Bitcoin Proponent Barry Silbert Hits Back At Gemini’s Cameron Winklevoss On Genesis Funds

On Monday, Barry Silbert, founder and CEO of Digital Currency Group (DCG), issued a response to an open letter addressing the DCG’s alleged $1.675 billion debt. The issue was first raised by Gemini’s co-founder Cameron Winklevoss in an open letter that he posted on the micro-blogging site Twitter on January 2.

Cameron’s Open Letter To Silbert

This comes after Cameron tweeted against the DCG head via a Twitter post earlier today, highlighting the delay in halting Genesis withdrawals. He addressed the issue of the 340,000 Earn customers who are waiting for withdrawals to resume with digital assets piling up to more than $900 million.

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/kouAviTho4

— Cameron Winklevoss (@cameron) January 2, 2023

Barry Silbert’s Remark

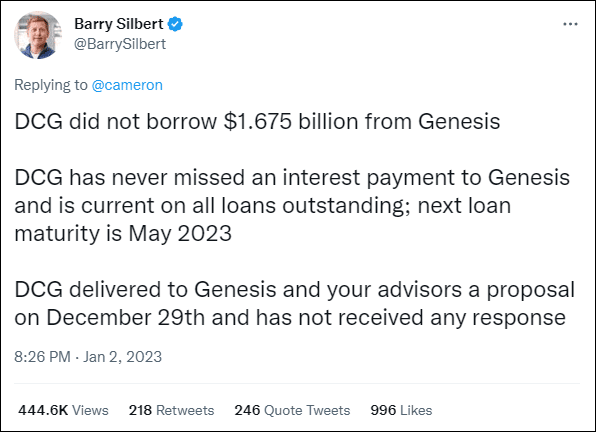

On the other hand, Silbert’s tweet mostly focused on rejecting any missing payments and assuring followers that DCG had never missed an interest payment and was current on all existing loans; with the next payment due in May 2023. The DCG CEO also stated that the next payment would be due in May 2023.

Read More: What’s Making Solana (SOL) Price Rally 12% In A Day?

In addition to this, he pointed out that the efforts his company undertook to provide a concrete resolution for Gemini users on the 29th of December, went unnoticed and have still not been acknowledged by Genesis’ team.

Winklevoss’s Jan 8 Ultimatum

In light of the fact that a large number of customers placed faith in Genesis, Winklevoss noted that Silbert’s actions were inexcusable and reprehensible. The co-founder of Gemini crypto exchange has further contested Silbert to make a public commitment by addressing the matter within January 8th.

On November 16, 2022, shortly after the downfall of the FTX empire, Genesis made a significant decision regarding withdrawals. It was announced by the lending division of the leading institutional digital asset manager that it would temporarily halt redemptions as well as the initiation of new loans. While few started speculating on Genesis’ insolvency, the crypto firm dismissed such allegations later on.

Also Read: Check Out The Top Crypto Telegram Channels Of 2023

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand