Bitcoin VS. Altcoins: Spot Volume and Social Media Sentiments Eclipses the Latter

The spot volume and social media sentiments on Bitcoin is witnessing All-Time High average levels surpassing the interest in altcoins altogether.

Bitcoin halving was celebrated yesterday with much vigor across the entire industry. There was considerable volatility in price as well. Mati Greenspan, leading financial and crypto analyst and founder of Quantum Economics, tweeted on the social media mentions of Bitcoin,

All time high social volume for #BTC

Reportedly, the social volume dominance of Bitcoin was around 77.84% , a new ATH for the cryptocurrency. As the social media average soared 55% above it’s mean, there were only two other cryptocurrencies in the top 10 (by market cap) that seemed to grab social media attention – Ethereum [ETH] and Binance Coin [BNB]. Lately, Chainlink [LINK] has become fairly popular among Crypto Twitter as well.

Social volume across crypto is soaring today to 55% above average today led by #btc on 307,647 total posts.

Breakdown of top coins:#Bitcoin @bitcoin 77.84% ? (ATH %)#Ethereum $eth 5.4%#Zilliqa $zil 3.81%#Digibyte $dgb 3.8%#BinanceCoin $bnb 2.34%#Chainlink $link 1.3% pic.twitter.com/lOFEuHIWNQ

— LunarCRUSH Social Listening for Crypto (@LunarCRUSH) May 11, 2020

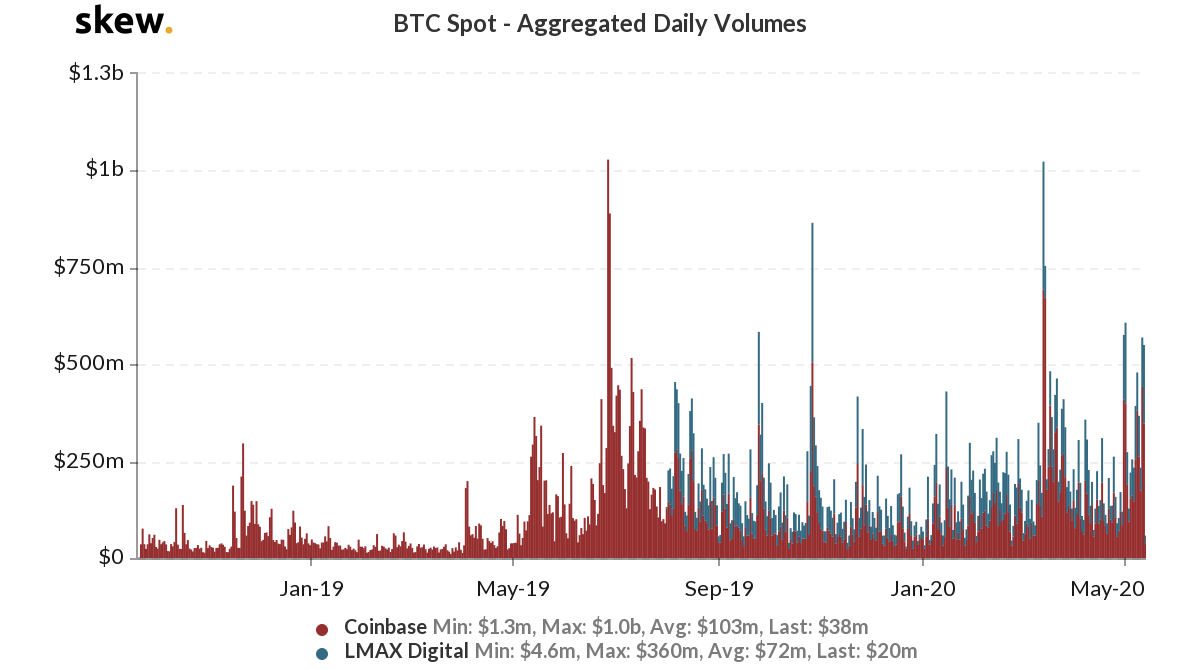

Spot Volume Nearing ATH

According to skew data, the spot volume for Bitcoin is nearly 4-6 times higher on Bitcoin than Ethereum. During the 2017 bull run, the hysteria had brought a lot of uncertain frenzy in the crypto markets. Three years down the line, the market is beginning to incline towards Bitcoin dominance again. Reportedly, Coinbase exchange merely 118,000 BTC less in April 2020 than in January 2018.

Moreover, at the time, spot volumes accounted for the majority of the trading in the crypto markets. Coinbase and Binance were one of the leading exchanges in the market for conversion from FIAT to crypto. Currently, the derivatives platforms (futures and options) have also made considerable progress.

Since then, the spot volumes have reached weekly spikes in trading volumes only on days with maximum volatility. The trend is echoing across Grayscale Trust fund as well, where Bitcoin and Ethereum is leading the interest among accredited and institutional investors in Q1 of 2020.

The dominance of Bitcoin [BTC] currently looking to establish support around the December 2017 levels. Notice how the majority of the decline was seen during December at the height of the ICO bubble. The levels around 50% are the next optimistic levels for altcoin investors.

Do you think that this is the local high for Bitcoin dominance or is set to increase further? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs