Binance-Paxos BUSD FUD: Massive Bitcoin Outflow From Binance, What It Means?

U.S. financial regulators SEC and NYDFS’ regulatory action against Paxos for Binance’s dollar-pegged stablecoin BUSD has caused a massive outflow from crypto exchange Binance.

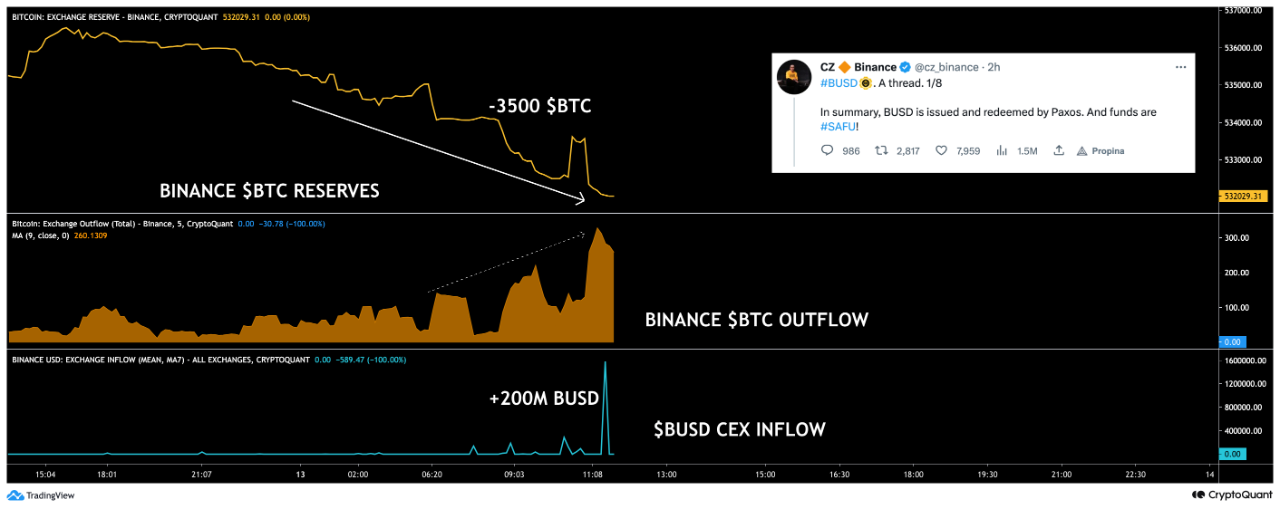

According to CryptoQuant data, Binance recorded over 16K Bitcoin outflow and 11K Bitcoin inflow on February 13. Meanwhile, the BUSD outflow and inflow on Binance were 428 million and 350 million, respectively.

Therefore, it indicates an increase in Bitcoin buying in the last 24 hours as exchange outflow is comparatively higher. On the BUSD front, outflow from Binance is comparatively higher than inflow. In total, users withdrew about $2.8 billion of crypto assets in the last 24 hours, with $2 billion of deposits during the same period. It is the largest daily net outflow from Binance since November.

Binance CEO Changpeng “CZ” Zhao tweeted that users have started migrating to other stablecoins. Binance plans to make product adjustments accordingly, including moving away from using BUSD as the main pair for trading. However, Binance will continue to support BUSD for the foreseeable future.

Just minutes after Binance CEO’s tweet, investors started taking action. Binance recorded nearly 3.5K Bitcoin outflows and large deposits of over 200 million BUSD in all CEX.

Binance USD (BUSD) depegged to Tether (USDT). The market cap of BUSD fell amid uncertainty, while the USDT market cap has increased to $68.58 billion today, February 13. Binance’s BNB price was also impacted by the news, with the price falling to below $280.

Also Read: Cardano Whale Transactions Jump In February, Will It Help ADA Rally?

Bitcoin Price Records Buying Pressure Amid Binance’s BUSD FUD

The increase in Bitcoin outflow from Binance has caused a rise in Bitcoin prices. BTC price is currently trading at $21,737, up 2% after making a low of $21.4K.

Traders are awaiting the U.S. CPI data for January to decide their next move. The inflation rate in the U.S. is expected to fall to 6.2% in January from 6.5% in December.

Also Read: US SEC Could Stop Hedge Funds From Working With Crypto Custodians

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?