Bitcoin Balance on Coinbase Falls to 4 Year Low, Can BTC Supply Shock Push Price Over $50K?

Bitcoin’s (BTC) price is trading at $47,188 continuing the consolidation phase under $50K price. The top cryptocurrency breached $50K last week to post a new 3-month high of $50,400, but couldn’t solidify its position above the key resistance. It has traded in the $45K-$50K range since then, having formed key on-chain support in the region. While BTC price showed little momentum, the exchange outflows continued to surge.

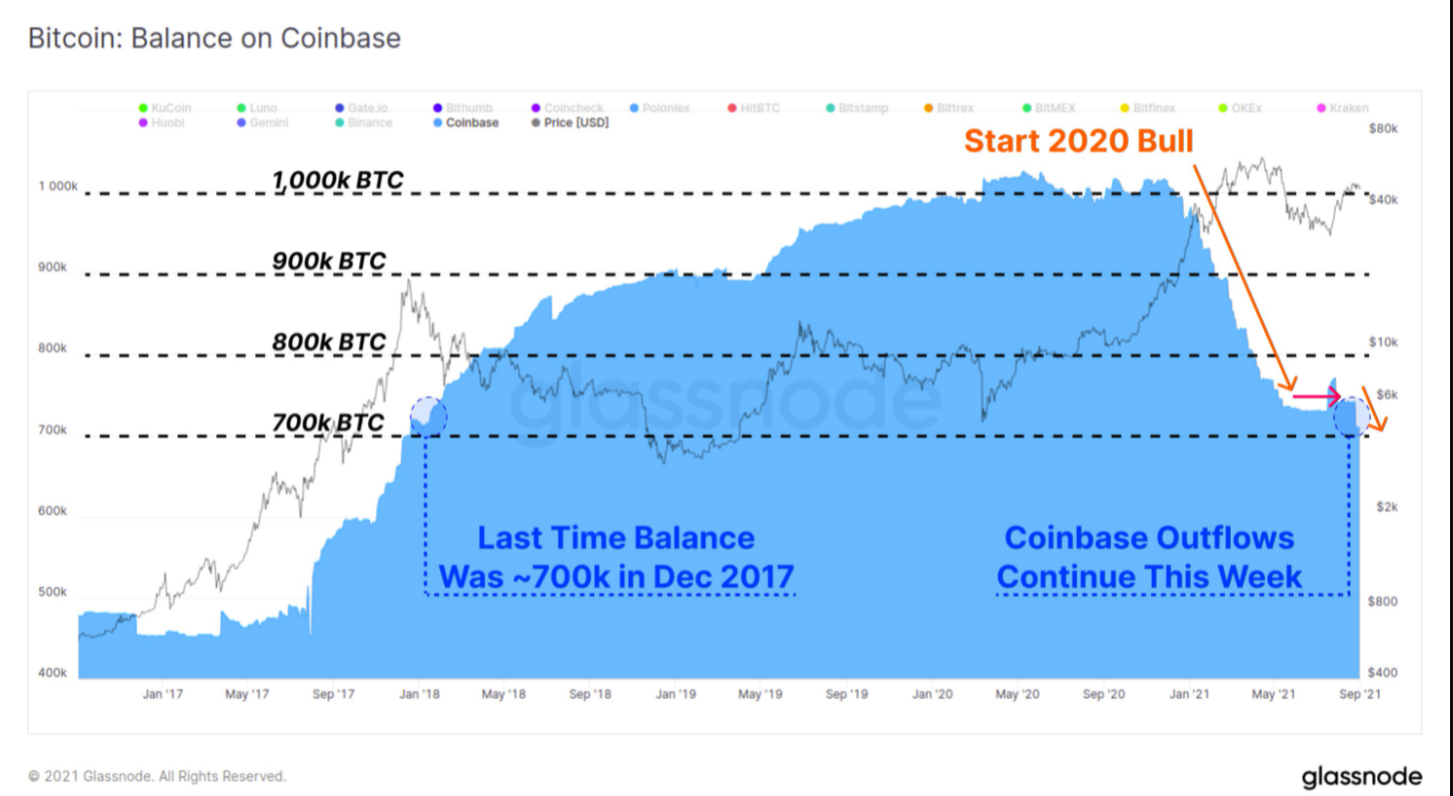

Coinbase crypto exchange saw a significant Bitcoin outflow over the past week after moderate inflows post-May crash. The outflow has led to a significant decline in Coinbase’s Bitcoin reserve reaching 700K BTC. The last time the BTC balance on Coinabse was this low was in December 2017 when the BTC price reached a new ATH.

The significant decline in BTC supply on Coinbase could be the work of whales or even institutional investors who use the exchange in plenty. An outflow of BTC away from exchanges is seen as a bullish signal as traders anticipate an increase in price. The supply shock could help the top cryptocurrency to get over the key $50K resistance.

Bitcoin Continues to Struggle With $50K Resistance

Bitcoin price faced rejection at $50K and it has moved sideways since then, even though it didn’t face any major corrections in the last week, it needs to get through the key resistance to retest its ATHs. The immediate resistance for $BTC lies at around the $49,400 mark.

Source: TradingViewBitcoin has formed strong on-chain support in the range of $45K-$50K with nearly 1.65 million BTC accumulated in the zone. It is currently sitting at the top of this strong support zone and needs a catalyst to move to the next on-chain support one of $55K-$59K.

#Bitcoin price is currently sitting at the top end of a strong on-chain support zone.

Over 1.65M $BTC now have an on-chain cost basis within the $45k to $50k range

The green zone below, at $31k to $40k, is also home to another 2.98M $BTC, indicative of large accumulation demand pic.twitter.com/P5W3zlvrSU

— glassnode (@glassnode) August 30, 2021

August proved to be a bullish month for Bitcoin as it managed to break out of the three-month-long bearish phase with several market sell-offs, but September has historically proven to be bearish for Bitcoin, which could make way for the altcoin season as already there altcoins have touched new ATHs.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise