Breaking: Binance Officially Exits UK After The Netherlands And Cyprus

The world’s largest crypto exchange Binance’s request to deregister Binance Markets Limited (BML) is approved by the UK Financial Conduct Authority (FCA). Binance Markets Limited didn’t start offering services and had no users due to heightened scrutiny from regulators.

Troubles for crypto exchange Binance continue to mount as it exits from the Netherlands and Cyprus markets amid regulatory challenges and uncertainty.

Binance Withdraws UK Registration With the FCA

According to the UK Financial Conduct Authority (FCA), Binance’s request to deregister Binance Markets Limited was completed on May 30. Now, no other Binance entity holds any authorization from the FCA to provide regulated services in the country.

“Following the completion of the cancellation of permissions, the firm is no longer authorized by the FCA. No other entity in the Binance Group holds any form of UK authorization or registration to conduct regulated business in the UK.”

Ilir Laro, Binance’s sub-regional manager for growth in the UK and Europe, said the deregistration of Binance Markets Limited doesn’t impact Binance operations as it never offered any services and has no users.

“BML was successfully acquired back in 2020 by Binance Group, intended to launch a regulated business in the UK. This attempt was not successful, however, and has since then remained dormant since its acquisition,” he added.

The firm was previously authorized by the FCA or PRA, thus, issued a warning against Binance Markets Limited, stating that the firm provided regulated services without prior written consent from the FCA.

Binance has been in a battle with the regulators in the UK ever since it launched its crypto service in 2020.

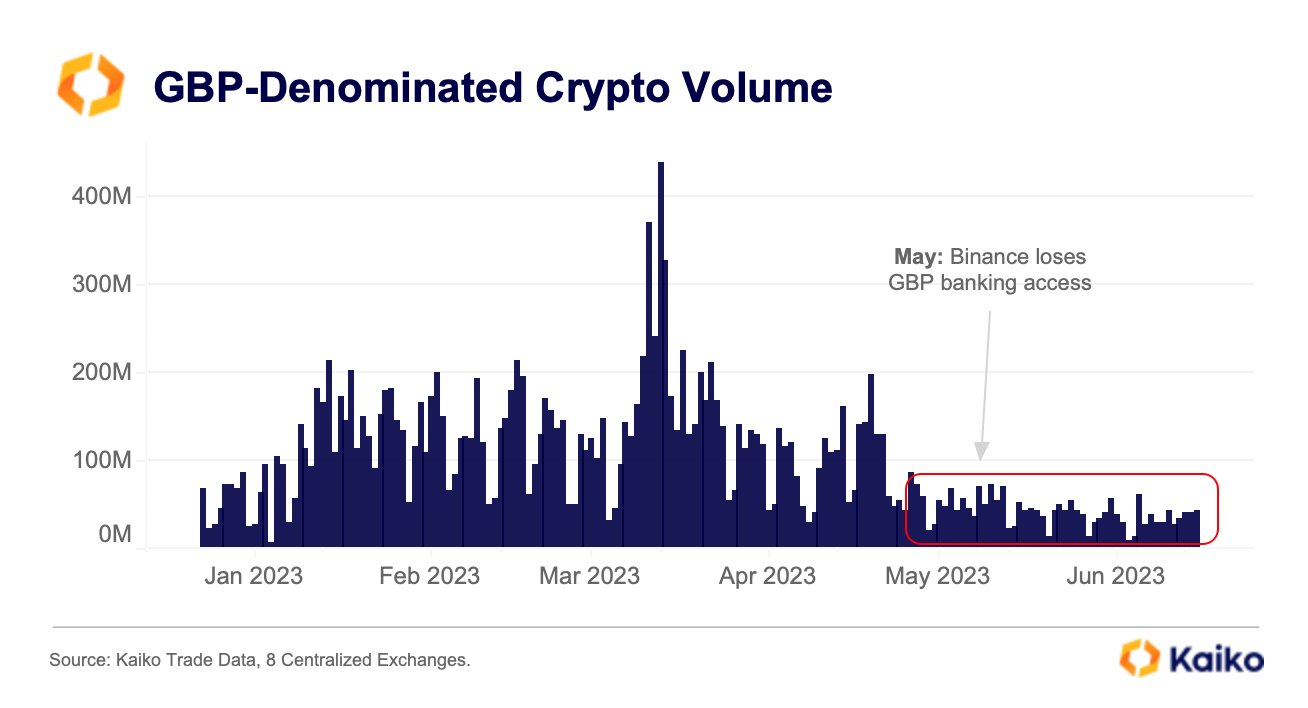

In March, Binance also ceased Sterling withdrawals and deposits for UK clients after its local partner Paysafe terminated operating agreements.

According to Kaiko data, the exchange previously accounted for most Sterling-denominated crypto volume until it lost its banking partner.

Also Read: Fidelity Investments Reportedly Filing BlackRock-Type Spot Bitcoin ETF, Acquire Grayscale

Troubles Faced By the Crypto Exchange

Binance is facing two lawsuits in the US, one by the Securities and Exchange Commission (SEC) and another by the Commodity Futures Trading Commission (CFTC). The experts point that the Dept of Justice may soon follow a lawsuit against the crypto exchange.

Binance recently withdrew its Cyprus virtual asset service providers (VASP) registration as it prepares for MiCA. The crypto exchange also stopped offering services in the Netherlands due to not obtaining a license.

Also Read: Key Events To Impact Bitcoin, Ethereum Price This Week

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- $2T Barclays Explores Blockchain to Tap Into Stablecoin and Tokenization Boom

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs