Is Bitcoin (BTC) Price Heading For $46K After This Massive Breakout?

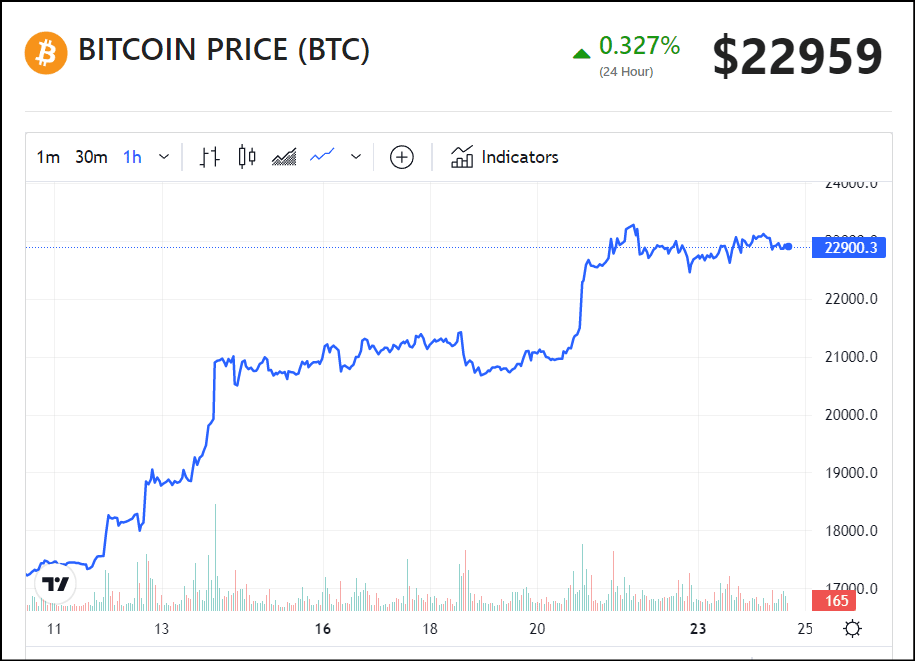

On Tuesday, several cryptocurrencies, including Bitcoin (BTC), were trading higher with gains as the crypto market continued to rise. The price of Bitcoin (BTC), the largest cryptocurrency by market cap, has risen by almost 40% to breach the $23,000 level in January, indicating a substantial surge for the asset. This marks the highest gain for Bitcoin since October of 2021.

Bitcoin (BTC) Price Surge

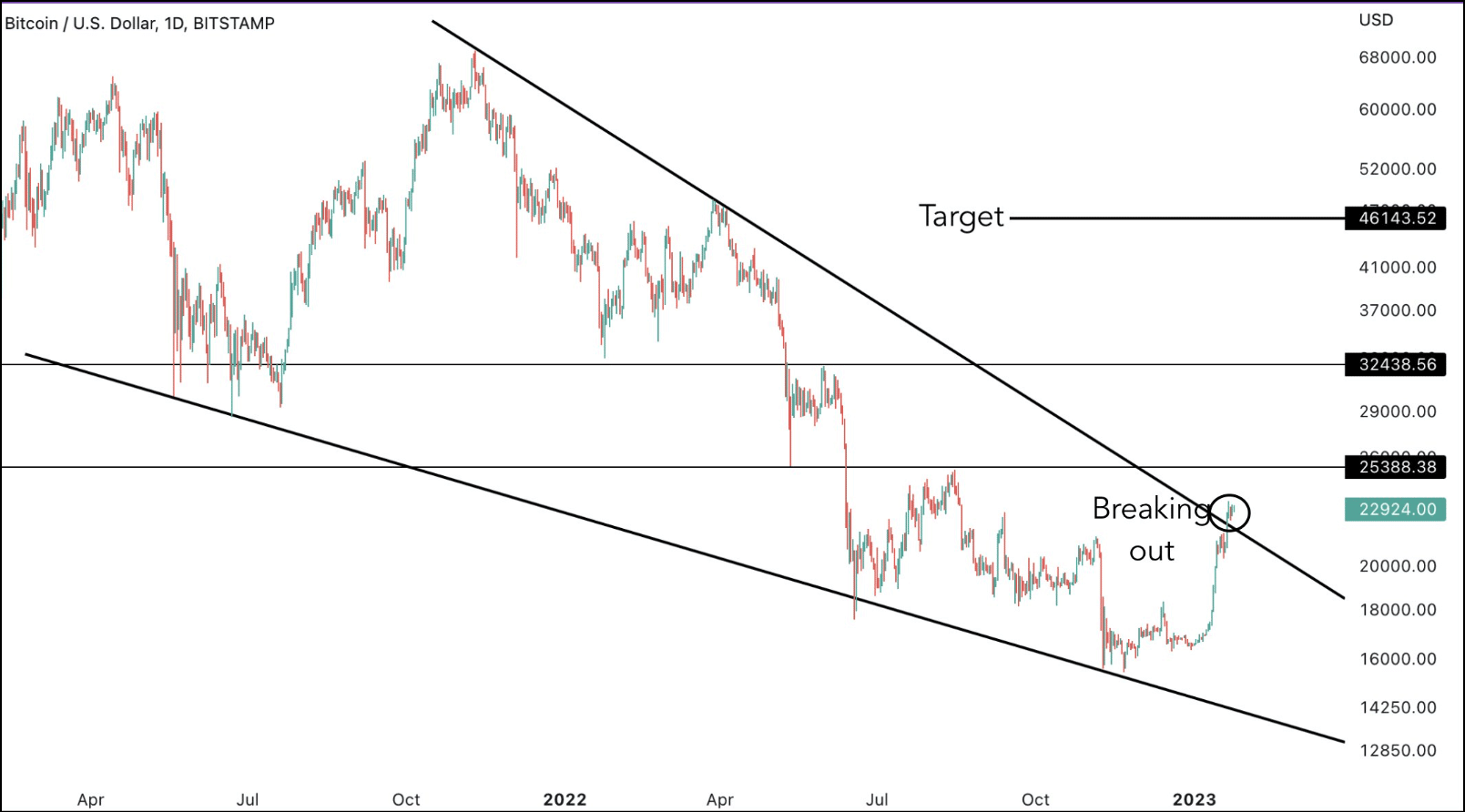

The recent price surge has caused many prominent analysts to focus on greater values, which were last seen in the mid of 2022. However, they also forecast further gains based on the sentiment of traditional risk assets which sometimes act as a catalyst to the price of Bitcoin. According to crypto research conducted by Game of Trades, BTC is racing towards a major breakout on its 1-year chart, with the likely prospect of hitting $46,100 sooner than it was initially anticipated. This would come after first breaking resistance levels located at $25,000 and $32,000.

A price is considered to be at a resistance level when there is a reasonable expectation that supply will be strong enough to prevent further price increases.

The rebound is strong given that it has overcome significant resistance levels despite continuing worries about the effects of the collapse of the crypto exchange FTX. And although a rally toward $25,000 is possible, it may be contingent on traditional risk assets, which are led by bluechip technology companies. As per market experts, these traditional risk assets have regained their footing over the course of the last two trading days as fears of a recession have subsided while the Federal Reserve is expected to be less hawkish. The government body is expected to hike interest rates on February 1 by only 25 basis points, according to speculators.

Read More: Check Out The Top Crypto Telegram Channels Of 2023

BTC Bullish Sentiment Intact

According to a report that was published earlier on CoinGape, there are other analysts who have voiced the same opinion on the price of Bitcoin (BTC). One such analyst is the well-known cryptocurrency analyst Michael van de Poppe, who predicts that the price of the flagship digital asset could reach as high as $35,000 in the coming few months.

According to data that was obtained at the time of writing, the overall cryptocurrency market had increased by 0.56%, bringing its value to $1.05 trillion. In addition, the total volume of trades executed increased by 5.85%, reaching almost $56.55 billion. As things stand, the Bitcoin (BTC) price is currently exchanging hands at $22,959. This represents an increase of 0.20% on the day, in contrast to a gain of 8% during the week as per CoinGape’s crypto market tracker.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs