Bitcoin (BTC) Likely To Bottom After One More Dump, Here’s Why

Bitcoin miners are preparing to dump a large amount of tokens on the open market, amid a recent crash in prices.

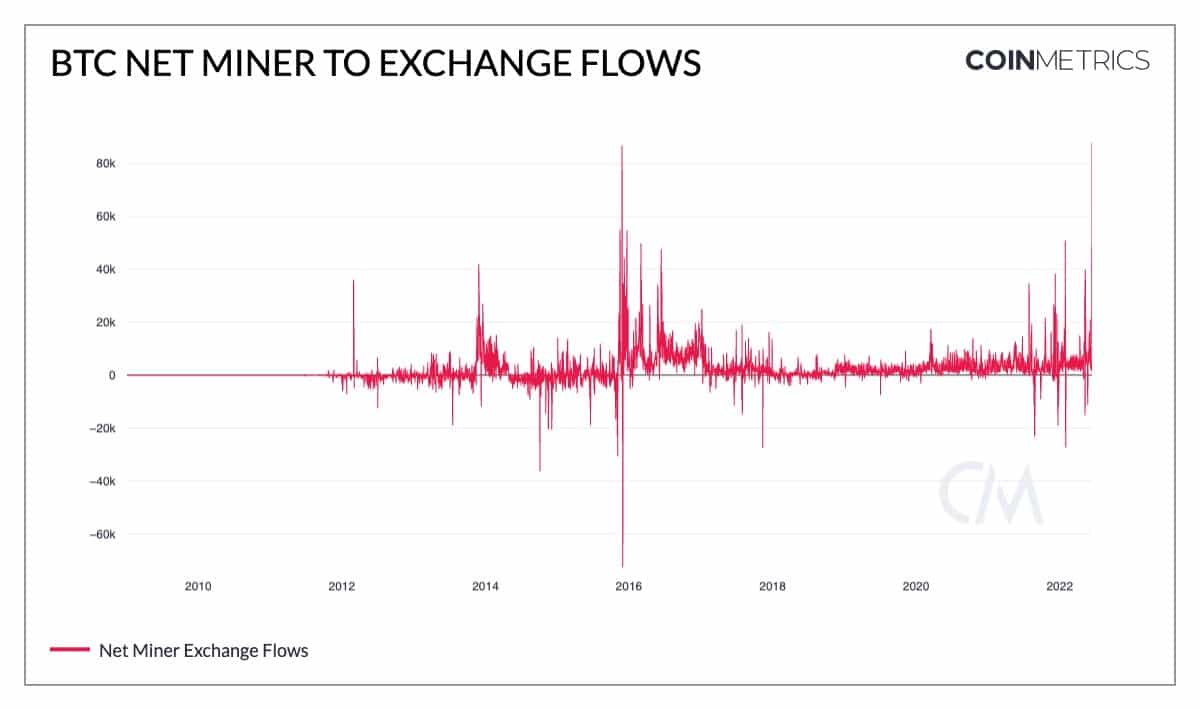

On-chain data shows that a record amount of Bitcoin was sent to exchanges from major miners over the past 24 hours. Such a move usually indicates that they are preparing to sell.

The move also comes as Bitcoin prices stabilized after tumbling 30%, and are currently holding above $22,000. The level is also the last point for a bulk of traders to cash out of Bitcoin to keep their positions positive.

Several Bitcoin miners were already seen selling their holdings in order to cover operational costs, as the market sentiment worsened.

Bitcoin miners the last to sell in a bear market

Data from on-chain analytics firm Coinmetrics shows that a net 88,000 Bitcoin ($1.7 billion) was sent to exchanges from major miners to exchanges- a record-high figure. Moving tokens onto an exchange usually precedes a sale.

A sale of this magnitude is likely to bring Bitcoin prices down substantially, likely causing a slump below $20,000.

But miners are usually the last to sell during a bear market. Even during the 2018 market crash, where Bitcoin fell as low as $3000, miners were the last to liquidate their holdings.

While the liquidation does cause a price crash, it also indicates that the near-term selling pressure on the token has eased, and usually results in the forming of a bottom.

Bitcoin miners see input costs as far lower than the tokens mined, allowing them to hold onto their tokens for longer. But with a drop in prices, their profitability reduces.

Mining profitability is currently at its lowest since late-2020.

Where will BTC bottom?

Given that a crash below $20,000 will also liquidate several large positions in the market, a Bitcoin bottom may be well below current levels.

Technical indicators show that the token could slump as low as $13,000– its lowest level since mid-2020. A recovery from these levels is also expected to take time, given the unfavorable macroeconomic conditions in the market.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs