Nearly 19,000 Bitcoins (BTC) Deposited on Gemini Exchange, Coinbase Premium Negative

After hitting its all-time high above $61,500 levels on late Saturday, Bitcoin (BTC) seems under pressure at this stage. At press time, BTC has slipped below $60K levels and is trading 2.5% down at $59,666 with a market cap of $1.114 trillion.

However, there’s a big red-flag at this stage and new buyers would maintain caution. CryptoQuant CEO and popular Bitcoin analyst, Ki-Young Ju notes that there has been a massive 18,961 BTC deposits on the Gemini Exchange. He further writes:

“This 18k $BTC deposit is legit as it was a transaction between user deposit wallets and Gemini hot wallet. All Exchanges Inflow Mean is skyrocketed due to this deposit. Don’t overleverage if you’re in a long position”.

Citing previous such moments and historical chart patterns, Ju further explains that the last time such exchange inflows happened on Gemini, BTC has gone through significant pullbacks.

Last time we got a big flow on Gemini

Chart???? https://t.co/2hhxmyzx1v pic.twitter.com/FAAArkr7mU

— Ki Young Ju 주기영 (@ki_young_ju) March 15, 2021

Bitcoin Price Rally Backed By Stablecoin Deposits & Not Institutional Driven

In further explanation, Ju also explains that it is difficult for the BTC price to sustain $61K since there’s been little backing by institutional players. In fact, the rally has been backed by more stablecoin deposits. He further notes:

“It’s not good for the bull market if the buying power continues to come from stablecoins. If so, as soon as this exchange stablecoins reserve dries up, we’re done”.

Ju’s claims that the rally came from stablecoin deposits are backed by the fact that unlike previous ATHs, the Coinbase Premium during the $60K surge was negative at -0.55%. Usually, when the institutions are buying, the Coinbase Premium remains negative.

Coinbase Premium Index was always significantly high when $BTC price breaking 20k, 30k, 40k, and 50k. It was significantly negative when the price breaking 60k.

This 60k bull-run is not US institution-driven, it all came from stablecoins.

Chart ???? https://t.co/RpcUEnGxB6 https://t.co/BafK1ggcoA pic.twitter.com/Xoz8cMj3sA

— Ki Young Ju 주기영 (@ki_young_ju) March 14, 2021

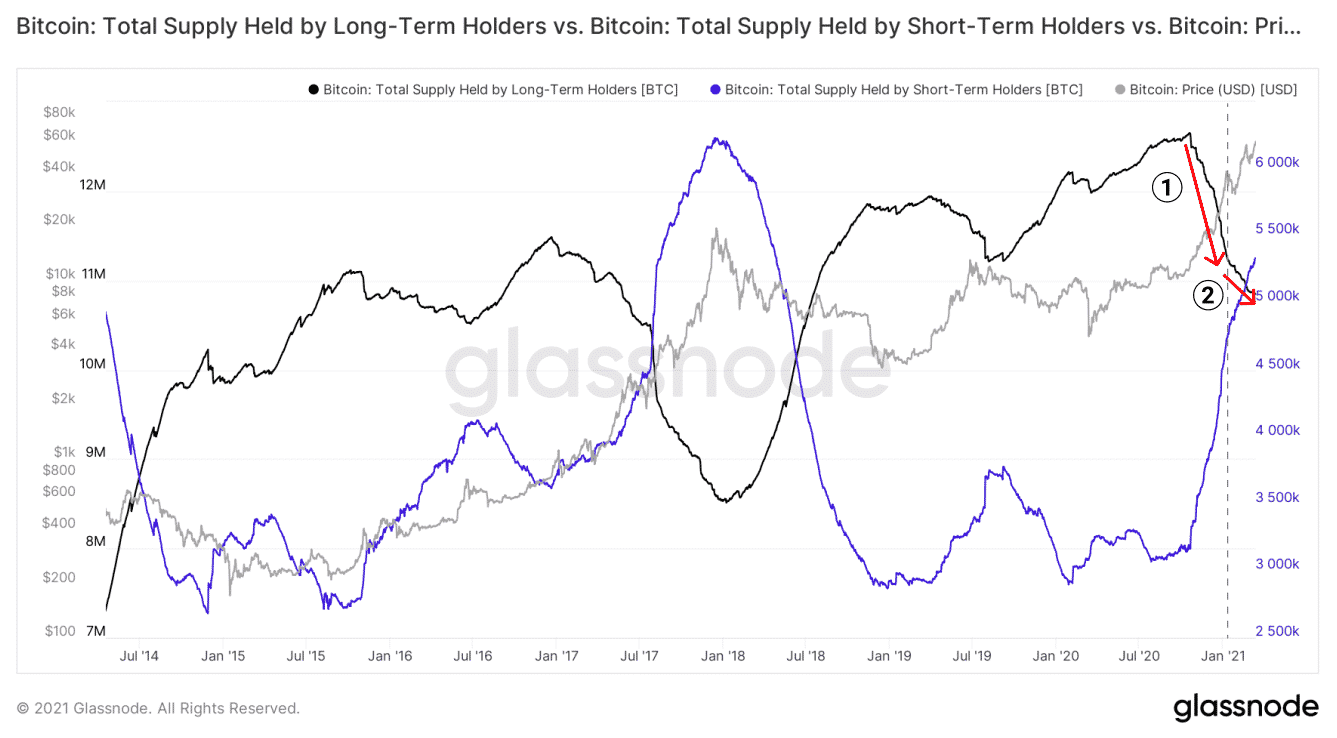

Another chart from Glassnode shows that the total BTC supply held by the long-term holders is decreasing while that held by short-terms holders is increasing. It means that the dormant tokens are moving from long-term holders to short terms holders which shows that price volatility will be seen soon.

Although Bitcoin (BTC) is likely to see a correction ahead as per the above indications, the historical chart shows that BTC is forming the first local top above $60K. During the previous bull runs of 2013 and 2017, Bitcoin (BTC) has typically formed 3 local tops, thus suggesting that there’s a massive rally coming ahead by the end of 2021. Thus, any dip from here onwards presents a new buying opportunity for investors.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs