Bitcoin (BTC) Long-Term Holders Are Finally Giving Up: Report

The world’s largest cryptocurrency Bitcoin witnessed another major weekend of a bloodbath as the BTC price took a dive under $18,000 for the first time. There have been major liquidations taking place with long-term Bitcoin holders dropping the towel and giving up.

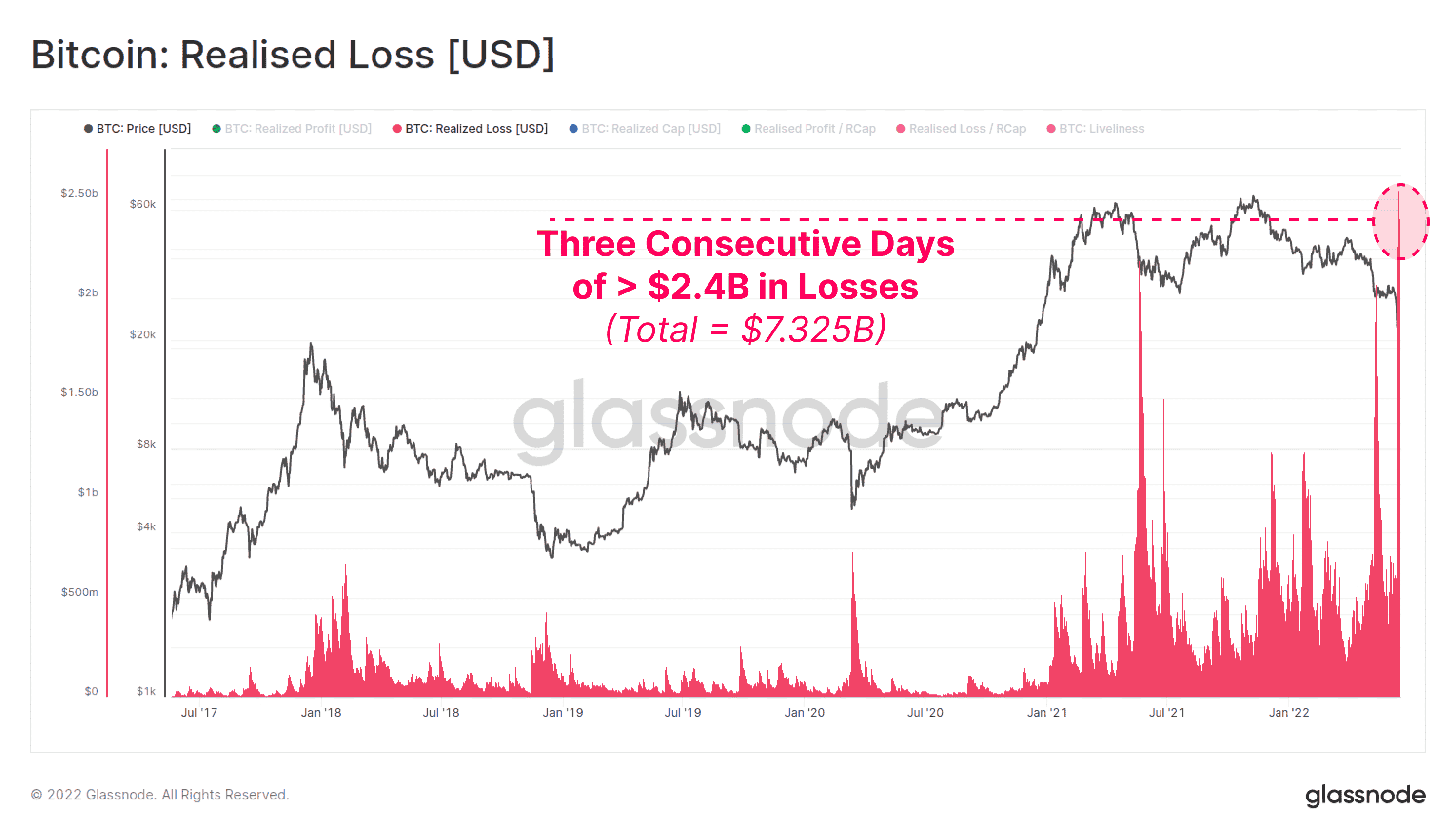

As per on-chain data Glassnode, there have been Bitcoin liquidations to the tune of $2.42 Billion every day, for the last three consecutive days. The data provider noted:

“The last three consecutive days have been the largest USD denominated Realized Loss in Bitcoin history. Over $7.325B in $BTC losses have been locked in by investors spending coins that were accumulated at higher prices”.

Furthermore, in the last three days, more than 555K Bitcoins have changed hands in the price range between $18,000-$23,000. Interestingly, long-term holders holding BTC for 1yr+, who accumulated coins in H1 2021 or earlier, started panicking, flooding the exchanges with 20K to 36K Bitcoins every single day.

Bitcoin (BTC) Long-Term Holder Balances Drop

As per data from Glassnode, long-term holders sold more than 178K Bitcoins after the price dropped under $23,000. This represents 1.31% of their total holdings. Further, it also takes the aggregate LTH balance to September 2021 levels.

Glassnode also mentions signs of major capitulation taking place. It writes:

“Investigating the profit and loss by Long-Term Holders sending coins to exchanges, we can see a deep capitulation took place. A few #Bitcoin LTHs even bought the $69k top, and sold the $18k bottom, locking in -75% losses. Total LTH losses 0.0125% of Market Cap per day”.

Besides, Glassnode also added that Bitcoin miners have also been under stress with their balances stagnating from the 2019-2021 accumulation period. Last week, BTC miners spent 9K from their treasuries and are still holding more than 50,000 Bitcoins. The Bitcoin hashrate has also dropped 10% from its all-time high.

Apart from long-term holders, the short-term holders have also seen major losses. Glassnode explains: “If we assess the damage, we can see that almost all wallet cohorts, from Shrimp to Whales, now hold massive unrealized losses, worse than March 2020”.

The data provider explains that as the BTC price tanked under $18,000, only 49% of the total Bitcoins were in profit.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs