Bitcoin (BTC) Bulls Are Back, Explains Binance CEO “CZ,” Willy Woo And Michael Saylor

Bitcoin (BTC) bulls appear to be back as the crypto market takes off despite the Fed rate hike and recession fears. Crypto evangelists Binance CEO “CZ”, MicroStrategy’s Michael Saylor, and Galaxy Investment’s Mike Novogratz were bullish on the crypto market before the FOMC meeting and thinks the recession will indeed drive Bitcoin adoption.

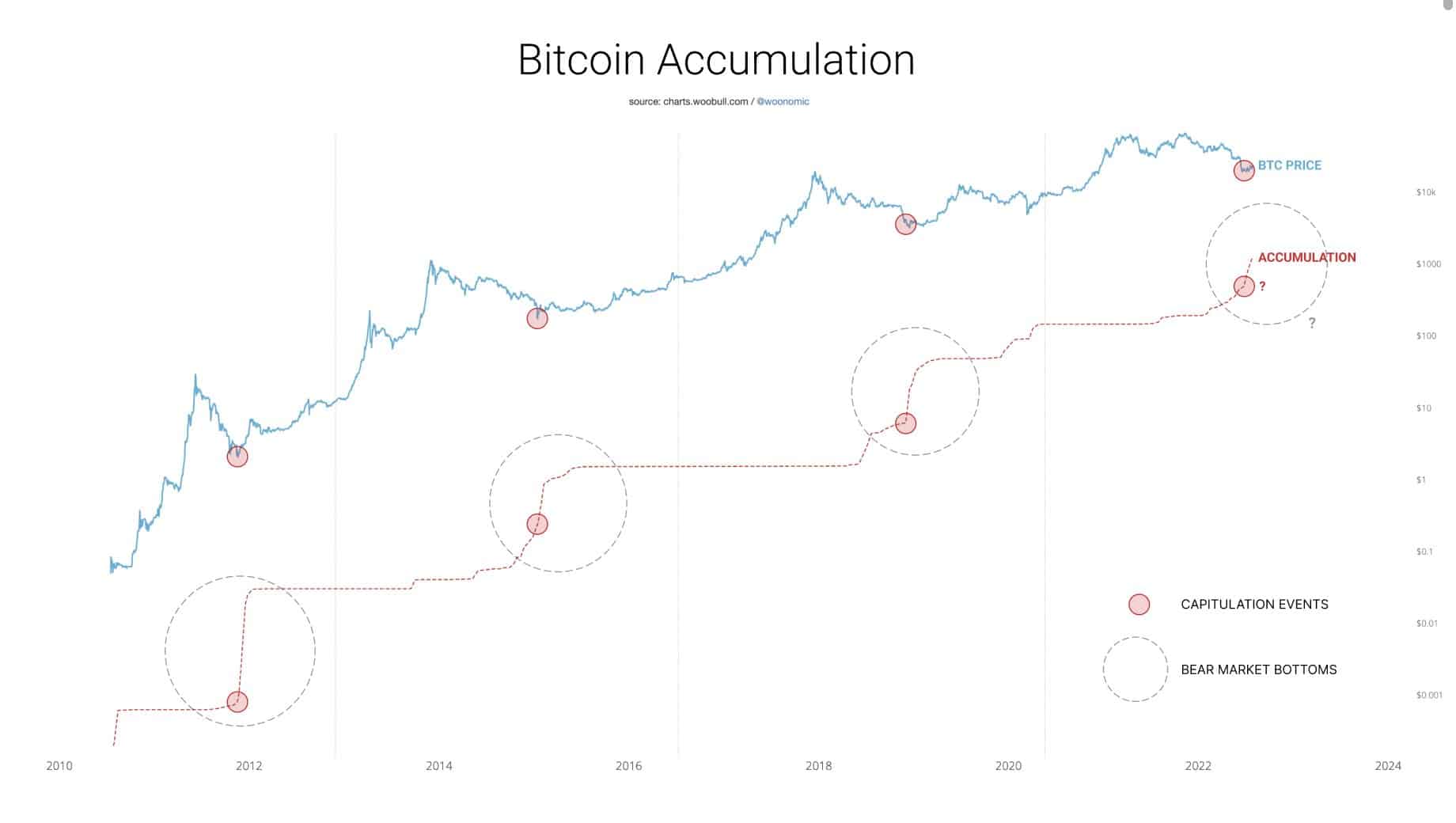

Bitcoin Accumulation Rising Amid High Inflation and Recession FUD

Bitcoin (BTC) price skyrocketed by 29% in July, making a high of $24,294 after 2 months on July 29. The U.S. Fed rate hike and negative GDP report fail to pull down the market rally due to rising positive sentiments. The Crypto Fear & Greed Index has jumped to 42 from 11 last month, making Bitcoin attractive above the $20k mark.

Binance CEO “CZ” in an interview with CNBC eases fear surrounding rising inflation and recession. He believes Bitcoin (BTC) is bearish above the $20k level as the last peak around $20k in 2017 acts as a strong psychological barrier.

He said the Bitcoin fundamentals are strong, money supply and Nasdaq 100 correlation are all secondary factors. The regulatory landscape improvement, higher inflation, and recession talks will help drive Bitcoin adoption.

He asserts logically the crypto market should move opposite to the stock market, but crypto is tied to macro factors these days due to its smaller market size. Both the crypto and equities markets are rising despite the Fed rate hike and recession fears.

“The cryptocurrency market is so small that whenever the big ship tank or when stock markets crash, people want to hold cash. Today, most people who are trading cryptocurrencies also trade stocks. So right now it’s positively correlated, which is illogical, but it’s just the way it is right now.”

Bitcoin analyst Willy Woo in a tweet on July 30 claims the Bitcoin accumulation is rising. He shared his personal Bitcoin capitulation and bear market bottom chart depicting historical Bitcoin movements. Bitcoin bulls can drive a rally.

Bitcoin evangelist and MicroStrategy’s CEO Michael Saylor believes Bitcoin will drive wave crypto regulation and rationalization as adoption continues to rise. In a recent tweet, he said:

“This month the need for bitcoin climbed to another all-time high.”

Bitcoin Bullish Above $20K Psychological Level and 200-WMA at $22.8K

The Bitcoin (BTC) price has rallied significantly higher this week on the back of the crypto market and stock market rebound. In the last 24 hours, BTC made a high of $24,294, currently trading at $23,825, down just 1%.

The Bitcoin (BTC) price will remain bullish above the $20k level for a longer time. Meanwhile, tracking the price trends above the 200-WMA is important.

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card