Bitcoin (BTC) Jumps Another 4% Gains As Whales And Institutions Buy More

Bitcoin (BTC) has once again given a 4% pullback surging past $58,000 and looking forward to breaking past its crucial resistance of $59,000. At press time, BTC is trading 4.12% up at $58,120 with a market cap of $1.086 trillion.

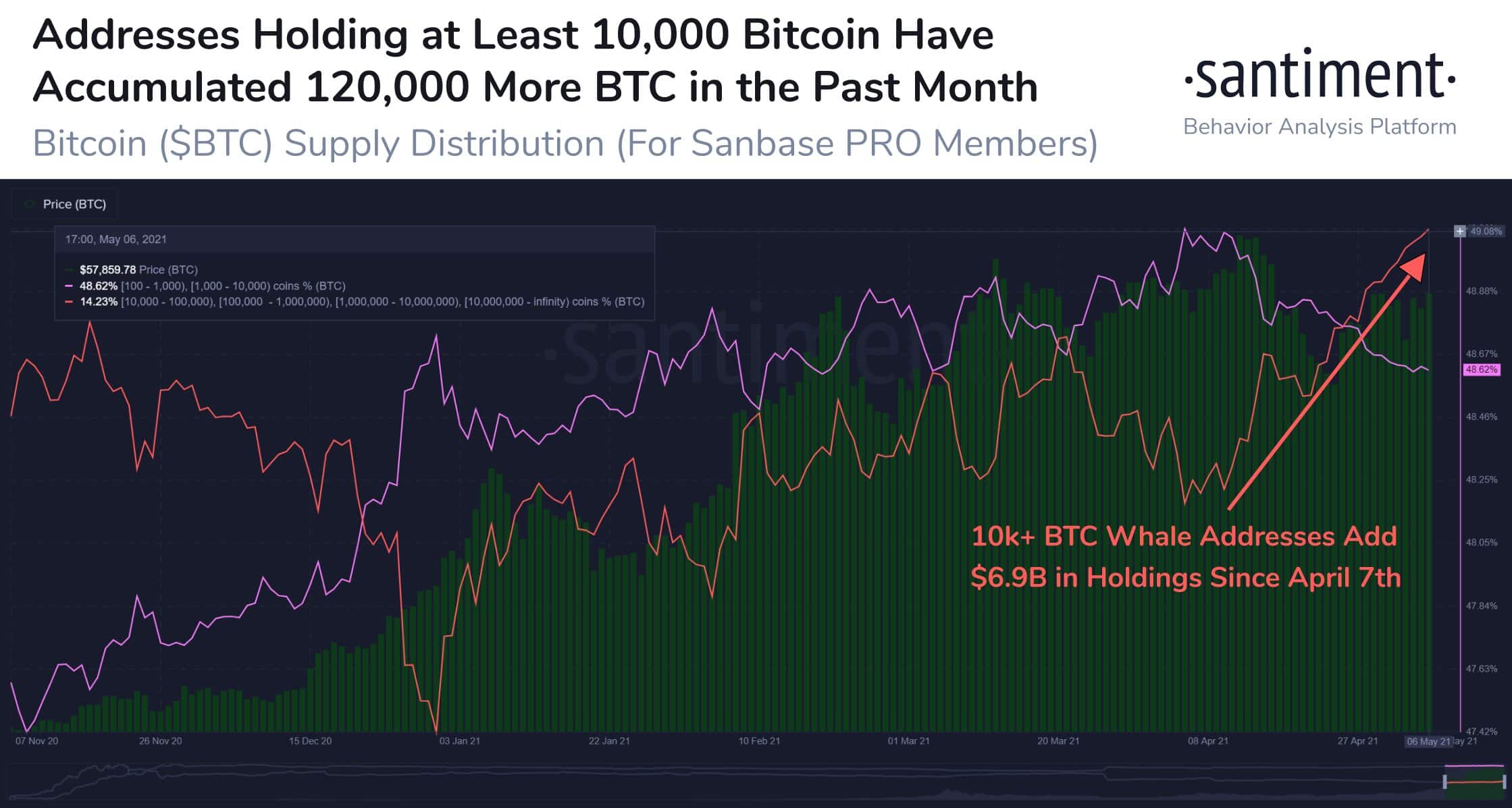

While Bitcoin has been trading flat over the last month and consolidating around $55,000, the big market fishes have been making the most of this opportunity. On-chain data provider Santiment brings interesting stats with whale behavior. Currently, there are 86 whale addresses holding over 10,000 Bitcoins.

Over the last month, these whale addresses have accumulated over 120,000 Bitcoins, which is 0.67% of the total supply valued at $6.9 billion. Santiment notes that this has been the most sustained accumulation since July 2019.

Bitcoin (BTC) Exchange Outflows and OTC Deals

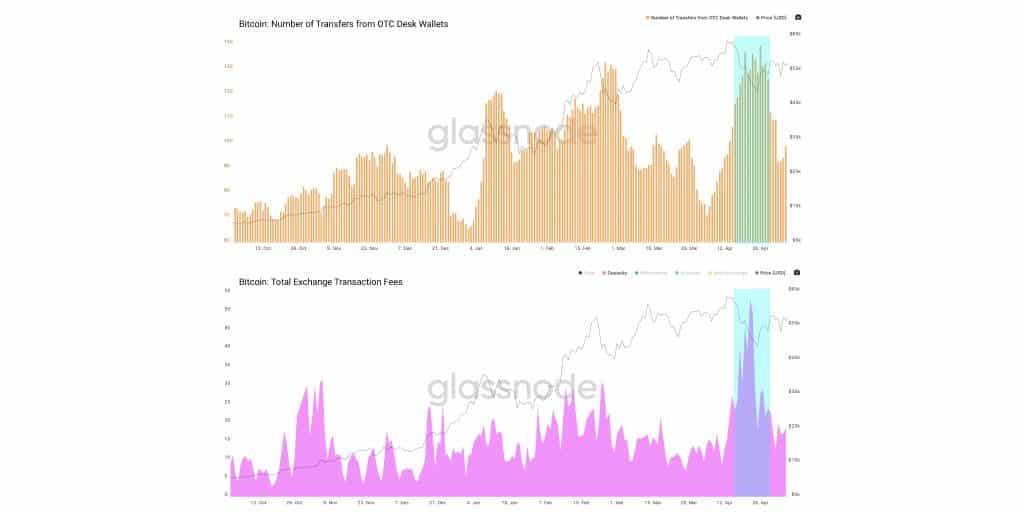

With Bitcoin (BTC) remaining under pressure amid the altcoin rally, retail investors have been skeptical of putting their money into it. But at the same time, institutional investors have been making big bets on BTC. Over the last week, there have been two major BTC outflows each of ~12K Bitcoins leading to bullish signs.

The first such outflow happened last Saturday on May 1. Another 12K BTC moved off Coinbase yesterday on Friday, May 7 as per data on CryptoQuant. Below is the chart of the number of Bitcoin transfers happening from the OTC desk wallets.

Another data from Galssnode shows that ‘sat stackers’ have been accumulating since 2018. Bitcoin addresses holding more than 1 BTC are nearly 5.25% of the total circulating supply. However, there’s yet not FOMO impulse like that of 2017.

#Bitcoin accumulation by 'sat stackers' has continued slow, steady and uninterrupted for many years.

Addresses holding less than 1BTC now own 5.25% of the circulating $BTC supply.

So far we've not seen a FOMO impulse like 2017 blow-off top.

Live Charthttps://t.co/gXharDj9Nu pic.twitter.com/whuQljrQPC

— glassnode (@glassnode) May 7, 2021

All eyes are currently on the SEC approval of the first Bitcoin ETF in the U.S. Once it happens, regulators worldwide will open the gates of Bitcoin derivative products driving massive institutional inflows. Goldman recently started offering its Bitcoin derivative product to Wall Street investors.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs