Binance, Coinbase Impacted As Jane Street, Jump Crypto Exit US Crypto Market

Leading market makers for the crypto market Jane Street and Jump Crypto are exiting the U.S. due to extreme regulatory crackdown, lack of regulatory clarity, and heightened scrutiny.

The US SEC-led crypto regulatory crackdown has raised a wide set of problems for leading crypto exchanges Binance, Coinbase, and other crypto-related entities, with some planning to move their operations offshore.

Jane Street and Jump Crypto To Exit US Crypto Market

Two of the world’s top market-making firms Jane Street and Jump Crypto have decided to cease crypto trading in the U.S. amid an intense crypto regulatory crackdown in the US. The firms will continue market making and not leave the crypto market entirely, reported Bloomberg on May 10.

Jane Street preparing to scrap its global crypto expansion plans because regulatory uncertainty has made it difficult for the firm to meet internal standards.

Meanwhile, Jump Crypto, the digital asset division of Jump Trading, is exiting the US market but planning to expand its operations globally.

US federal departments and regulators have intensified regulatory crackdown against the crypto market following the FTX debacle and Terra-LUNA crisis. In fact, Jane Street and Jump Crypto were linked to FTX and Terra-LUNA crisis. Jump Crypto backed the TerraUSD algorithmic stablecoin by proving liquidity and funds, while Jane Street is cited by the US CFTC in its lawsuit against crypto exchange Binance. It is also linked to FTX and Sam Bankman-Fried. Many executives of FTX were earlier employees of Jane Street.

Also Read: Terraform Labs Moves Tokens Worth Millions A Year After Terra-LUNA Crisis

Crypto Market Could Face Severe Liquidity Issues

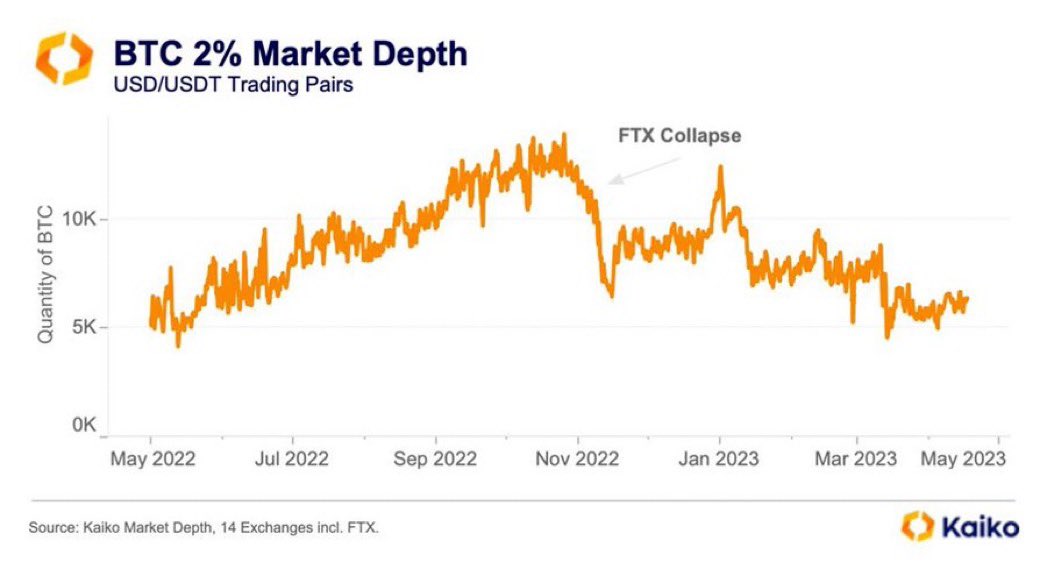

Market makers such as Jane Street and Jump Crypto support the crypto market by providing liquidity. Troubles due to lack of liquidity were one of the primary reasons for the crypto contagion seen last year.

The crypto market has already been becoming less liquid throughout the year and Jump and Jane Street pulling back their market-making activity will put further pressure. Coinbase and Binance are witnessing less liquidity as compared to earlier quarters.

CoinGape Media earlier reported, the U.S.-licensed crypto exchanges lost market share in 2023 Q1, with Coinbase accounting for 1.31%, Kraken 0.60%, and Binance.US 0.37%. Moreover, Coingecko reported a continuous decline in trading volume on Coinbase from 7% in January to 5% in March. Meanwhile, trading volume on crypto exchanges outside the U.S. rising due to the regulatory crackdown against crypto in the US.

a more nuanced view of the current liquidity situation

3/10 banking volatility

3/22 binance 0 spot fee program ended

3/27 binance cftc chargebig market makers scaling back is just one reason for the reduction in liquidity pic.twitter.com/6tJKWX4s64

— Alex (@thiccythot_) May 10, 2023

Also Read: US SEC Is Reportedly Close To Taking Enforcement Action Against Binance

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs