Bitcoin (BTC) Outperforms S&P 500 in August, Market Bottom Near?

The world’s largest cryptocurrency Bitcoin (BTC) has entered a phase of strong consolidation hovering around $29,000. Investors are seeing no price action with volatility hitting multi-year lows along with other on-chain indicators.

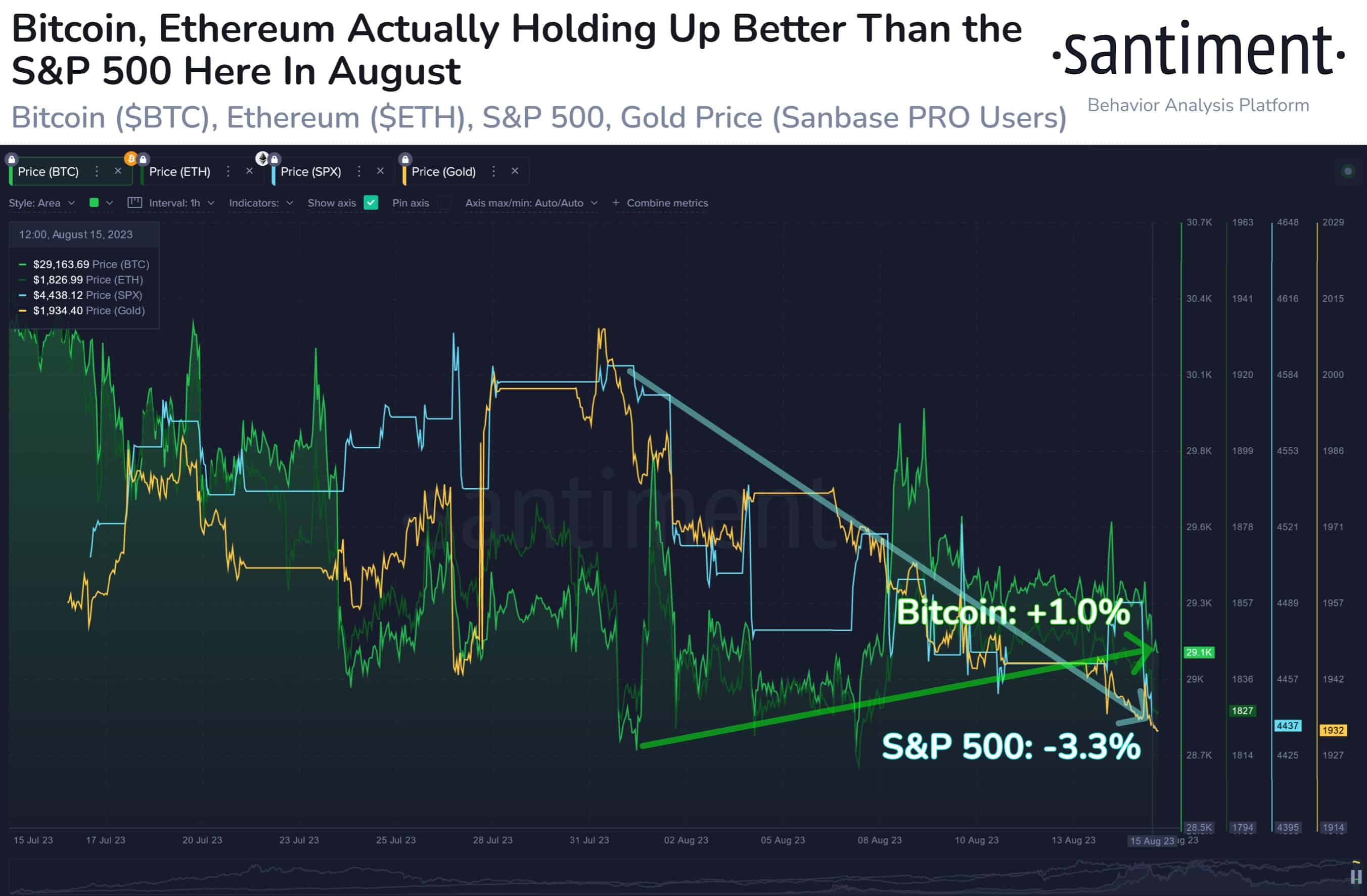

While Bitcoin has been consolidating for a while, it has actually delivered a better performance than the US equity market. On-chain data provider Santiment explains that Bitcoin remains within a narrow price range at $29.4k, and interestingly, this stable trend is currently showing better performance compared to equity markets such as the #SP500 in August. The shift away from the correlation that started in mid-July has historically been advantageous for #crypto prices.

On Tuesday, August 15, QCP Capital reported that the Bitcoin (BTC) price could be heading to $34,000 as it rests on a crucial support level. As per QCP Capital, September would be a key month, adding that $29,300 would serve as a specific area of interest. It added:

“On the charts, the wedge pattern that BTC has been trading in since its 15k lows reaches its first termination point at the start of Sep. Will there be a sharp rally that takes us to the 34k resistance — like the prior three times which kissed the support trendline this year? We think it could still be another quiet few weeks before we find out. We are on the lookout to buy back our end-Sep short calls and go long end-Dec vol in due time.”

Bitcoin and Altcoins Under Stress, Is A Market Bottom Near?

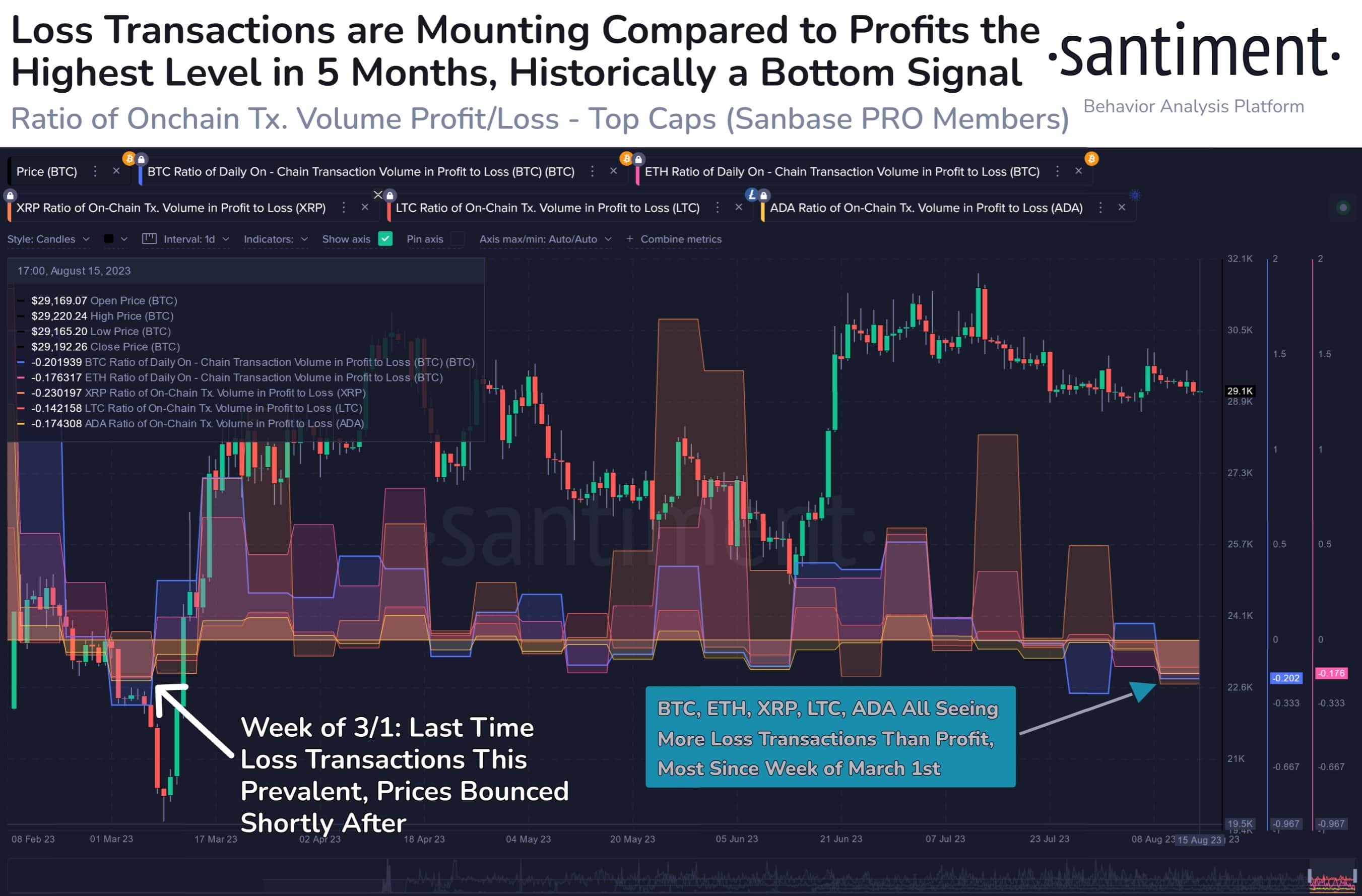

While Bitcoin has corrected 0.7% in the last 24 hours, altcoins have come under greater correction, thereby dragging the overall market down. Santiment notes: “Traders are showing more and more complacency among each asset as markets continue to fail to find any traction on a rally. Historically, this high ratio of loss transactions compared to any profit taking raises the probability of a bounce”.

Also, a Bloomberg report shows that the SEC-tainted cryptocurrencies have been showing greater trading activity. Despite losing around $20 billion in combined market value due to allegations of illegal securities sales just two months ago, the 19 highlighted cryptocurrencies are now experiencing an uptick in trading volume. Their collective trading share has risen by approximately 2 percentage points to around 13%.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs