Bitcoin Accumulation Strategy Under Threat As Stock Prices Plummet, Says VanEck

Highlights

- Matthew Sigel of VanEck warns BTC holding companies to reassess their strategies.

- VanEck highlights the risk of stock prices plummeting and market cap falling.

- Sigel asserts that Semler's stock price has fallen despite Bitcoin's surge.

VanEck’s Matthew Sigel raises concerns over the risks of public companies’ Bitcoin accumulation strategy. Sigel warns companies to scale back their Bitcoin buying spree if stock prices falter.

VanEck Warns BTC Buying Firms to Reassess Strategy

In a recent X post, VanEck Crypto Research Head Matthew Sigel raised a red flag on public companies’ Bitcoin accumulation strategy. Sigel alerts that these companies should abandon the BTC tactics if their stock prices experience a significant decline.

Urging platforms to reevaluate their strategies, Sigel stated, “That might include a merger, spinoff, or sunset of the BTC strategy.” He also asserted that one prominent firm is nearing a critical point. He wrote on X,

No public BTC treasury company has traded below its Bitcoin NAV for a sustained period. But at least one is now approaching parity. As some of these companies raise capital through large at-the-market (ATM) programs to buy BTC, a risk is emerging: If the stock trades at or near NAV, continued equity issuance can dilute rather than create value.

Notably, Sigel advises companies accumulating Bitcoin to tie executive compensation to net asset value per share growth, rather than the size of their Bitcoin holdings or share count. He emphasizes the importance of disciplined decision-making while companies still have strategic flexibility. He added, “Once you are trading at NAV, shareholder dilution is no longer strategic. It is extractive.”

Further, Sigel recommends safeguards for companies with Bitcoin treasury strategies to mitigate potential risks.

- Suspension of ATM issuance- ATM issuance shall be suspended if the stock price falls below 0.95 times net asset value (NAV) for an extended period, say, for example, 10+ trading days.

- Share buyback prioritization: Share buybacks could be prioritized when Bitcoin’s value surges, but the company’s stock price doesn’t follow suit.

- Strategic review- A review shall be conducted if the NAV discount persists, potentially exploring options like mergers, spinoffs, or discontinuing the Bitcoin strategy.

Semler’s Bitcoin Bet Backfires, Stock Price Falls 45%

In a subsequent thread, the VanEck Head revealed that Semler Scientific, a medical technology firm, is the company that is “approaching parity.” Since May 24, Semler has been accumulating Bitcoin, now holding 3,808 BTC worth $404.6 million. As of now, Semler is the 13th largest BTC holder among public firms.

Other prominent companies, such as MicroStrategy and Metaplanet, are increasingly accumulating Bitcoin. Earlier today, Japanese firm Metaplanet added 1,112 BTC, bringing its total holdings to 10,000. Michael Saylor’s Strategy has also hinted at its next Bitcoin purchase, with its current holdings totaling 582,000. As per VanEck head’s statement, these companies are poised to face increased risks if their stocks plummet.

In contrast to Bitcoin’s straight ascendance, Semler’s (SMLR) stock price has fallen sharply by about 45% this year, returning to levels seen when the company first began accumulating Bitcoin. As a result, its market capitalization has dropped to approximately $434.7 million. Reportedly, Semler’s market capitalization relative to its Bitcoin holdings, measured by its multiple of net asset value (mNAV), has fallen to approximately 0.821x, dipping below 1x.

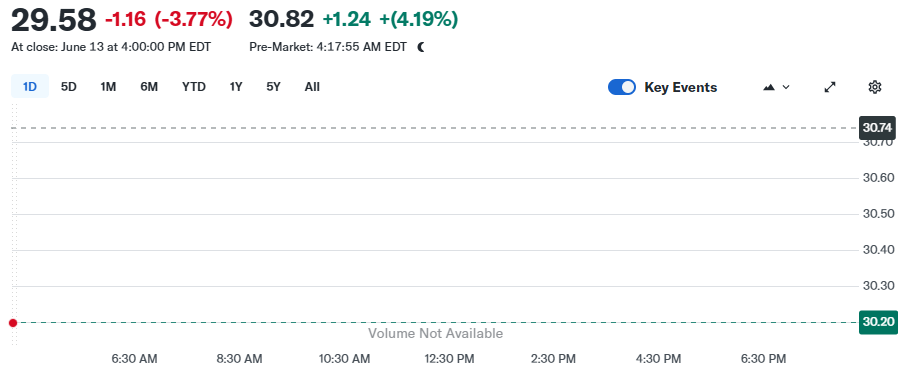

Semler Scientific, Inc. (SMLR) closed at $29.58 on June 13th, 2025, which was a decrease of $1.16 or 3.77% from the previous closing price. However, during pre-market trading, the stock price rose to $30.82, showing an increase of 4.19%.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs