Just In: Bit Global Files Lawsuit Against Coinbase Over WBTC Delisting

Highlights

- Bit Global has slammed Coinbase exchange with a monopoly lawsuit

- The firm accused Coinbase of wrongfully delisting wBTC to favor cbBTC

- Coinbase has had its own legal win this week, showcasing how dynamic the market is

American crypto trading platform Coinbase Global Inc. is in the spotlight after Bit Global named it a defendant in a new lawsuit. Bit Global, a professional digital asset custody and management solutions provider, claimed Coinbase unlawfully delisted its WBTC token so it could promote the rival cbBTC.

The Bit Global Stance Against Coinbase

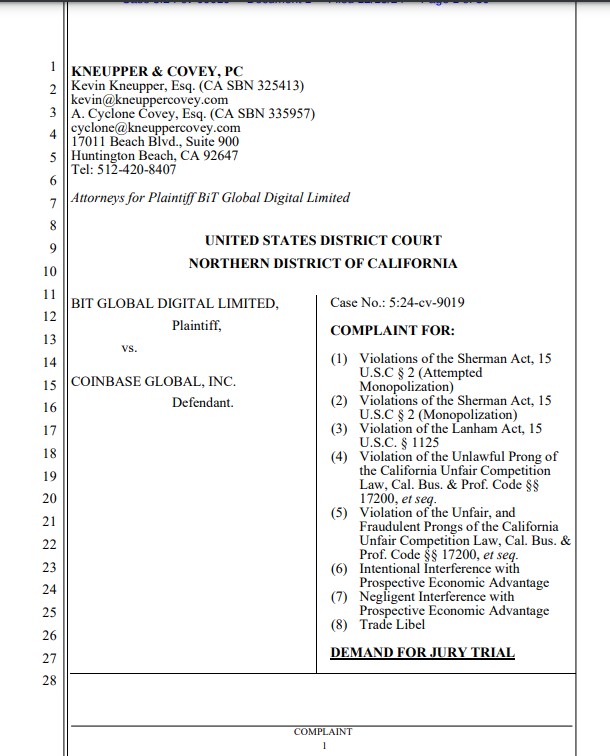

In the 36-page filing, Bit Global accused Coinbase of 8 offenses including but not limited to monopolization, trade libel and the violation of the Lanham Act. The custodian firm said Coinbase delisted WBTC as it is a major competitor to its own rival, the cbBTC.

The plaintiff argued that Coinbase has listed many memecoins which unlike WBTC have no inherent value other than jokes. It also reaffirmed that delisting WBTC in place of these memecoins proves the exchange did not make the move based on any defined listing standards.

“Like all the centralized tech giants before it, Coinbase gives lip service to the innovation of a decentralized world,” the firm’s lawsuit reads. “But in the case of wrapped Bitcoin, Coinbase viewed it as just another cash grab.”

Kneupper & Covey, the law firm representing Bit Global said the wBTC delisting comes with no room for appeal. It argued this move forces Coinbase’ wBTC users to accept cbBTC in violation of both Federal and State laws.

Coinbase launched the cbBTC token on Base in September and has been driving the development of the token. Notably, the trading platform launched cbBTC on Solana last month, a prove of its growth.

Demands and Legal Twist Around Coinbase

As part of the suit, Bit Global is asking for $1 billion in damages from the trading platform for hurting the wBTC market. Beside this, the firm wants the court to declare the delisting of the wrapped Bitcoin asset as illegal and to prohibitive the exchange from proceeding with it.

In the case that it deems it fit, it wants the court to refer all matters triable to trial the jury.

While Coinbase Exchange is facing a ngative legal challenge, it won a big one against the Federal Deposit Insurance Commission (FDIC) earlier this week. The court ruled against FDIC’s heavy redactions in the duo’s ongoing Freedom of Information Act (FOIA) case.

Effectively, the court asked the agency to revise the redactions, setting a deadline of January 3 to provide Coinbase with the required documents.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs