Bitcoin (BTC) and Ether (ETH) Lose Key On-Chain Support, What it Means for Their Price?

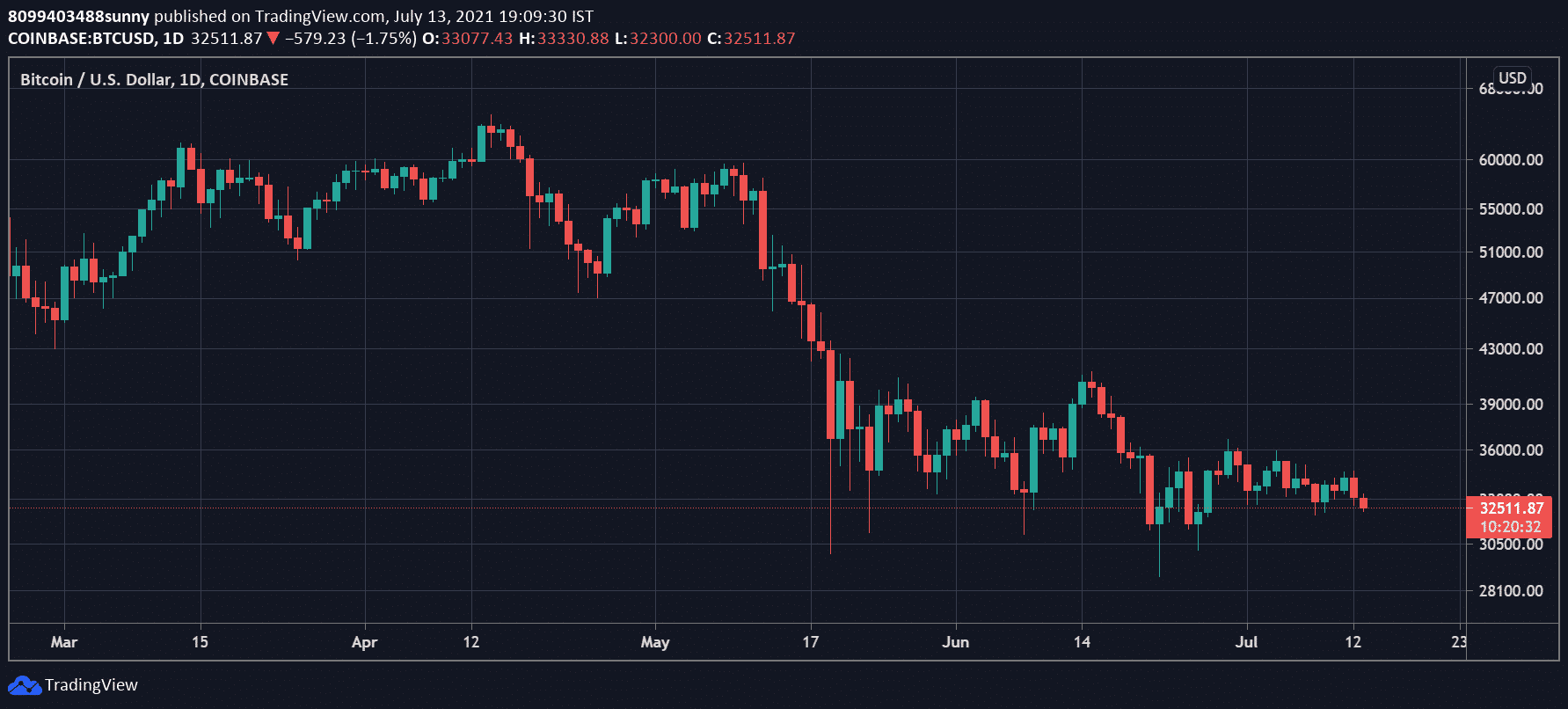

Bitcoin’s (BTC) price fell below the key on-chain support level of $33,000 again as US markets opened. BTC is currently trading at $32,540, down by 2.43% over the past 24-hours. The top cryptocurrency managed to shrug off the bearish weekend sentiment and tried to move past the key $35K resistance again but failed to do so. Now $30K is back into play for the top cryptocurrency as it tries to avoid any major sell-off.

$35K has become a critical on-chain resistance while $33K is key on-chain support for the top cryptocurrency. BTC has consolidated for the majority of the past two months under $35K with occasional breakouts above it, but never managed to solidify any gains. If the selling pressure increases and BTC loses $30K support as well, then another blood bath like May can be expected.

The overall market sentiments for the top cryptocurrency remain bearish as Google search for Bitcoin also fell to a 7-moth low.

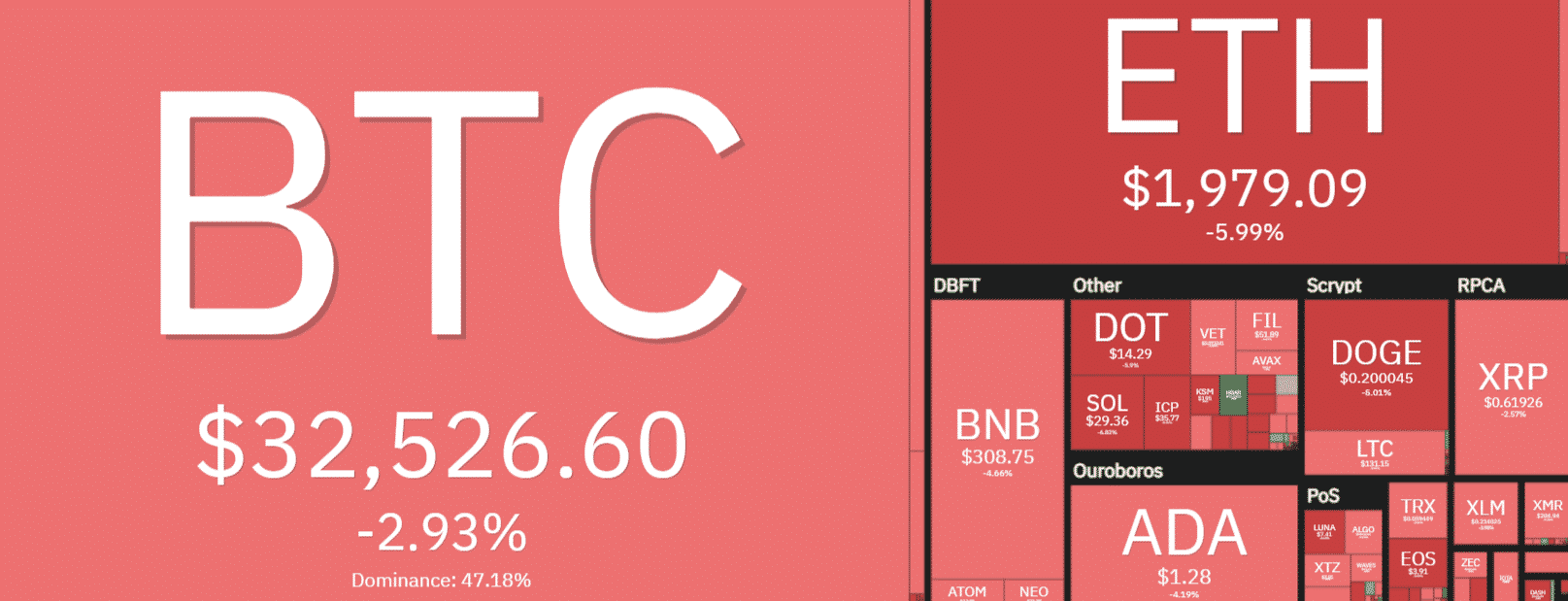

Ether (ETH) the second-largest crypto asset by market cap also lost its $2,000 on-chain support after holding onto it strongly for over two weeks now. The second-largest crypto showed a strong recovery post last month’s sell-off which saw its price retrace to $1,707. The upcoming London Hardfork scheduled to commence on August 4 was believed to be the key reason behind its recent price recovery.

The crypto market cap also slumped by 3.58% to fall below $1.4 trillion as majority of digital assets traded in the red. Both BTC and ETH need to hold onto their immediate support to avoid any further sell-off.

Crypto Market Turns Red

All cryptocurrencies in the top-10 fell in the red zone losing anywhere between 3%-8%. Uniswap was the biggest loser with an 8% decline, followed by Ether at 6.29% and Polkadot at 6.03%.

On-chain metrics indicated a significant flow of funds continue to move out of exchanges but despite that the low liquidity and high volatility continue to plague the crypto market. A recent report suggested major crypto exchanges saw a 51% decline in trading volume in the month of June after the May crash.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs