BTC Tanks Under $47K Despite Bitcoin Exchange Supply At 31-month Low, Big Hands Buying?

A brutal sell-off strikes once again in the crypto market with the Bitcoin price crashing under $47,000 on Monday, December 13. As of press time, Bitcoin seems to have recovered from the Monday lows and is currently trading at $47,198 with a market cap of $890 billion.

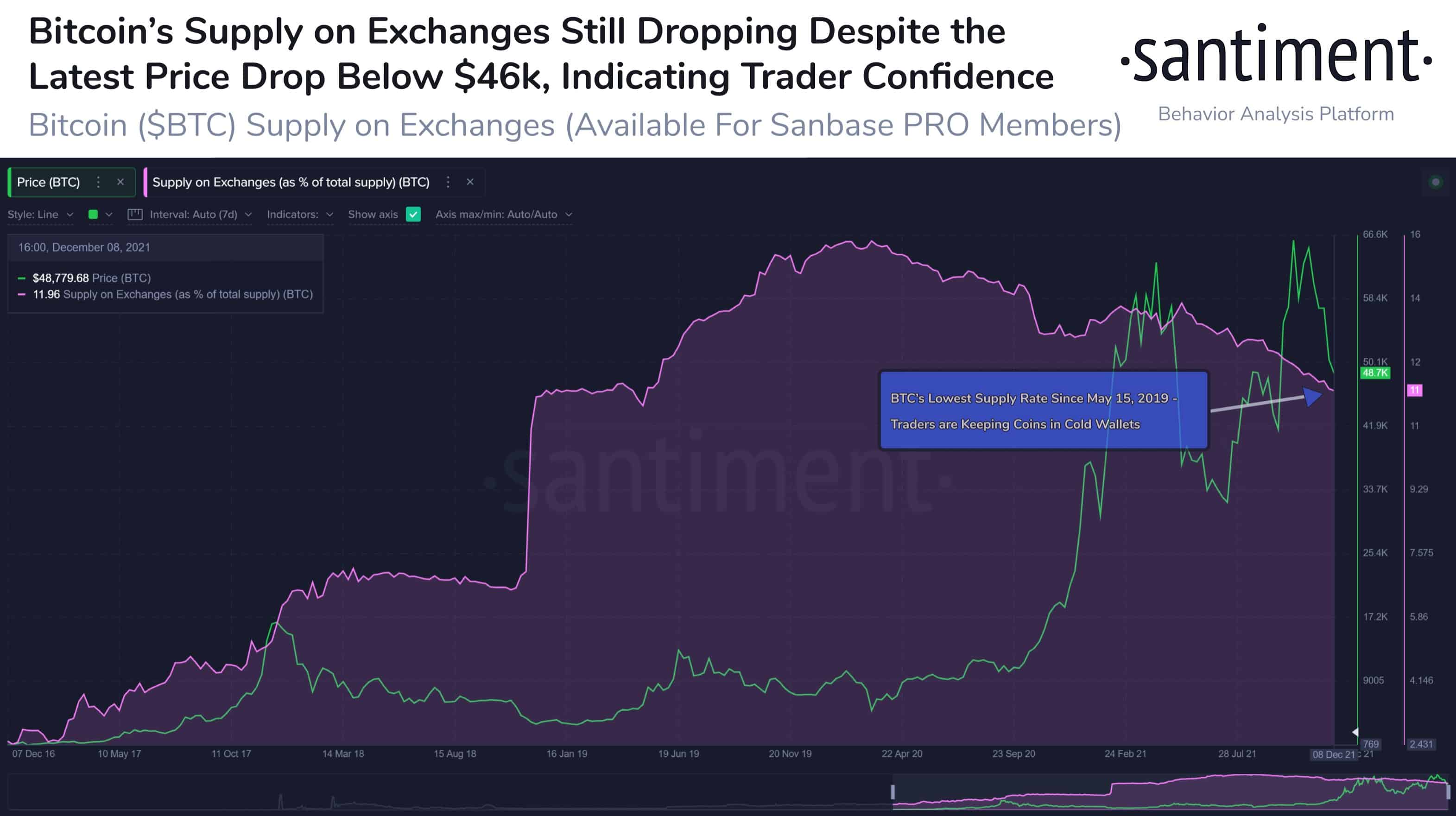

Interestingly, despite the Bitcoin price constantly staying under pressure, the BTC supply at the exchanges has been reducing simultaneously reaching a 31-month low. As on-chain data provider Santiment reported:

Bitcoin’s supply on exchanges hasn’t been this low in 31 months, according to @santimentfeed data. Prices have been volatile as of late, but the lack of $BTC moving to exchanges right now is a positive sign that major selloff risk should be limited.

While many have been comparing the recent market sell-off to that in May 2021 as the Bitcoin (BTC) price has already corrected nearly 40% from its all-time high of $69,000. Crypto market analyst Will Clementele says that there’s one key difference though between May’s correction and that in the current one.

During the May period, there was a major sell-off by strong hands. However, strong hands are buying this time, he says.

From an on-chain perspective, here's the key difference between now and May:

In May: Previously strong hands became weak hands

Now: Strong hands buying from weak hands pic.twitter.com/kMe75YN732

— Will Clemente (@WClementeIII) December 14, 2021

Willy Woo: No signs of Further Sell-off Cascade

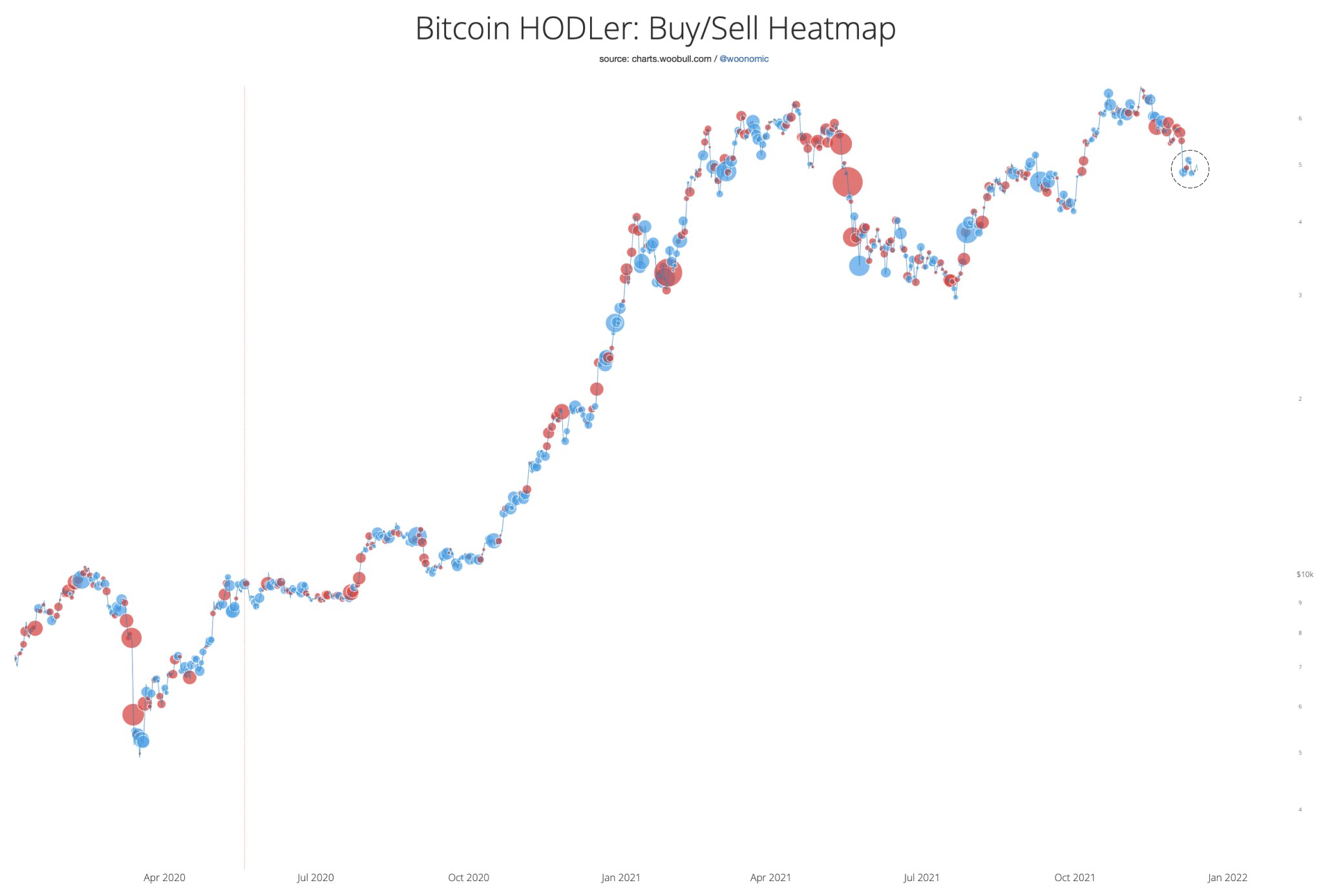

Major long positions for Bitcoin futures have been liquidated in the recent price correction suggesting a kind of reset. Besides, based on the buy/sell heatmap, crypto analyst Willy Woo says that buying the dip has been clearly visualized. He adds:

Buying the dip visualised (spot volumes seen on-chain). It has been happening, it’s moderate, but most importantly, as yet there’s no signs of a further sell-off cascade. Also worth keeping in mind longs have already been flushed.

While the retail investors continue to face a test of patience and anxiety, the on-chain data has been hinting at strength. Will this translate into a good pullback or not remains to be seen.

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- UAE’s Second Largest Bank Eyes Bitcoin Allocation, Backs Tokenization

- Crypto Group Proposes Tax Rules To Boost Innovation As CLARITY Act Talks Progress

- XRP News: SBI Ripple Explores XRPL for Cross-Border Payments in Strategic Research

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

Claim Card

Claim Card