Bitcoin (BTC) Long Term Holder Accumulation Hits New High, Ethereum (ETH) Whales Addresses Increase

Two of the world’s largest cryptocurrencies – Bitcoin and Ethereum – have made solid moves over the last weekend breaking past crucial resistances. BTC has surged all the way to $48,000 while ETH has been trading past $3,300 levels.

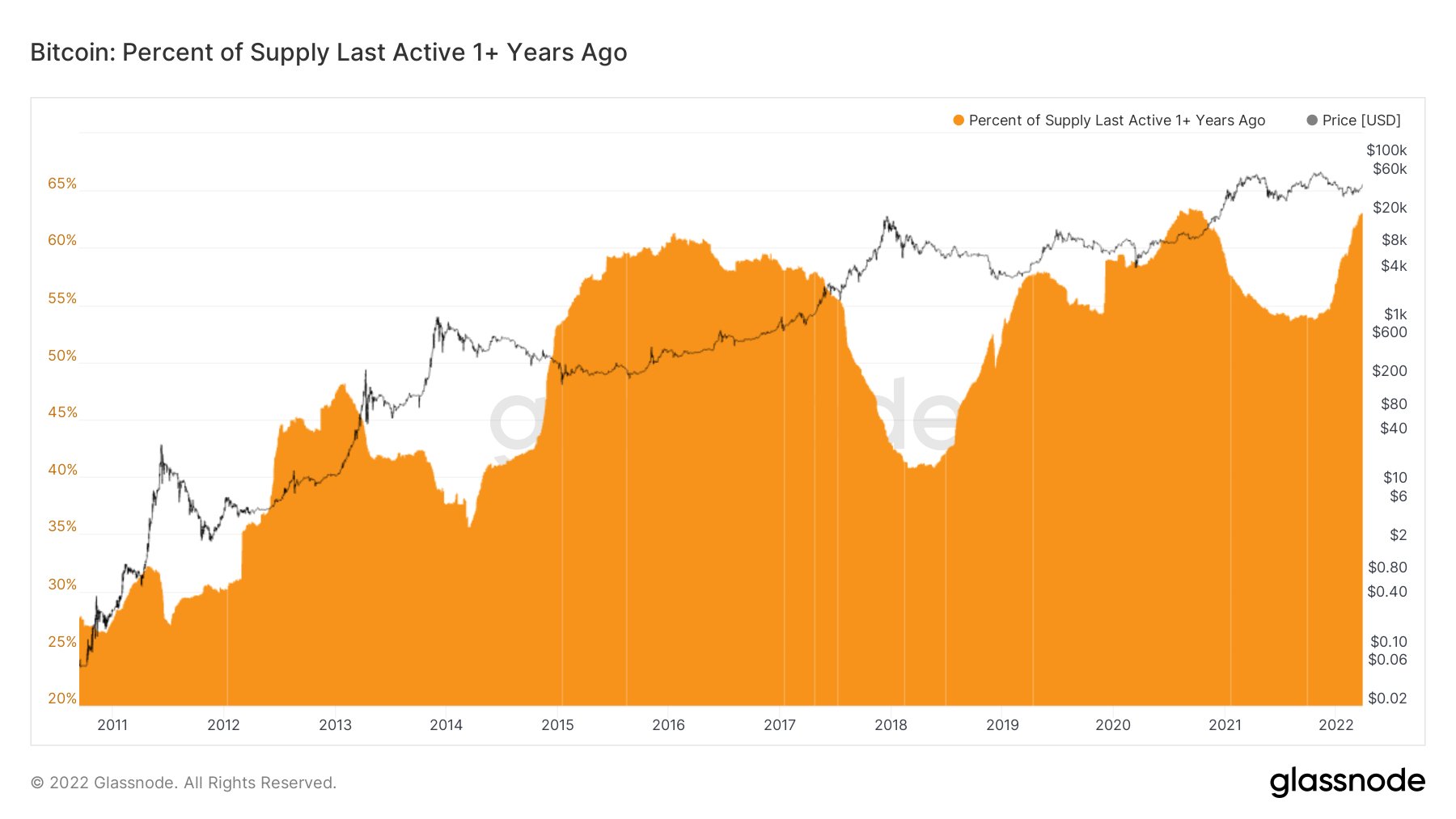

As Bitcoin continues to make strong gains, its long-term holder accumulation has reached the highest level as per data from Glassnode. Furthermore, as BTC gives a weekly close above $46,000, its short-term capitulation seems to be over.

Bitcoin is 45% off the lows and Long-term holder accumulation is still at the highest level ever. pic.twitter.com/JyRZLi3KUH

— Will Clemente (@WClementeIII) March 28, 2022

Additional on-chain data shows that the Bitcoin accumulation is pretty strong at this stage. Citing data from Glassnode, crypto market analyst Dylan LeClair explains:

Bitcoin is trading at $48,000 and throughout its entire history, there has only been one other time that the percentage of supply that hadn’t moved in over a year was at this level; September 2020.

But as the Bitcoin (BTC) price approaches $48,000, we might see some short-term profit booking at this stage. To understand this, let’s take a look at the Bitcoin MVRV ratio. It shows the average Profit/Loss of Bitcoin holders who bought the coin within the last year.

As we know the BTC price has surged past $47,000 for the first time in three months since January 4, 2022. Crypto market analyst Lesia Chenko writes:

Short-term MVRV (30d) is breaking above 10%, meaning recent Bitcoin buyers are on average up 10% on their investment. Previous two times when avg P/L of short-term traders reached 10% we faced strong selling pressure (sending BTC down over 15%).

Ethereum (ETH) Whale Addresses On the Rise

The world’s second-largest cryptocurrency has shown similar volatility as Bitcoin this year. However, the Ethereum (ETH) accumulation by whales continues on the sidelines. On-chain data provider Santiment reports:

The number of #Ethereum addresses with 10k+ $ETH has grown to the largest amount (1,329) since December, 2021. This includes 40 more in just 5 weeks. There has been an evident correlation between the number of whale addresses & future price movement.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise