Bitcoin (BTC) Exchange Outflows Hit 5-Year High, Address Activity Shoots 30%

As Bitcoin (BTC) continues to flirt around $40,000 levels, its fundamentals and on-chain metrics are showing significant improvement. On Wednesday, July 28, the Bitcoin blockchain registered the largest ever net outflows in 5 years since 2016.

On this day, the exchange balance dropped by more than 60,000 Bitcoins in total. This is certainly a bullish indicator as a shortage in supply is likely to drive prices higher.

FYI yesterday was the largest day of net outflows from exchanges since mid-2016, with exchange balances dropping by 60,004 BTC.

Watching to see if we get a continued decline of exchange balances in the coming weeks. pic.twitter.com/0REQUPY4pM

— Will Clemente (@WClementeIII) July 29, 2021

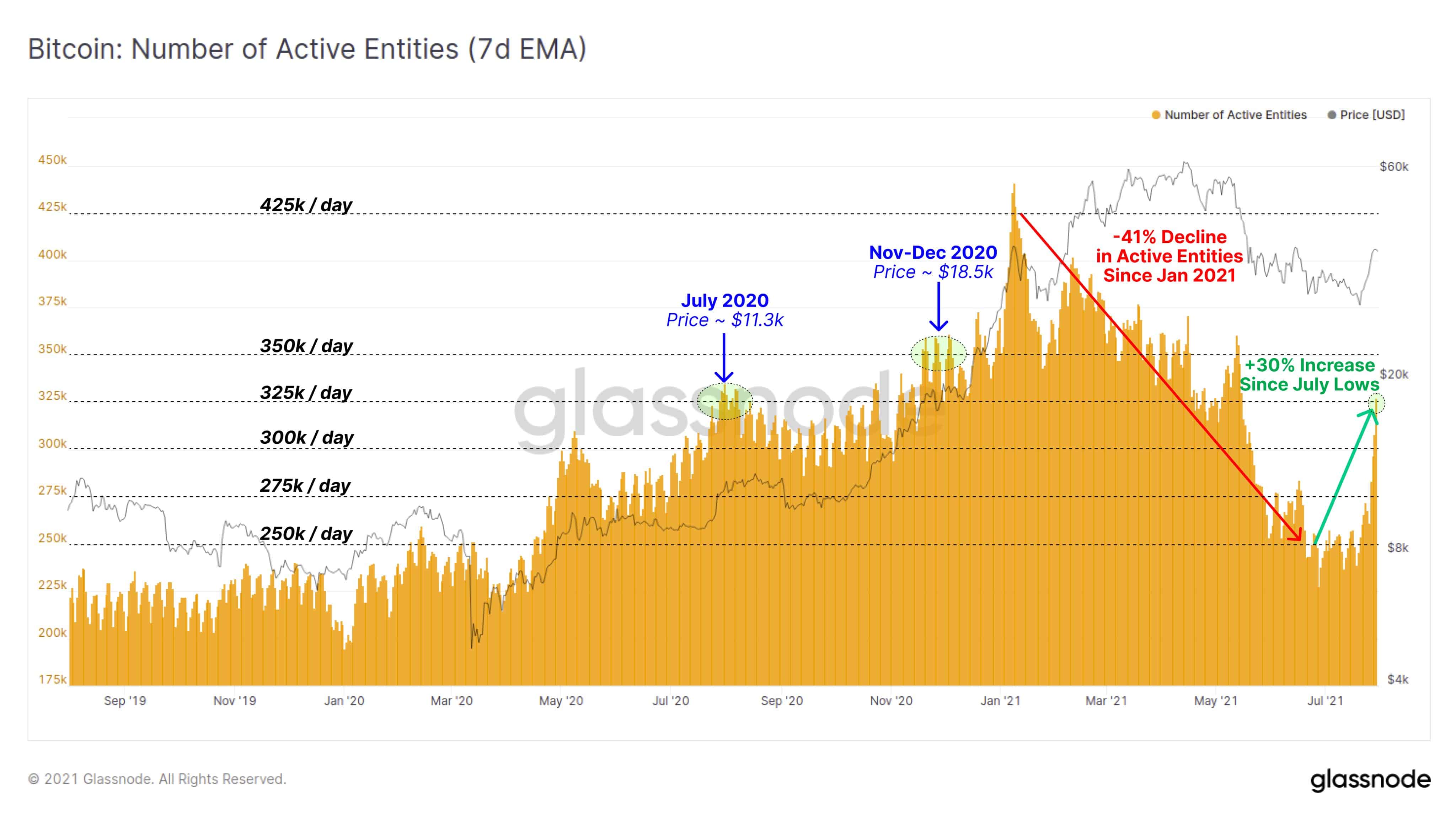

At the same time, the number of unique entities interacting with the Bitcoin network has surged significantly over the last week! As on-chain data provider Glassnode reports:

“Bitcon has seen a resurgence in Active Entities over the past week, rising by 30% from 250k to 325k active entities per day. This degree of activity was sustained in July 2020 when $BTC prices were around $11.3k in Q2-2020″.

Whale and Retail Accumulation Continues

While Bitcoin whales have been stacking up major supplies during this consolidation phase, small retail players have also contributed to it. Santiment reports that Bitcoin’s millionaire-tier whale addresses – holding between 100 to 10,000 – BTC has touched a new milestone with a combined holding of 9.19 million.

Since May 2022, these whale addresses have added 170,000 Bitcoins of which a staggering 130,000 comes just in the last 4 weeks. On the other hand, popular market analyst Willy Woo strongly believes that micro-retail investors are playing a crucial role in continuing the bull market. In the latest update, Woo writes:

“A heat map of total coins absorbed by shrimps stacking their sats each day. No signs or a bear market in sight. Shrimps = holders of less than 1 BTC across all of their addresses. Shrimps control the middle and late stages of a bull market”.

Interestingly, the Bitcoin blockchain has touched another milestone with its total users crossing 114 million for the first time. This is the same number of users the internet had during the dot-com boom of 1997, however, it’s growing at a much faster rate.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BitMine’s Tom Lee Bets on ‘March Turnaround’ to Spark Crypto Market Recovery

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

Buy $GGs

Buy $GGs