Binance Announces MATIC To POL Token Swap Support, Is Breakout Imminent?

Highlights

- Binance to delist all MATIC pairs and start POL trading on September 13, 2024.

- MATIC margin trading and loans will cease on the crypto exchange by September 5.

- Polygon's POL price remains low despite on-chain activity spike.

Binance has announced its support for the upcoming Polygon (MATIC) token swap to Polygon (POL), with plans to implement the changes throughout September 2024.

This move aligns with the broader changes within the Polygon network as it transitions from MATIC to the new POL token. Despite the announcement, the POL price is still down by double digits.

Binance Announces MATIC To POL Token Swap Support

According to a press release, Binance will delist all MATIC spot trading pairs on September 10, 2024, at 03:00 UTC, including pairs like MATIC/BNB, MATIC/BTC, and MATIC/USDT.

Following the delisting, all trading orders for MATIC will be canceled, and the crypto exchange will terminate Trading Bots services associated with these pairs. Consequently, users should cancel or update their Trading Bots to avoid potential losses.

Subsequently, the trading for the new POL token pairs will commence on September 13, 2024, at 10:00 UTC. The crypto exchange will handle all technical requirements during the swap, converting all MATIC tokens to POL at a 1:1 ratio, ensuring a seamless transition for users. However, the exact timing for the resumption of POL deposits and withdrawals has yet to be set.

As the Polygon network prepares for this major token swap, security concerns have surfaced. The official Polygon community Discord channel was recently compromised, raising alarms among users. Hackers took control of the channel and promoted phishing links, attempting to exploit the upcoming MATIC to POL migration.

Suspension of Deposits, Withdrawals, and Margin Trading

As a result, to facilitate the transition, Binance will suspend MATIC deposits and withdrawals starting September 10, 2024, at 03:30 UTC. Users should, as a result, complete any pending deposits before this time. Moreover, once the swap completes, withdrawals of MATIC tokens will not be supported on the platform.

Margin trading for MATIC will also be affected, with the suspension of isolated margin borrowings set for Sep 2. In addition, a complete removal of MATIC pairs from both Cross and Isolated Margin is set for Sep 5, 2024, at 11:00 UTC.

Binance Margin will automatically settle and close all positions, converting any remaining MATIC balances to other stable assets as needed. As a result, users should transfer their MATIC holdings to Spot Wallets to avoid any complications during the delisting process.Concurrently, the crypto exchange will also make adjustments to its Futures and Loans services.

MATIC Futures contracts will close and settle automatically starting Sep 4, with all positions being delisted after settlement. Users holding MATIC positions are encouraged to close them before the specified times to avoid automatic settlement. In addition, Binance Loans will close all outstanding MATIC loan positions on Sep 4, at 03:00 UTC. Users are urged to repay any outstanding loans to avoid losses during the transition. The platform will not support new MATIC loan applications, aligning with the broader transition to POL.

MATIC Price Rally Amid Market Activity

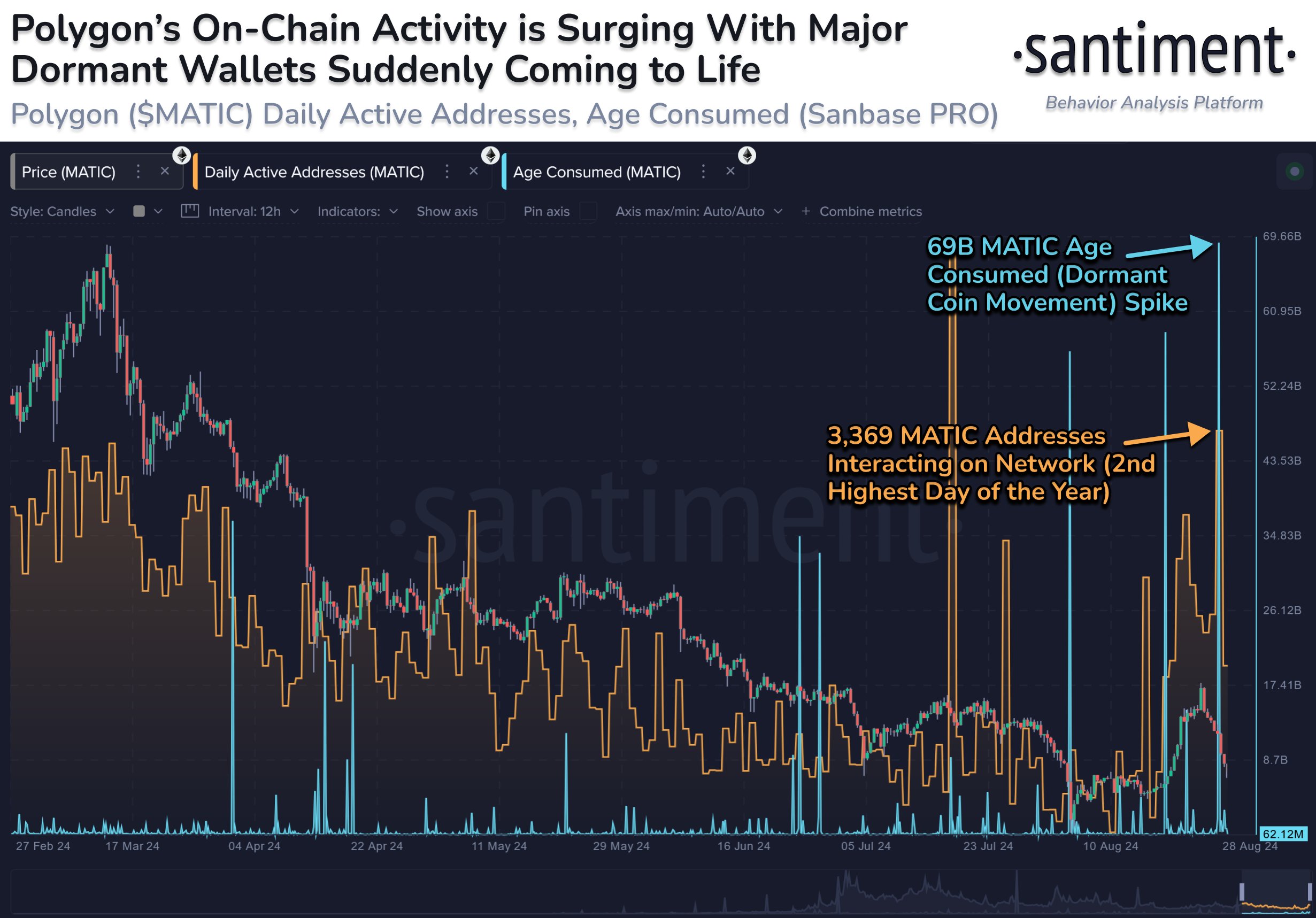

Despite Binance support, Polygon has been among the networks declining since the broader crypto market retrace began back in March. However, as per data the on-chain activity suggests that a MATIC reversal may be on the horizon.

This aligns with a spike in active addresses and dormant coin movements which are signals of a potential price turnaround. As per Santiment, the addresses have hit the second highest in the year while whale movements recording about $69B.

Market analysts are closely eyeing the MATIC price action, as it currently trades near crucial technical levels. A CoinGape price analysis predicts that a sustained hold above the $0.5065 support could pave the way for a rally, with targets set around $0.65.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs