Bitcoin (BTC) Bulls and Bears Engage In Close Battle. Who Shall Win It from Here?

After leaning under $35,000, Bitcoin (BTC) is trading 6% up today at $36,858 while participating in the overall crypto market recovery. It a close battle between the Bitcoin (BTC) bulls and the bears and either of the two will gain dominance in a short time. To understand this, let’s take a look at some of the on-chain metrics for Bitcoin.

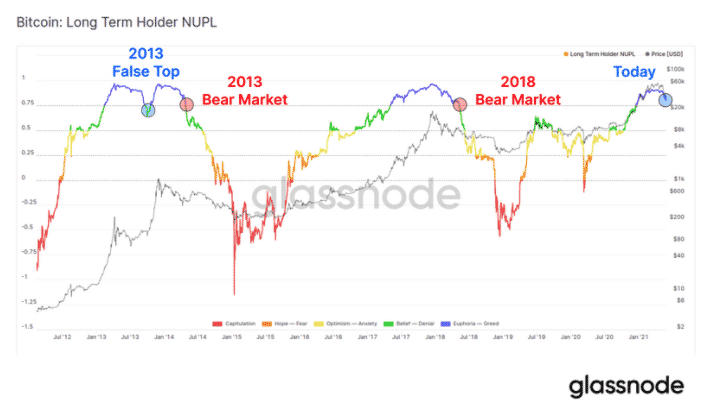

As we know, the short-term holders (STHs) continue to book losses with every Bitcoin downfall while the long-term holders (LTHs) have started the accumulation. As per the on-chain data provided by Glassnode, the Net Unrealized Profits (NUPL) for long-term holders is at a make or breakpoint.

So far, a majority of the long-term holders (LTHs) are currently in profit. But what if they start booking the remaining unrealized gains? This could possibly mark the beginning of a bearish trend as per the historical chart patterns.

The Glassnode report adds that short-term holders (STHs) can continue to “be a source of sell-side supply moving forwards”. If the LTHs give up their accumulation and rather turn to sell, we are moving ahead in a bear market for sure. As per the technical charts, Bitcoin is suggesting a drop to $24,000 i.e. another 40% correction from the current levels.

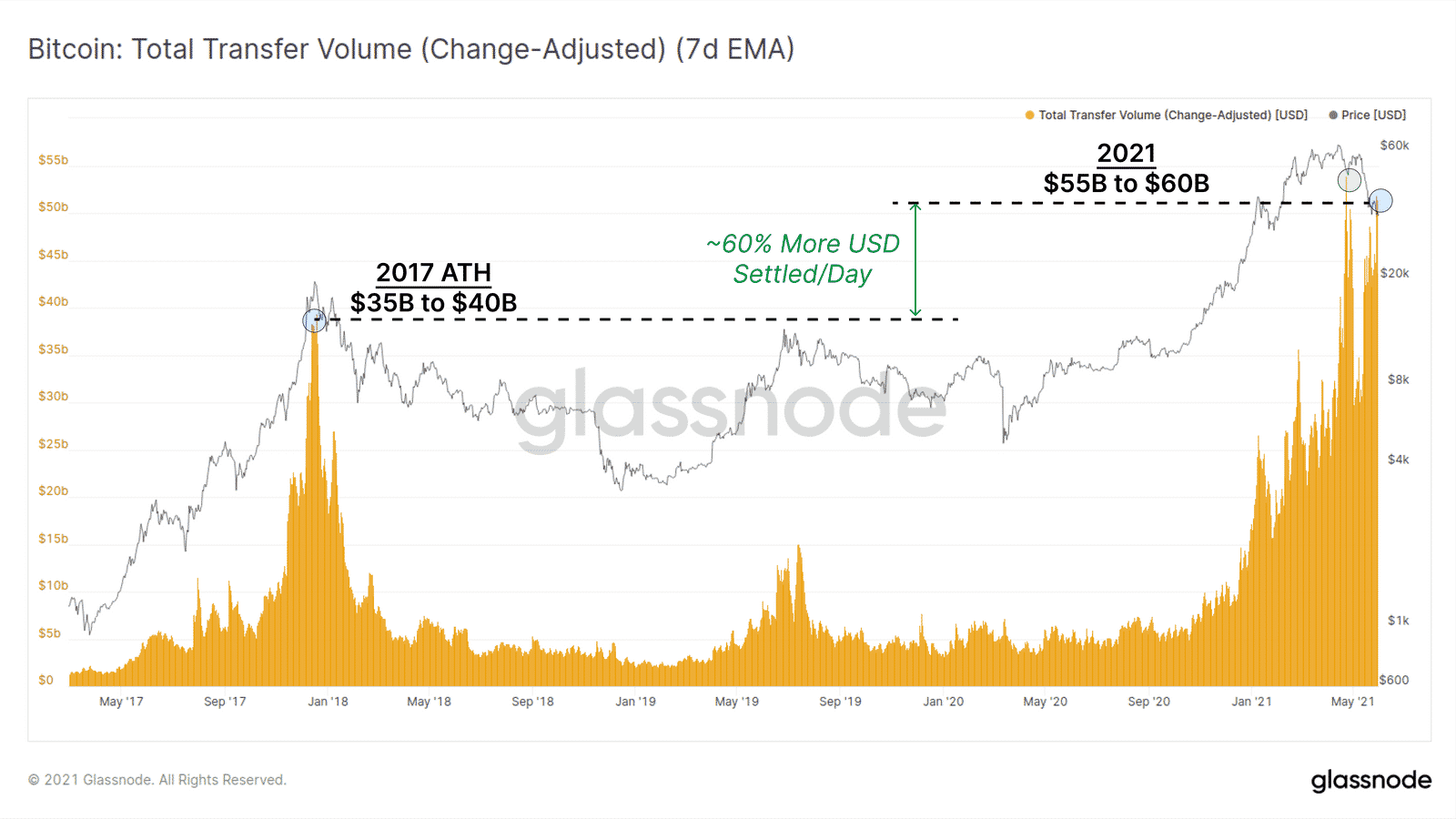

Bitcoin On-Chain Settlements Shoot to $55 Billion Per Day

During the recent market correction, the Bitcoin network activity has surged once again. The Bitcoin on-chain settlements have moved past $55 billion per day showing that a large number of coins are on the move. This is nearly 60% more volume than what we saw during the 2017 market peak.

As Glassnode reports: “Throughout May, a total of 155k BTC have transitioned from an Illiquid state (HODLed) to Liquid or Highly Liquid state providing an estimate of the total ‘sell pressure’.”

However, since the Bitcoin price has dropped very past, the profits for long-term holders have trimmed significantly. The report notes that as a result of it, these players are unwilling to liquidate their holdings at such reduced prices.

So far, long-term holders (LTHs) have shown the conviction to accumulate at the current dips. But STHs are putting constant pressure by increasing their selling by 5x over the last few weeks. In this tug-of-war, it will be interesting to see who has the final call.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs