Bitcoin (BTC) Supply Moving Fast to the East, Will the West Pay for Heavy Regulations?

Bitcoin (BTC) and the broader cryptocurrency market faced strong selling pressure amid SEC slapping lawsuits on two biggest crypto exchanges – Binance and Coinbase. As heavy regulatory action in the US and the West continues, a large part of Bitcoins has been moving to the East.

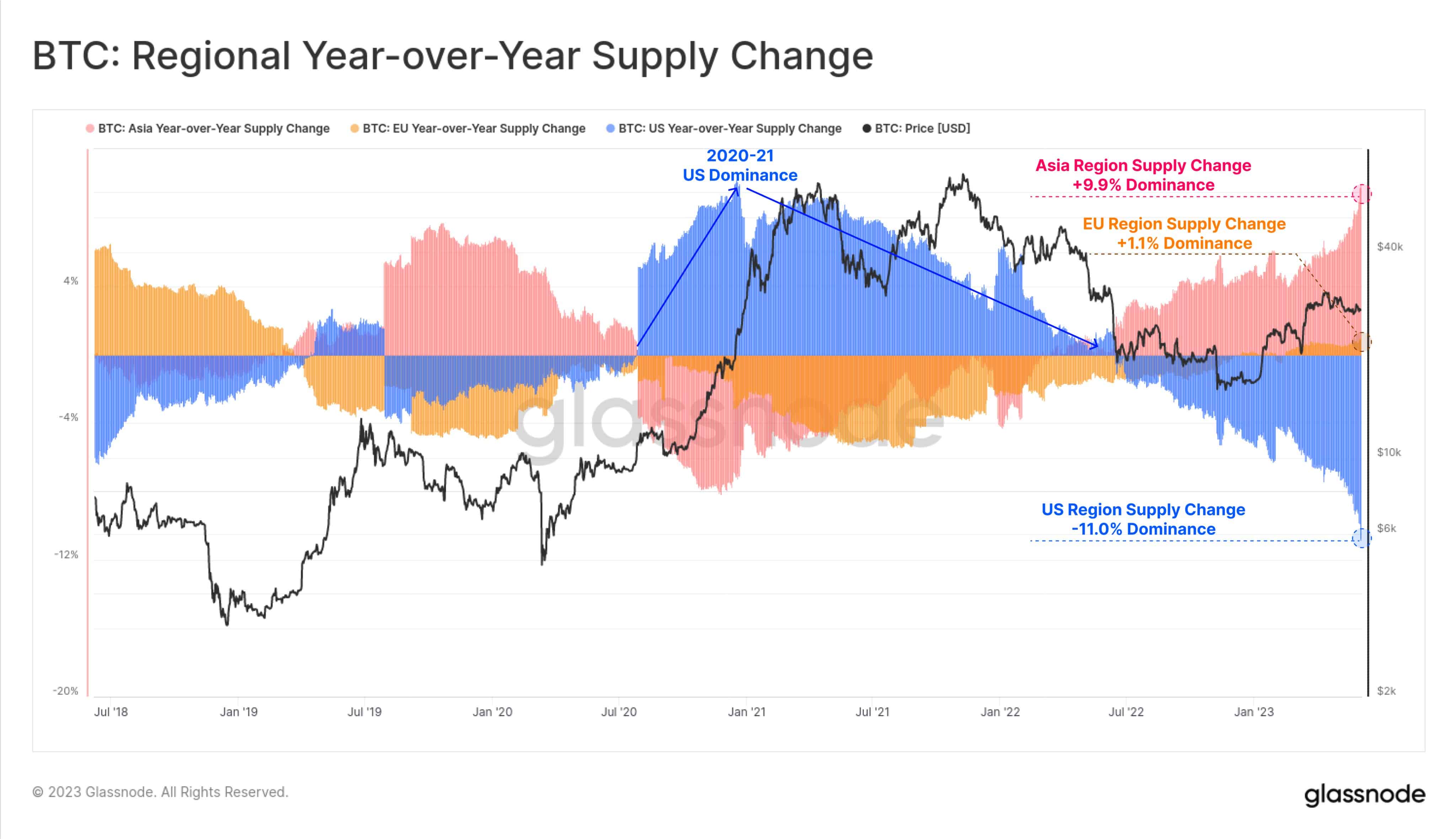

On-chain data from Glassnode shows that the East has been absorbing most of the Bitcoin (BTC) outflows from the West, over the last year. By West, we mean typically the US, as the supply in Europe remains almost flat. In its latest report, Glassnode mentions:

“A clear divergence is visible in the year-over-year BTC supply change based on geographical regions. The extreme dominance of US entities in 2020-21 has clearly reversed, with US supply dominance falling by 11% since mid-2022. European markets have been fairly neutral over the last year, whilst a significant increase in supply dominance is visible across Asian trading hours”.

Similarly, Glassnode makes an interesting observation regaqrding the shift in hands of Tether (USDT). It notes: “Tether has been more popular in countries where their own currency is not very strong and it’s harder to get US dollars. Also, because the US has been making stricter rules for digital assets, people are moving their money to other places, especially in the east”.

Bitcoin Price Volatility and Trading Volume

The Bitcoin (BTC) price tanked all the way close to $26,000, however, it has still managed to hold above the crucial supply of $26,300. As of press time, BTC is trading at $26,502 and has a market cap of $514 billion.

Following the SEC’s action on Binance, the BTC market depth on Binance.US has dropped by a staggering 70% in the last three days. this could continue to fall further as Binance.US announces suspending all USD deposits on the platform.

#BTC market depth on https://t.co/pup2WYms9R has collapsed in recent days. Both bid and ask depth have fallen over 70% since June 6.#LiquidityUpdate pic.twitter.com/cVVAL29vQR

— Kaiko (@KaikoData) June 8, 2023

Also, on-chain data provider Santiment explains that with rising market volatility, the unique BTC addresses interacting have surged past 1 million for the last two days.

📈 With volatility increasing market-wide, #Bitcoin's level of utility has picked up quite drastically. The amount of unique addresses interacting on the $BTC network has exceeded 1 million in each of the past two days, the first time since April 21st. https://t.co/QVfRuwUwXQ pic.twitter.com/k1jvEXDi7G

— Santiment (@santimentfeed) June 8, 2023

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs