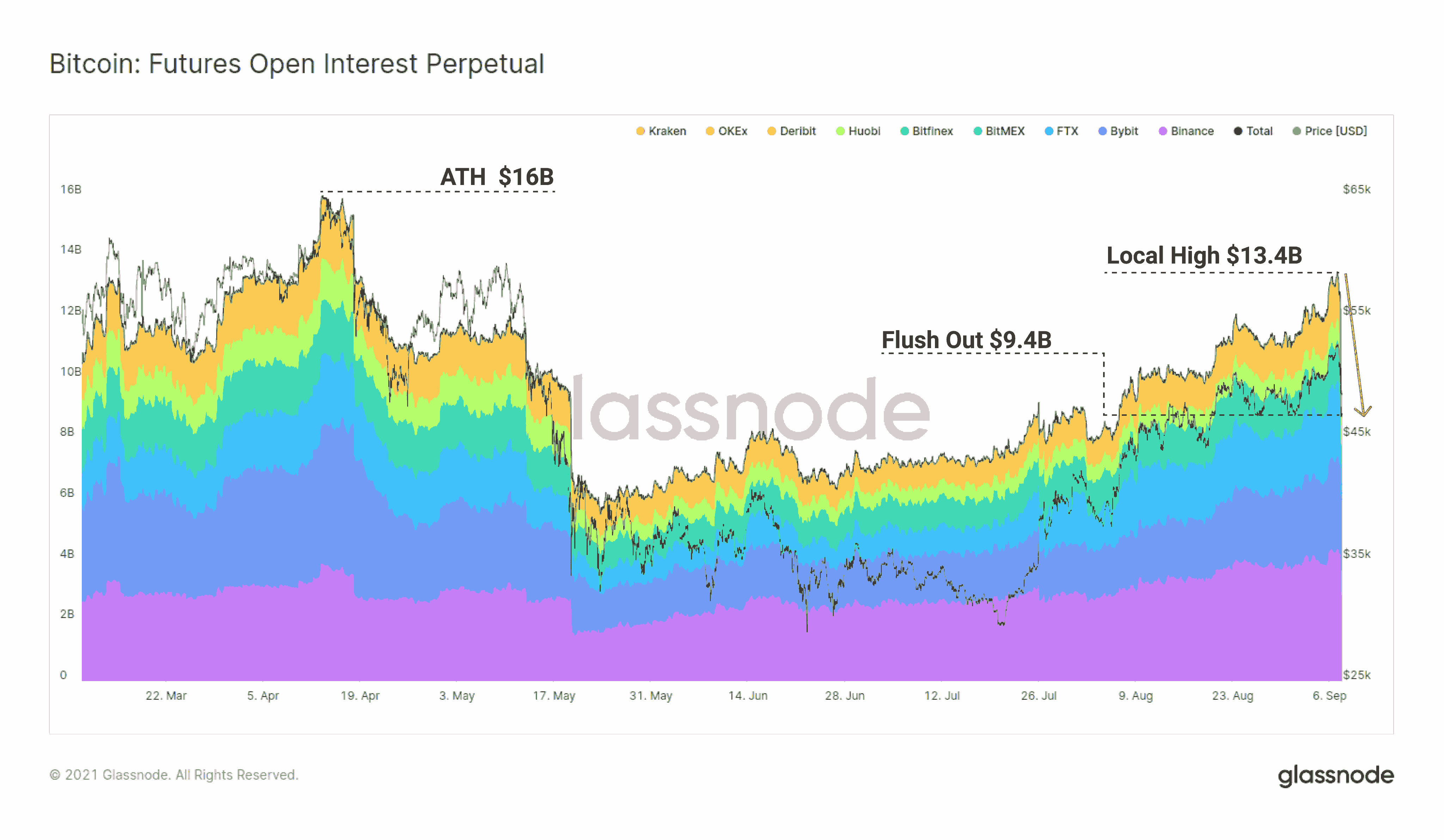

As on-chain data provider Glassnode reports, the sharp BTC correction led to massive liquidation in Bitcoin futures open interest. The data provider noted:

Over $4B in #Bitcoin open interest has been cleared during this sell-off. This is the most significant leverage flush out since the sell-off in mid-May.

As we can see in the above chart, the Bitcoin futures open interest made a local high of $13.4 billion on Monday, build up over the last month. However, Tuesday’s price crash to $42K has seen major liquidations in the long positions. It looks like Bitcoin could be hinting at a trend reversal with bears getting their grip in the market.

As CoinGape reported, bitcoin miners have been already taking profits off the table as the BTC price went above $50,000 and above. Commenting on this massive sell-off in the market, Stephane Ouellette, chief executive and co-founder of FRNT Financial told Bloomberg:

“Mystery selloffs, or selloffs where a legitimate reason is only found a significant while later are much more common in crypto than in other asset classes. The market remains far more opaque and global than most if not all other notable asset classes.”

El Salvador Buys the Bitcoin Dip

The BTC price correction came just on the day when El Salvador made Bitcoin its official currency. However, on the very first day, El Salvador’s digital wallet system Chivo crashed hours after launch.

On Monday, before the Bitcoin launch, El Salvador purchased 400 Bitcoins worth $21 million. El Salvador continued to buy the Bitcoin dip on Tuesday, adding an additional 150 Bitcoins.

Buying the dip 😉

150 new coins added.#BitcoinDay #BTC🇸🇻

— Nayib Bukele 🇸🇻 (@nayibbukele) September 7, 2021

Tuesday’s sell-off marks the biggest break in the 75% Bitcoin price rally since mid-July 2021. Historically, September hasn’t been much favorable for Bitcoin and the overall crypto market. Matt Maley, chief market strategist for Miller Tabak + Co told Bloomberg:

“It didn’t surprise me that Bitcoin didn’t rally on the El Salvador news, but this pullback is weird, especially since it came mid-morning and not shortly after the news broke. If it was a ‘fat finger’ at a hedge fund or brokerage firm, it won’t be a problem. If it is something else, I’ll become a lot more worried.”

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- UAE’s Second Largest Bank Eyes Bitcoin Allocation, Backs Tokenization

- Crypto Group Proposes Tax Rules To Boost Innovation As CLARITY Act Talks Progress

- XRP News: SBI Ripple Explores XRPL for Cross-Border Payments in Strategic Research

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

Claim Card

Claim Card