Binance Witnesses 5000 BTC Withdrawn in Just 60 Seconds

Binance is witnessing a significant withdrawal of Bitcoin with the crypto world unstable. Amid whispers surrounding the platform, investors pulled over 5,000 BTC in just one minute, underlining the sheer magnitude of the issue. Significantly, Changpeng Zhao, Binance’s CEO, labels this incident as mere ‘fear, uncertainty, and doubt’ tactics.

🚨 🚨 🚨 🚨 🚨 4,000 #BTC (106,039,171 USD) transferred from #Bitfinex to unknown wallethttps://t.co/982bCEb4SO

— Whale Alert (@whale_alert) August 24, 2023

However, besides the one-minute wonder, a six-day streak from August 17 showed Bitcoin outflows dominating the Binance exchange. Hence, by August 22, 14,460 BTC found their way out of Binance’s reserves.

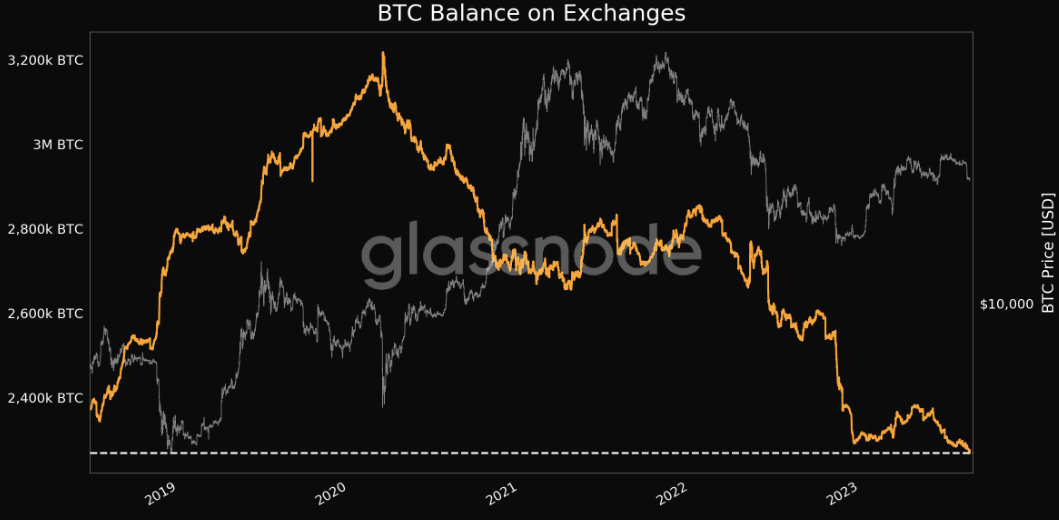

Moreover, Binance is one of many platforms seeing such massive withdrawals. Glassnode’s recent insights highlighted a 5-year low for BTC balances across all major exchanges.

BTC Balance on Exchages (Source: glassnode)

Consequently, fewer than 2.27 million BTC remain in known exchange wallets. Additionally, these shifts point to ‘HODLers’ preferring the safety of private wallets, indicating a potential reluctance to sell their holdings in the immediate future.

Fee Overhaul at Binance

Additionally, with Binance’s pivot from a zero-fee Bitcoin trading model starting September 7, the dynamics of its BTC/TUSD trading pair will undergo a significant transformation. The days of enjoying zero-maker and taker fees are ending. Moreover, while the maker fees will hold zero status, taker fees will now hinge on the user’s VIP level.

#Binance will update the zero-fee Bitcoin trading program effective from September 7, at 00:00 UTC.https://t.co/nlHvZU4ZJ0

— Binance (@binance) August 24, 2023

With Binance phasing out BUSD support in favor of TUSD, a noticeable drop in Tether (USDT) volumes came to the fore. Many seasoned traders and crypto enthusiasts see this as a pivotal moment with far-reaching market implications. Consequently, as this new crypto phase looms, all eyes remain on Binance’s subsequent moves and the overarching market aftermath.

The crypto sphere is experiencing some noteworthy shifts. The landscape is evolving with changes in trading fee structures and substantial BTC withdrawals. As these events unfold, market players and enthusiasts will watch closely, anticipating the next significant turn.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Ethereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

- Analyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

- U.S.-Iran War: Trump Threatens to Hit Iran ‘Very Hard’ Today as Bitcoin Faces New Selling Pressure

- Crypto Market Weekly Recap: US-Iran War Steer Crypto Prices, Kraken Gets Fed Master Account, Tokenization Push March 2-6

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

Buy $GGs

Buy $GGs