Bitcoin (BTC) Can Fall Another 20% Due to Its Correlation With S&P 500

Following the higher-than-expected CPI inflation data on Tuesday, Bitcoin and the broader crypto market witnessed a sharp fall. Currently, Bitcoin is trading at 8.4% over the last 24 hours holding just above its crucial support of $20,000.

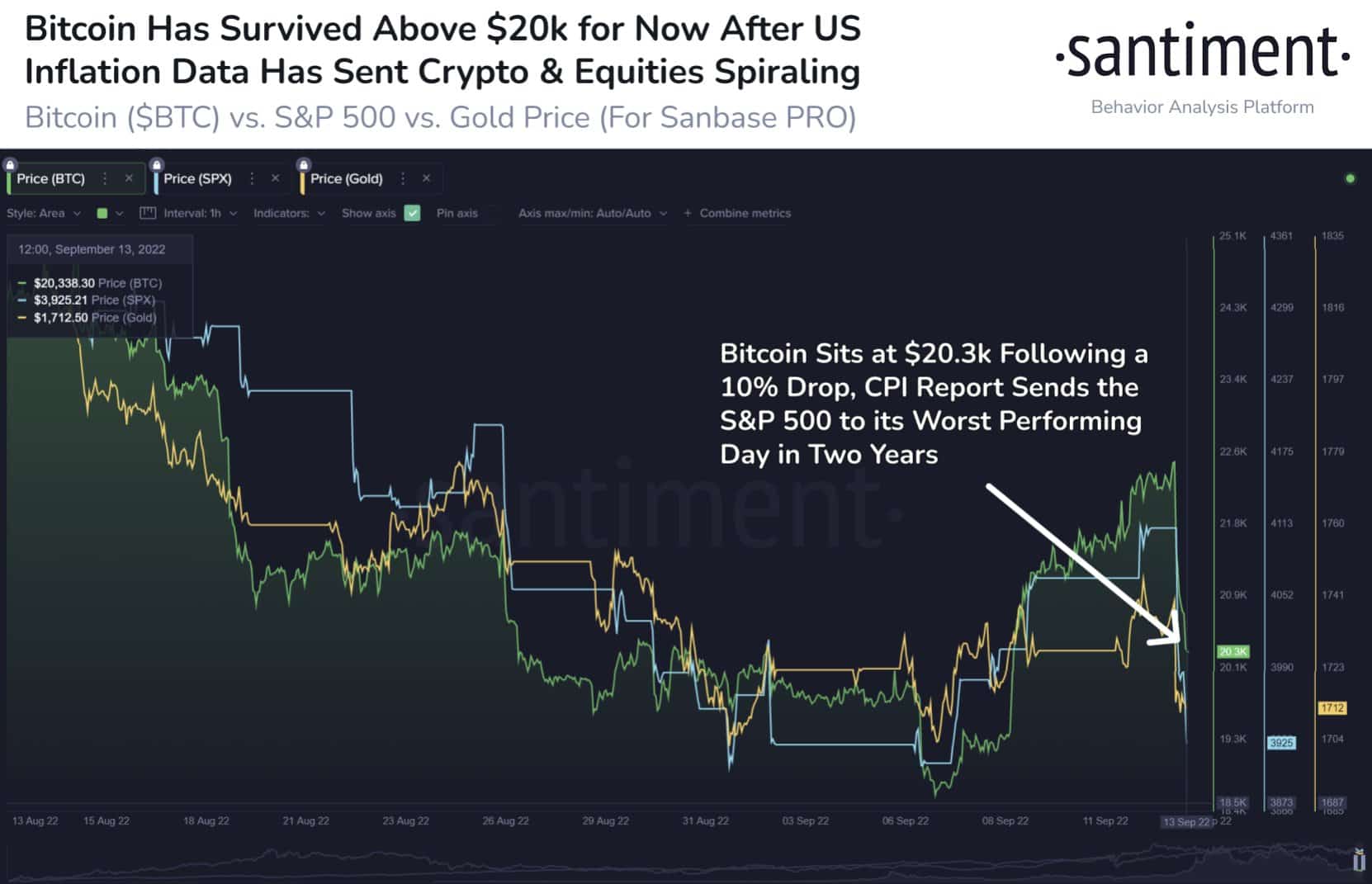

Bitcoin’s price crash came alongside that of the S&P 500 dropping 4.5% and slipping under $4,000. As on-chain data provider Santiment explains:

After a brutal #CPI report on disappointing inflation news Tuesday, #Bitcoin fell alongside the #SP500‘s biggest daily drop in two years. The correlation between the sectors remains high, and #crypto typically thrives best with zero #equity reliance.

As we know, Bitcoin has been showing a greater correlation with the S&P 500 here. As long as Bitcoin continues to follow the equity markets it is likely to stay in the bear’s grip going ahead.

Bitcoin (BTC) Can Correct Another 20%

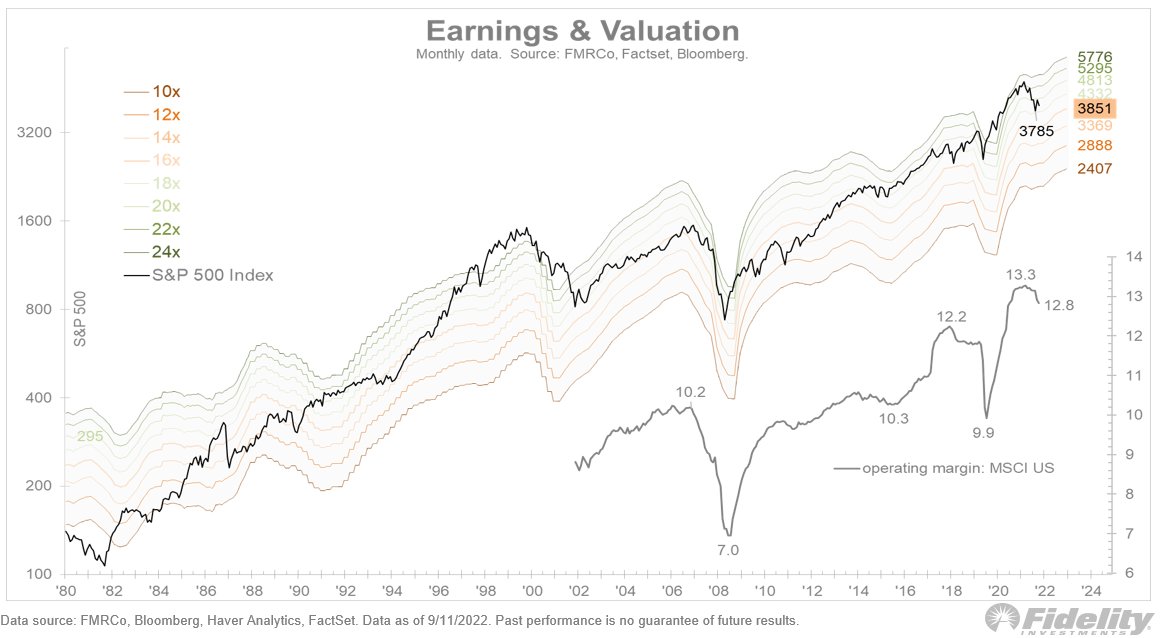

If BTC continues to follow its correlation with S&P 500, another 20% drop to $16,000 is very much likely. Jurrien Timmer, director of global macro at Fidelity said:

If a 14x forward multiple is the correct valuation, then simple math will tell us that the fair value for the S&P 500 is 3200-3400 at an EPS of $230. This suggests that this bear market is not yet over.

Just as the news of U.S. CPI inflation came on Tuesday, the Bitcoin Fear & Greed Index slid from 34/100 to 27/100. However, it has still not entered the “extreme fear” zone which shows some kind of investor resilience at this point.

Once again the news of inflation prevents Bitcoin from crossing its 200-day moving average (DMA), a zone of crucial resistance for Bitcoin this year.

Along with Bitcoin, several other altcoins have also corrected. A day ahead of the Merge event, Ethereum (ETH) has once again tanked 7% moving to $1,600 levels. As the Merge approaches closer, ETH has come under some selling pressure by following “sell the news” kind of momentum.

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?