Bitcoin (BTC) Price Sinks Another 5% As Sell-off Intensifies, Is $30K Possible Now?

CoingapeSell-off in the broader cryptocurrency market has intensified as the world’s largest digital asset Bitcoin (BTC) tanks by another 5% thereby dropping down under $29,000. As of press time, Bitcoin is trading 4.28% down at a price of $28,913 and a market cap of $559 billion.

Along with Bitcoin, the top ten altcoins have corrected anywhere between 5-10% as bears seem to be taking a dominant position currently. Currently, $28,450 is a crucial support zone for Bitcoin below and it can fall further all the way to $25,000.

Even at the current price, Bitcoin’s year-to-date gains stand at a staggering 75%. Also, the sentiment around Bitcoin has turned positive recently with the hope that Fed could be loosening its monetary policy going ahead. However, inflation would be a key metric to watch going ahead which has been sticky so far and shown little signs of cooling down.

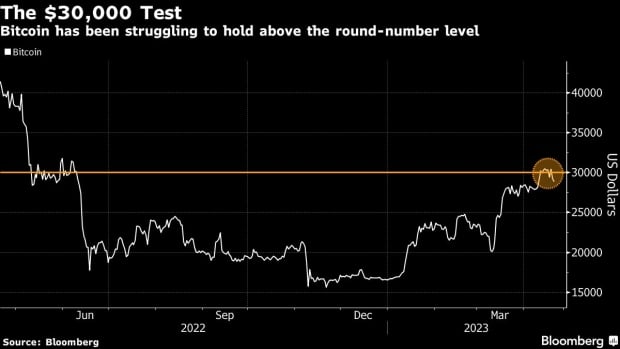

Is Bitcoin’s Retreat to $30,000 Possible Now?

As the crypto bears take a dominant position in the market right now, there are a few good signals that keep the optimism alive that the Bitcoin price can once again rally to $30,000 and above. Yesterday, Coingape reported, Bitcoin whales have once again started accumulating BTC after a long sell-off period. As per the data analyzed by Bloomberg:

Bitcoin rose about 7% on average over three, five and 10 days after the previous 17 such signals in the last five years. The study identified bullish periods by using the token’s relative strength index, a momentum gauge, which had to be above 50.

Noelle Acheson, author of the “Crypto Is Macro Now” newsletter writes that the recent pullback could be due to a “build-up in leverage which could have triggered a liquidation”. She further added: “This suggests that the drop is unlikely to be long-lasting, as recent support as well as derivatives positioning points to a bias to accumulate”.

However, some analysts have maintained a cautious stand considering the recent US regulatory crackdown in the crypto space.

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card