Here’s Why Bitcoin (BTC) Price Could See A Major Correction Soon

The crypto community rejoiced after Bitcoin’s (BTC) price stunned the market by posting gains as it surpassed the $25,000 milestone on February 16. After a prolonged effort lasting eight months, BTC finally managed to surpass the coveted price level, however, Bitcoin experienced a decline on Friday as bulls struggled to gain traction in response to the Federal Reserve’s repeated hawkish tones, which hinted at additional rate hikes and likely at a faster pace.

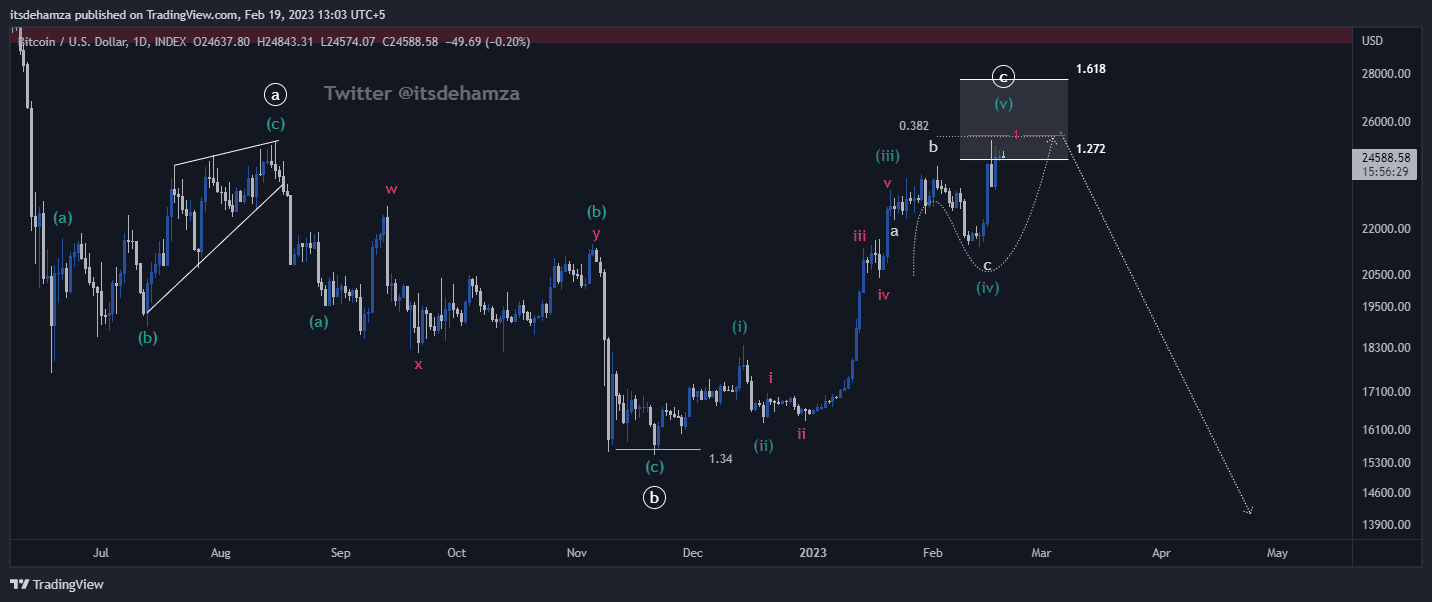

Bitcoin (BTC) Price To Dump?

Although, the price has seen an uptick from the bulls, the recent pullback has led few cryptocurrency experts to forecast that the price of Bitcoin might witness a new low or a significant correction in the near future. Moreover, experts opine that the recent pump is attributed to speculative buying and may fail to sustain in the long run.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

According to an analysis that was released recently by pseudonymous cryptocurrency expert Hamza, Bitcoin’s price is on the verge of a major breakout with a downward potential of creating new lows for the month. This comes after, the 5-wave sequence for the Bitcoin price chart shows signs of successful completion. His analysis also provides support for the hypothesis that Bitcoin could breach the $20K barrier and continue to fall further.

The same has been voiced by some of the other experts in the market. il Capo Of Crypto, a well-known crypto analyst and swing trader who goes by the Twitter username CryptoCapo, has stuck to his opinion regarding the likelihood of Bitcoin retracing back to the levels of $12,000.

Like I've said several times, bear market show people's true colors. And in the end, market (and life) humbles everyone.

12k is still likely imo.

— il Capo Of Crypto (@CryptoCapo_) January 14, 2023

BTC Price Analysis

An examination of BTC’s on-chain analytics revealed a number of factors that aided the bears and contributed to the current price drop. For instance, according to CryptoQuant, the exchange reserve for BTC was growing, which indicated that there was a higher level of selling pressure. In the midst of the bull rise, Bitcoin’s aSORP was red, which suggests that more investors liquidated their holdings to make a profit. Furthermore, in the previous twenty-four hours, there was a drop in the open interest for BTC that was greater than nine percent — which was another critical bearish indication.

Additionally, it should be noted that BTC’s technical analysis (TA) indicators at CoinGape’s crypto market tracker recommend a buying opportunity as summarised by the moving averages which suggest a “buy” at 15 and “sell” at level 2. As things stand, the price of Bitcoin (BTC) is currently trading at $24,677 which represents an increase of 0.65% over the past 24 hours, in contrast to a gain of 13% over the last seven days.

Also Read: Ethereum Shanghai Upgrade To Trigger Massive ETH Price Dump?

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?