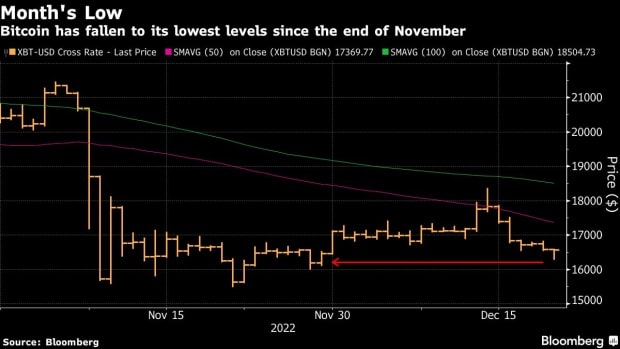

Bitcoin (BTC) Price Hits A New Monthly Low, Further 20% Decline Possible

The world’s largest cryptocurrency Bitcoin (BTC) has once again come under strong selling pressure and is not finding enough catalysts to move past the $17,000 resistance. A few hours ago, the BTC price tanked to a new low for the month of December at $16,277.

However, it has recovered the dip and is currently trading at $16,740 level. The equity market has been facing turbulence over the last weekend owing to macro factors and other developments in the crypto space.

Market analysts are expecting further lows in the Bitcoin (BTC) price going ahead and the possibility of another 20% correction from here can’t be ruled out. Speaking to Bloomberg, Katie Stockton, founder of Fairlead Strategies LLC said:

“We expect a retest of the November lows, near $15,600, in the coming weeks” after a failed test of levels in the $17,000 to $18,000 range. “We ultimately expect Bitcoin to make a lower low, increasing risk to long-term support near $13,900″.

New Lows for Bitcoin and Crypto?

The year 2022 has witnessed one of the biggest crypto winters in the history of the industry. Bitcoin is down by 75% and a majority of the altcoins are down by nearly 90%. On the other hand, the Fed has made it clear that they would continue with rate hikes throughout the next year of 2023.

If so, there’s a strong chance of correction in the U.S. equity markets next year. With crypto having a greater correlation with U.S. equities, we can expect a further correction in the crypto market as well. In their latest report, blockchain analytics firm Nansen Research writes:

Given the Fed’s determination to maintain tightening for longer, our key scenario for 2023 is a US recession and a US equity sell-off. Crypto prices could experience one further (perhaps final) drop in this cycle before interest rates turn more favorable.

Also, crypto exchange Bitfinex explains a slowdown in trading activity this holiday season. “As we approach the end of the year many firms and traders take a break, however, the slowdown in trading activity brings with it the risk of higher volatility, given the declines in trading volume and liquidity,” it noted.

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Bitcoin, ETH, XRP, Solana Rebound to Max Pain Price amid Short Liquidations Today?

- 3 Top Reasons XRP Price Will Skyrocket by End of Feb 2026

- Metaplanet CEO Simon Gerovich Defends Bitcoin Strategy Amid Anonymous Allegations

- “Sell Bitcoin Now,” Peter Schiff Projects Further BTC Price Crash to $20k

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying