Bank Of America Predicts Four Fed Rate Cuts In 2025, What This Means For Crypto Market

Highlights

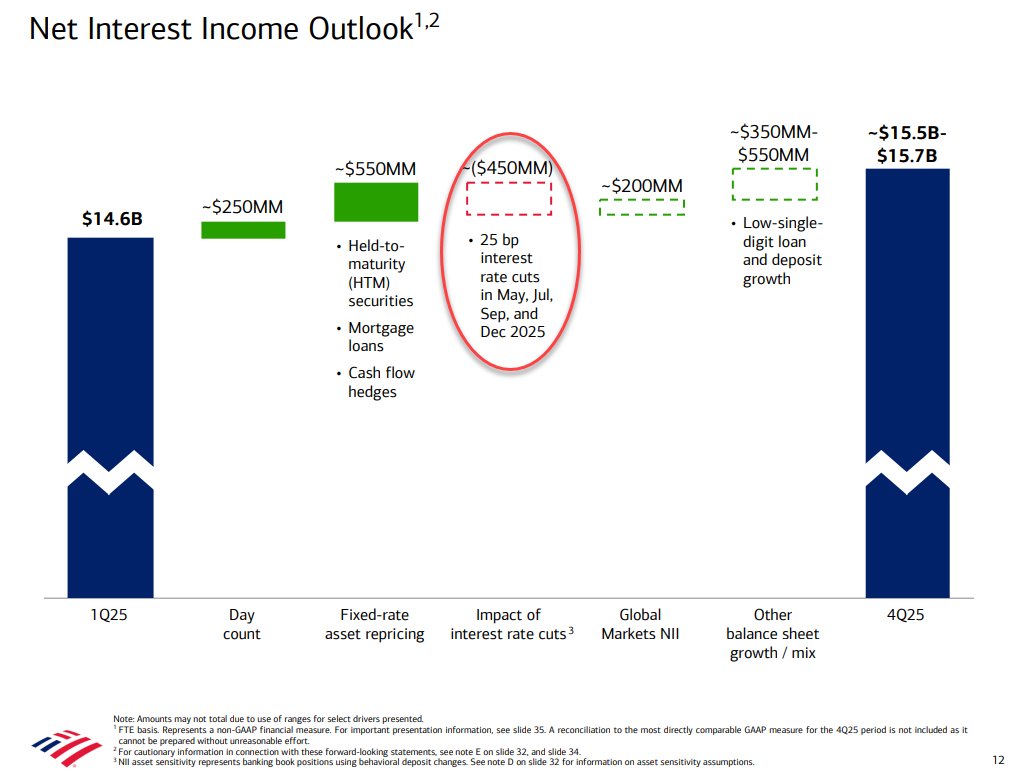

- Bank of America predicts that there will be four rate cuts in May, July, Sepetember, and December this year.

- This provides a bullish outlook for the crypto market, which will benefit from monetary easing policies.

- Bitcoin and altcoins have surged on the back of this prediction.

Bank of America (BofA) has predicted that there will be four Fed rate cuts this year, providing a bullish outlook for the crypto market. Bitcoin and altcoins could witness a significant rally as the Federal Reserve moves to ease its monetary policies.

Bank Of America Predicts Four Rate Cuts In 2025

Bank of America (BofA) has predicted that there will be four Fed rate cuts in 2025, which will take place in May, July, September, and December. Based on this, The US Federal Reserve could ease its monetary policies at the next FOMC scheduled to take place between May 6 and 7.

As Coingape reported, the latest US CPI inflation data had come in lower than expectations, which raised Fed rate cut bets as traders became more optimistic that the Central Bank could ease its monetary policies seeing as inflation is cooling off. The March PPI inflation data had also come in lower than expectations, further boosting hopes of these rate cuts.

Meanwhile, another reason the US Fed looks like to cut interest rates in May, as Bank of America predicts is because the increasing likelihood of a recession happening this year.

BlackRock CEO Larry Fink recently warned of a US recession, stating that it might already be happening. As such, if these recession fears increase, the Federal Reserve is likely to step in as it looks to stimulate the economy. It is worth mentioning that Boston’s Fed President Susan Collins recently stated that the Central Bank is ready to step in if necessary.

Fed rate cuts are bullish for the market as this move will inject more liquidity into risk assets like Bitcoin and altcoins. Moreover, the crypto market is known to thrive on such macro fundamentals.

Trump’s Tariffs Continue To Hinder The Market

Amid Bank of America’s prediction, Donald Trump’s tariffs continue to hinder the crypto market, with traders wary of the uncertainty which the tariffs and trade war between the US and other countries causes.

The Bitcoin price had surged past the $86,000 mark today but sharply dropped below $85,000 on the back of reports that the European Union (EU) was likely going to proceed with its counter tariffs on US goods due to the failure of both sides to reach an agreement.

China has also shown that it has no intention to back down from the trade war against the US except if Donald Trump drops all the reciprocal tariffs. With such uncertainty, experts such as Bitiwise’s Head of Alpha Strategies Jeff Park believe that BTC’s current outlook is still bearish.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs