Bitcoin (BTC) Price Retracing To $21,000, This Remains Key Resistance Level

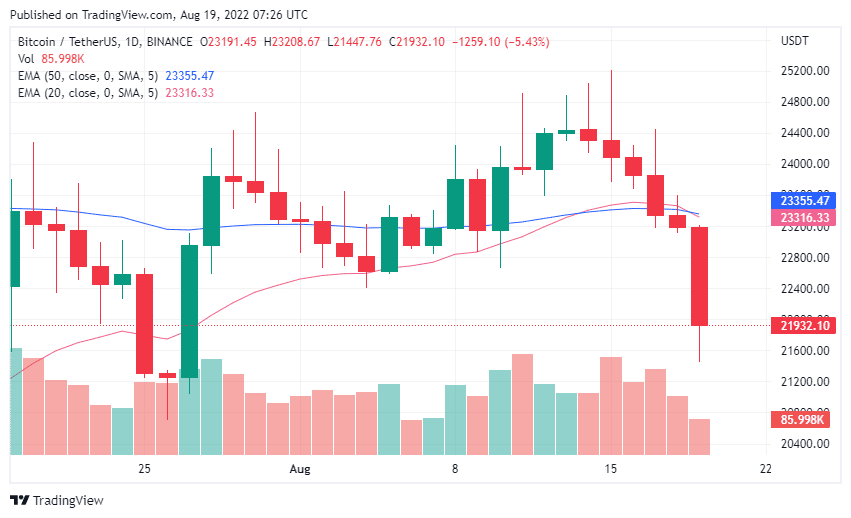

Bitcoin’s (BTC) price is retracing to $21,000 after the massive sell-off negates the uptrend, as predicted in the previous report. The BTC price is now trading below the 200-weekly moving average (WMA) after falling nearly 9% to below $22,000 in the last 24 hours.

Bitcoin (BTC) Price Risks Falling to $20,000-$21,000 Range

Bitcoin (BTC) price rally comes to an end after the price entered a short-term overvalued region this week. As, a result, the BTC price retraced from the short-term resistance level after making a high of $25,135. Whales and long-term holder had sold their holdings after a pullback to the $23k-$24k range.

The Crypto Market Fear and Greed Index tumbles from 47 to 30 in a week as market sentiments turn negative. Moreover, the Federal Reserve confirming aggressive interest rate hikes in the coming months, massive sell-off pressure, and exchange inflows are causing the Bitcoin (BTC) price to break lower.

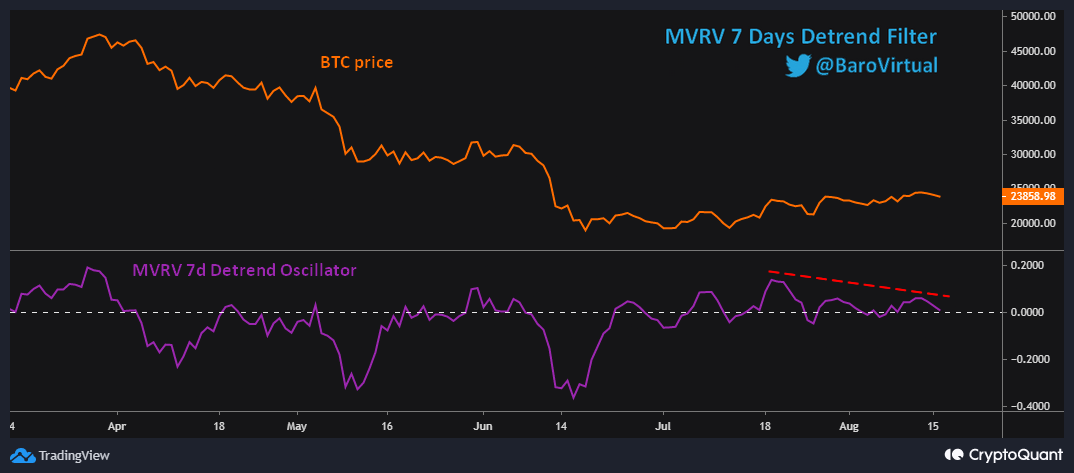

As reported earlier, the Bitcoin price trend has formed a bearish divergence pattern in the MVRV 7-day Detrend Oscillator. A bearish divergence pattern predicts an upcoming price fall. It suggests the Bitcoin (BTC) price risks falling to the $21,000-$20,000 range.

Bitcoin (BTC) bulls have faded as the recent sell-off has pulled the Bitcoin price in favor of bears. The Bitcoin (BTC) price is now trading below $23,000, the key 200-weekly moving average (WMA). Thus, a fall below $21,000 seems imminent.

Moreover, the 20-EMA (red) did move above the 50-EMA (blue), generally considered a bullish trend. However, the bulls failed to build momentum. The 20-EMA moves below the 50-EMA again, confirming a bearish movement below $21,000.

As per Coinglass data, Bitcoin price recorded a total liquidation of over $168 million in the last 24 hours, with $150 million liquidation coming from long-term positions. Major exchanges including Huobi, Binance, and Okex accounted for over 90% of long positions liquidated in the last 24 hours.

Here’s What Popular Crypto Analysts Expect

Crypto analysts including Michaël van de Poppe, Crypto Tony, Crypto Birb, and BigCheds earlier confirmed a fall below the $22,700 level. Crypto analysts believe the 200-WMA will play a key role here.

Most analysts are positive about an upside move from lower levels. The Bitcoin price fall has given a “buy-the-dip” opportunity for investors as the short-term resistance is at the $25,000 level.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs