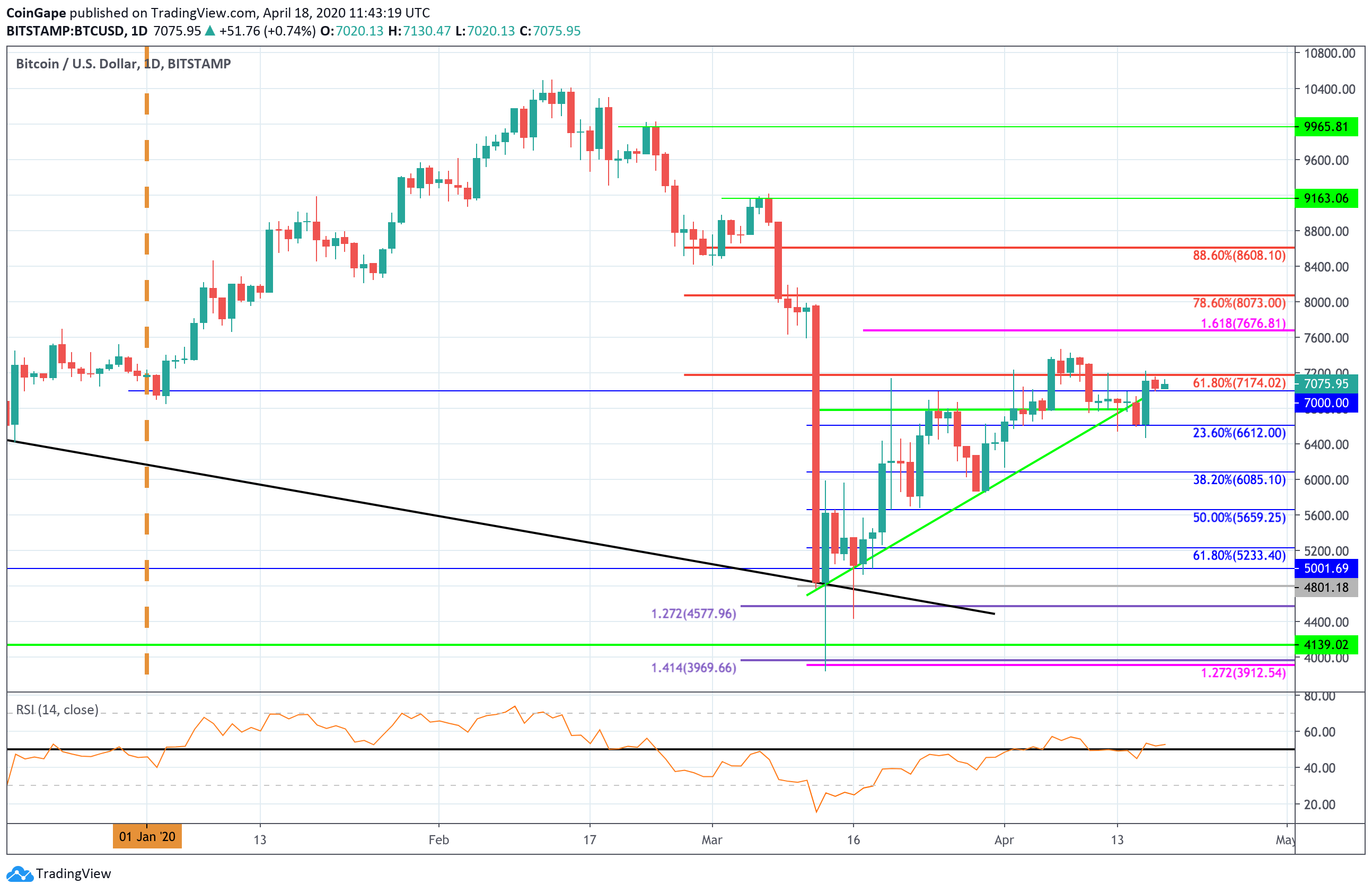

Bitcoin (BTC) Price Analysis: Bitcoin MUST Break $7,175 To Head Above $8,000 Before Block Halving

- Bitcoin increased by a total of 8% over the past 3-days which had allowed the cryptocurrency to climb above $7,000.

- The cryptocurrency is now struggling to break above resistance at $7,175.

Bitcoin had witnessed a strong 8% price surge over the past 3-days which allowed the cryptocurrency to climb back above the $7,000 level. However, Bitcoin is now struggling with resistance at $7,174 which is provided by a bearish .618 Fib Retracement level. It must break this resistance and higher resistance at $7,400 if it would like to make a move toward $8,000.

Bitcoin was previously trading lower over the past 7-days as it dropped into support at $6,612, provided by a short term .382 Fib Retracement level. It rebounded from this support 3 days ago which allowed it to climb back above $7,000.

This rebound is not surprising when we consider the fact that the Bitcoin block halving is just a short 23 days away now.

Bitcoin Price Analysis

BTC/USD – Daily CHART – SHORT TERM

Market Overview

Analyzing the daily chart above, we can clearly see Bitcoin dropping into the support at $6,612, provided by short term .236 Fibonacci Retracement level. It had broken beneath a rising support trend line which put it in danger of turning bearish, however, the rebound at $6,612 which stopped the coin from unwinding lower.

Short term prediction: Neutral/Bullish

Bitcoin still remains neutral as we wait for a break above $7,400 to turn bullish again.

The first level of resistance to break is at $7,175 which is provided by a bearish .618 Fib Retracement level. Above this, strong resistance lies at $7,400.

If the buyers can continue to climb above $7,400, higher resistance is located at $7,500, $7,676 (1.618 Fib Extension), and $8,000 (bearish .786 Fib Retracement).

On the other hand, if the sellers push beneath $7,000, the first level of support lies at $6,6112 (.236 Fib Retracement). Beneath this, support lies at $6,500, $6,200, and $6,000 (.382 Fib Retracement).

Key Levels

Support:$7,000 $6,800, $6,500, $6,100, $6,000, $5,911, $5,786, $5,636, $5,600, $5,500, $5,467 $5,200, $5,000, $4,800, $4,672, $4,577, $4,139, $4,000, $3,912, $3,500, $3,436.

Resistance: $7,174, $7,400, $7,500, $7,676, $8,000, $8,073, $8,250, $8,461, $8,672, $8,979, $9,000, $9,100.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs