Binance Could Be In Trouble Amid Recent Actions: Bloomberg

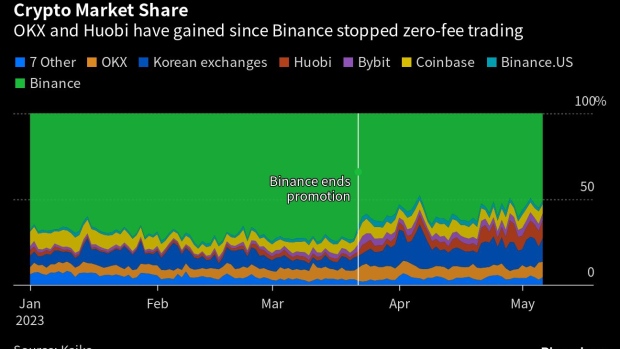

The world’s largest crypto exchange Binance continuously losing its dominance in the crypto market, according to a Bloomberg report. The decline in Binance’s market share in spot trading helped crypto exchanges such as OKX, Huobi, and Bybit gain market share in the last few weeks.

The heightened scrutiny and regulatory action by US regulators against Binance has become a big concern for its users. A potential enforcement action by the US Securities and Exchange Commission (SEC) could be devastating for the exchange and the market.

Coinbase and Binance are witnessing less liquidity as compared to earlier quarters. Jump Crypto and Jane Street pulling back their market-making activity from the U.S. will put further pressure on exchanges.

Also Read: US SEC Is Reportedly Close To Taking Enforcement Action Against Binance

Binance Losing Market Cap Constantly

US regulators have taken strict regulatory actions against major crypto exchanges Coinbase, Bittrex, and entities related to crypto. Binance was not spared, US SEC and NYDFS took action against Paxos ordering the firm to stop minting Binance USD (BUSD) stablecoin.

As a result, Binance ended its zero-fee Bitcoin trading program and BUSD zero-maker fee promotion. The exchange decided to switch from BUSD to low-market cap TrueUSD (TUSD) stablecoin. Binance CEO “CZ” confirmed the reason behind their recent change, making BTC/TUSD as the only zero-fee spot trading pair from March 22.

Important update. Given recent events, we are moving 0 fee BTC trading from BUSD to TUSD.

Let's spread the liquidity to more pairs.

https://t.co/6SwqjZYSFZ— CZ 🔶 Binance (@cz_binance) March 15, 2023

Also Read: Elon Musk Names New Twitter CEO, Who Is Linda Yaccarino?

According to Kaiko, Binance’s spot-trading volumes share fell to 51% in May from 73% in March. The market share of Huobi jumped from 2% to 10% and OKX from 5% to 9%. South Korean exchanges market shares increased to 14% from under 8%.

Cici Lu, founder of Venn Link Partners, said the intense regulatory heat in the US will continue to target Binance and its CEO “CZ.”

“The US crackdown has led to users worrying about the safety of their funds and that’s the reason they are diversifying into other centralized exchanges.”

Binance spokesperson asserts the market share drop is in contrast lower than projected by their modeling study. Binance will continue to improve existing products and services and invest in compliance processes to prepare for a “new era of regulatory certainty.”

Binance CEO is planning to reduce his shareholding in the Binance.US crypto exchange to reduce the impact on its US arm amid a targeted attack against Binance.

Also Read: Crypto Market In Free Fall As Bitcoin Price Breaks 200-WMA

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs