AVAX Price Eyes Rally To $44 As Grayscale Files For Avalanche ETF

Highlights

- Grayscale has filed to offer an Avalanche ETF, which will be listed and traded on the Nasdaq exchange.

- Grayscale is the second asset manager to file for an AVAX ETF.

- The AVAX price eyes a rebound to $44.

According to a recent analysis, the AVAX price is eyeing a rebound to as high as $44. This comes just as asset manager Grayscale files to offer an Avalanche ETF, which will list and trade on the Nasdaq exchange.

Grayscale Files With US SEC To Offer Avalanche ETF

Grayscale has officially filed with the US SEC to offer an Avalanche. This came following Nasdaq’s 19b-4 filing with the Commission to list and trade this proposed ETF on the exchange. The SEC will have to determine whether or not to approve the fund.

Grayscale becomes the second asset manager to file to offer an AVAX ETF. VanECK was the first as the asset manager filed the S-1 for its ETF with the SEC two weeks ago. It is worth mentioning that Grayscale already has an Avalanche Trust, which it is simply looking to convert to an ETF.

Asset managers continue to file for several altcoin ETFs under the new SEC administration, with acting Chair Mark Uyeda looking to create a regulatory-friendly environment for the crypto industry. US SEC Chair nominee Paul Atkins has also affirmed that he plans to prioritize regulatory clarity for the industry.

Market expert Nate Geraci also highlighted the wave of altcoin ETFs that have stormed the SEC’s desk, including filings for XRP, Solana, Dogecoin, Cardano, SUI, Hedera, Polkadot, Litecoin, Aptos, and Axelar.

AVAX Price Eyes Rebound To $44

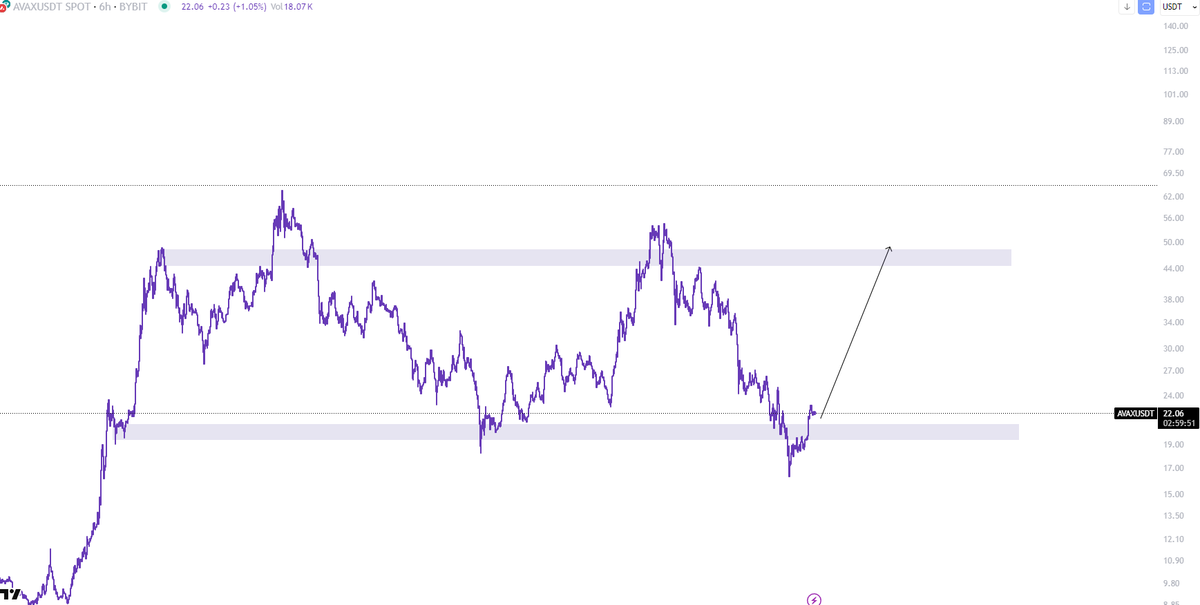

The AVAX price is eyeing a rebound to $44 as predicted by crypto analyst Jarfan. Grayscale’s filing for an Avalanche ETF undoubtedly provides a bullish outlook for the altcoin and could spark this rally.

Jarfan stated that AVAX’s chart is one of the cleanest on the market at the moment. He remarked that the altcoin has taken out previous lows and looks to be putting a double bottom on the higher timeframe.

In line with this, he affirmed that overall, a very bullish structure is forming at the moment and that AVAX is showing a lot of relative strength in comparison to other altcoins. The analyst noted that there have been major moves from other coins recently, although they have been mainly meme coins, and that the fact that Avalanche is keeping up with them is truly impressive.

Jarfan also stated that the AVAX price is holding above a very strong support right now, with barely any drawbacks. As such, he believes that the altcoin will rally to $30 in no time once Bitcoin breaks out from $88,000.

His accompanying chart also showed that the altcoin could rebound to $44, although it would face a major resistance at that level as it attempts to rally further to the upside. The crypto analyst predicts that Avalanche will break in the top 10 cryptocurrencies by market cap very soon.

Crypto analyst Kong also affirmed that AVAX’s current price action looks good and predicted that the altcoin could rally to $60. This could eventually pave the way for a rally to triple digits.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs