Beware, Bitcoin (BTC) Shots Are Building Up Heavily Amid Hot Gas Fee

Bitcoin (BTC) has recently come under some selling pressure as the gas fee has shot up to a two-year high forcing popular players like crypto exchange Binance to suspend withdrawals.

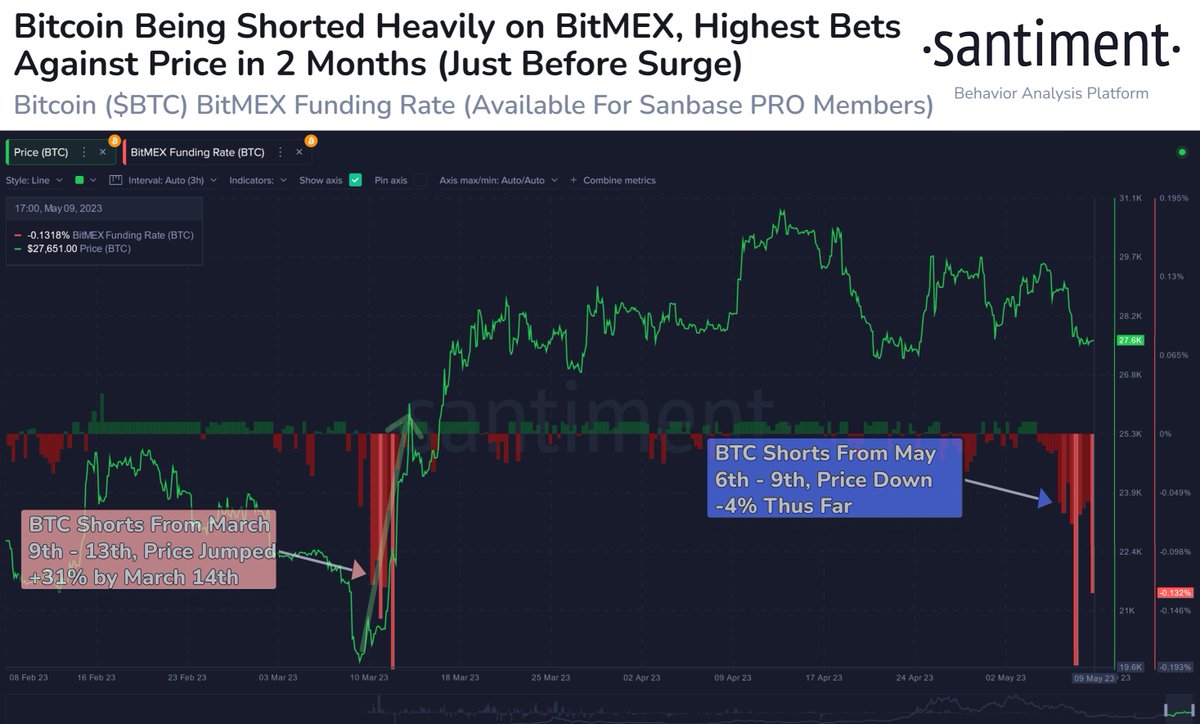

As per the on-chain data, the Bitcoin shorts on the crypto exchange BitMEX have surged to their two-month highs. However, as per on-chain data provider Santiment, this increases the chances of a bounceback. It reported:

Bitcoin’s funding rate on @BitMEX is seeing its most negative ratio since the heavy bets against prices in mid-March, just before prices soared. Generally, price rise probabilities increase when the crowd overwhelmingly assumes prices will be dropping.

As of press time, Bitcoin is trading at $27,668 with a market cap of $535 billion. As of now, $27,000 remains a major support on the downside. If it fails to hold, the next immediate support level for Bitcoin would be $24,000.

If $27,000 fails to hold for #Bitcoin

$24,000 is next. pic.twitter.com/YulNcHcdIi

— Crypto Rover (@rovercrc) May 9, 2023

Bitcoin Gas Fee Continues to Remain High

Despite all the drama over the past two days, Bitcoin gas fees are showing no signs of cooling down. Over the last 24 hours, the Bitcoin gas fee has shot up once again by a significant amount. Popular crypto handle WhaleWire noted: “It now costs an average of $30.91 per transaction, and many analysts predict it will break all-time highs in the near term”.

As we know, the strong demand for Bitcoin Ordinals aka Bitcoin NFTs has been the reason behind the recent surge in gas fees. On-chain data provider Glassnode explains: “Bitcoin is experiencing extremely high demand for blockspace, driven by BRC-20 tokens, utilizing text-based inscriptions, and ordinals This is a revenue boost for Miners, as the average fee paid per block has reached 2.905 $BTC, near past bull peaks”.

Of course, going ahead, key macros will continue to play a major role in determining the future Bitcoin price trajectory. Sharing his views about the economy and the monetary policy on Tuesday, May 9, FOMC Vice Chair John Williams said:

First of all, we haven’t said we’re done raising rates. We’re going to make sure we’re going to achieve our goals, and we’re going to assess what’s happening in our economy and make the decision based on that data.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs