Bitcoin [BTC] Can Easily Reach The Value Of Gold In The Next 2-3 Years: Analyst

In the next 2-3 years, the total market capitalization of Bitcoin will surpass Gold ‘s as the most valuable coin establishes itself as a preferred store of value thanks to its decreasing inflation and adoption.

This is the view of one analyst who also adds that there is “no other asset to own today” other than BTC.

“Bitcoin can easily reach the value of gold in the next 2-3 years. Few understand this. Never has there been such an easy layup trade. Today, that’s about 500K-600K. This is easy. There is no other asset to own today. Won’t be long before this is obvious to all.”

#bitcoin can easily reach the value of gold in the next 2-3 years. Few understand this.

Never before has there been such an easy layup trade.

Today that's about 500K-600K.

This is real easy.

There is no other asset to own today.

Wont be long before this is obvioius to all.— BitcoinTina☣️- "TINA" #bitcoin (@BitcoinTina) March 25, 2020

A 68X Rally for Bitcoin to Usurp Gold

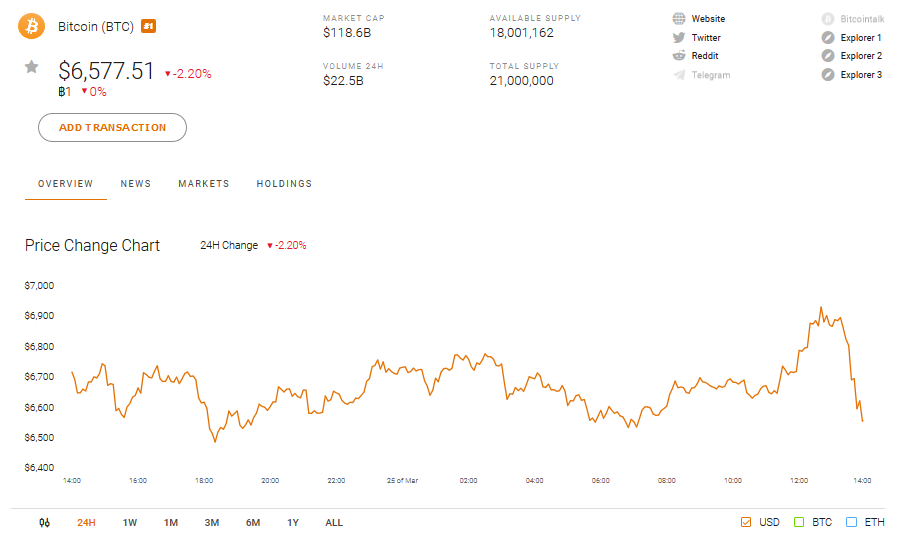

At BTC spot rates, the market capitalization of Bitcoin stands at $118 billion, down several billions when prices tanked from highs of $10,500 recorded in mid-February 2020.

Meanwhile, that of gold is estimated to be worth $8 trillion.

Comparing the two, Bitcoin’s market cap is 68X lower than gold’s, the latter being an established asset used through the centuries as a store of value thanks to its corrosion resistant properties and scarcity.

The yellow metal is also coveted by many and has intrinsic value since it can be used as jewelry. Its demand is perpetually high, garnering the support of many like Peter Schiff, a renowned gold bug.

Still, within a standardized time period, Bitcoin outperforms gold. Bitcoin total supply is fixed and from 2011, gold is down 13%.

Bobby Lee has a $500,000 price tag for Bitcoin

Within this time, BTC rallied and is up 6,000X from 2011’s average price.

Because of this, Bitcoin supporters say, analysts should treat this alternative store-of-value asset fairly:

“Gold is down 13% since 2011 highs. Bitcoin is up *6,000 times+* since early 2011. Bitcoin also outperforms gold in most standardized time periods. Once again, history and standardized performance conveniently ignored. Why not be fair to Bitcoin?”

Gold is down 13% since 2011 highs. Bitcoin is up *6000 times+* since early 2011. Bitcoin also outperforms gold in most standardized time periods. Once again, history and standardized performance conveniently ignored. Why not be fair to Bitcoin?

— Gabor Gurbacs (@gaborgurbacs) March 24, 2020

For Bitcoin to surpass gold, then its price should surge past $440,000 level, a 65X rise at spot market caps.

If this is to happen in the next 2-3 years, BTC may be grossly undervalued and at spot rates, a remarkable opportunity is presenting itself for savvy traders and holders.

This price range is well within Bobby Lee’s predictions.

In his analysis, he expects the flip to happen in the 2020s when each BTC coin in circulation will be worth over $500,000:

#Gold is at about $8 trillion today, which is 50x the worth of #Bitcoin.

I predict the #flippening will happen within 9 years and $BTC will shoot up past USD $500,000.

And with all of the money printing that’s happening globally, $BTC will actually very likely be over $1 million! https://t.co/hbqGze38k5— Bobby Lee – Ballet: Simple & Elegant Wallet (@bobbyclee) November 10, 2019

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

Buy $GGs

Buy $GGs