Bitcoin (BTC) Celebrates Its 12th Birthday Hitting $14,000, Its New 2020-High

Bitcoin (BTC) moves past $14,000 just on the day it turns 12. As per the chart on TradingView, Bitcoin hit a high of $14,089 before retracing back again. At press time, BTC is trading at a price of $13,822 with a market cap of $259 billion.

Bitcoin has recovered 1000 points just in 48-hours after it was under pressure and momentarily dropped below $13,000. However, the bulls have taken the charge again with Bitcoin extending its dominance in the market. Currently, Bitcoin dominates nearly 64% of the overall cryptocurrency market.

Today, October 31, the Bitcoin community is celebrating the 12th year after its whitepaper was released by founder Satoshi Nakamoto for the first time in 2008. A decade after, the world’s strongest cryptocurrency continues to dominate the crypto market while swaying several institutional players.

Bitcoin has strongly stood the test of time and strongly stood as a potential hedge against uncertain global economic conditions. The Grayscale Bitcoin Trust that caters to institutional players recently reported 147% in assets under management.

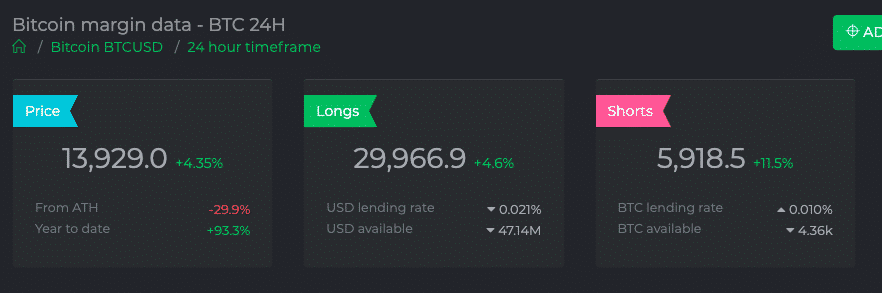

Bitcoin Longs and Shorts Liquidations

As per the data provided by Datamish.com, the Bitcoin longs have jumped 4.6% with the total long positions just under 30,000. On the other hand, the short positions have surged 11% and just under 6000.

At the current price, Bitcoin is trading at 93% year-to-date returns and if the trends continue, we can expect a 100% return today itself. Despite the quick recovery in the U.S. stock market, Bitcoin has outperformed all indices by more than 3x this year. Not only that, when compared to some of the top-performing stocks, Bitcoin has outclassed all by a good margin.

On the other hand, Bitcoin is also strengthening its position against its biggest hedge-alternative aka gold. Bitcoin aka the Digital Gold becomes a more favorable asset class over the yellow metal. Many market analysts suggest that we might see funds gradually flipping from Gold to Bitcoin in the coming years.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs