Bitcoin (BTC) Testing $44K Support, Ethereum (ETH) Below $1400, On-Chain Metrics Improve

The overall cryptocurrency market continues to stay under pressure and has lost $400 billion over the last week slipping below $1.4 trillion. Slipping another 6% today, Bitcoin (BTC) is down 20% on the weekly charts and testing up crucial support levels at $44K.

At press time, BTC is trading at $44,692 with a market cap of $833 billion. Popular bitcoin analyst and trader Josh Rager notes that if the BTC price slips below $44K, its next support is at $40K.

Keeping an eye on the $44ks – tested once but a break below there likely sends price back down to $40k

And if price makes way to $40k – you know it's going to wick in the mid to upper $30ks

Could bounce here – but going to take it level by level/day by day pic.twitter.com/kGf12LshqG

— Josh Rager ???? (@Rager) February 26, 2021

However, CryptoQuant CEO Ki-Young Ju has stated that institutional players are likely to defend the $44K as a lot of players have entered at this stage. Despite Bitcoin remaining under pressure, the on-chain data for the world’s largest cryptocurrency continues to improve.

On Saturday, CoinGape reported that over 13K Bitcoins moved out of Coinbase to cold storage with Bitcoin liquidity further reducing. Another data from Glassnode now shows that miners have now stopped selling and rather started accumulating. On Friday, February 26, it was for the first time in 2021 that the net miner position turned positive.

Miners have stopped selling and started accumulating #Bitcoin

Yesterday was the first day since Dec, 27 when Miners Position change turned positive.

Miners were selling their bitcoins for two months.

Bullish. pic.twitter.com/S89iBcz4k3

— Lex Moskovski (@mskvsk) February 27, 2021

On the other hand, the “Bitcoin Reserve Risk” is only half-way through the peak of its 2017 levels. Analysts see it as a positive indicator and expect higher moves in coming months.

Updated #Bitcoin Reserve Risk

Can you feel what I'm feeling? ????

Big moves (jumps? leaps?) higher are coming in the next few months. Don't miss it.

**Not individual investment advice.**

h/t @glassnode pic.twitter.com/zlNf49RT6D

— Jeff Ross (@VailshireCap) February 27, 2021

Ethereum (ETH) Tanks Below $1400, Major Relief in Gas Fee

Just like Bitcoin, Ethereum (ETH) continues to remain under major pressure and has slipped below $1400 levels today. At press time, ETH is trading at $1393 with a market cap of $159 billion. With this drop, Ethereum has lost all its February 2021 gains and is currently at levels seen during the start of the month.

The Grayscale Ethereum Trust (ETHE) Premium has dropped 5.21% and is currently trading at a discount. However, Grayscale has made aggressive purchases this month in February buying a total of 239,769 ETH worth over $356 million. But since February 20, Grayscale’s net assets under management (AUM) have dropped by $1.5 billion.

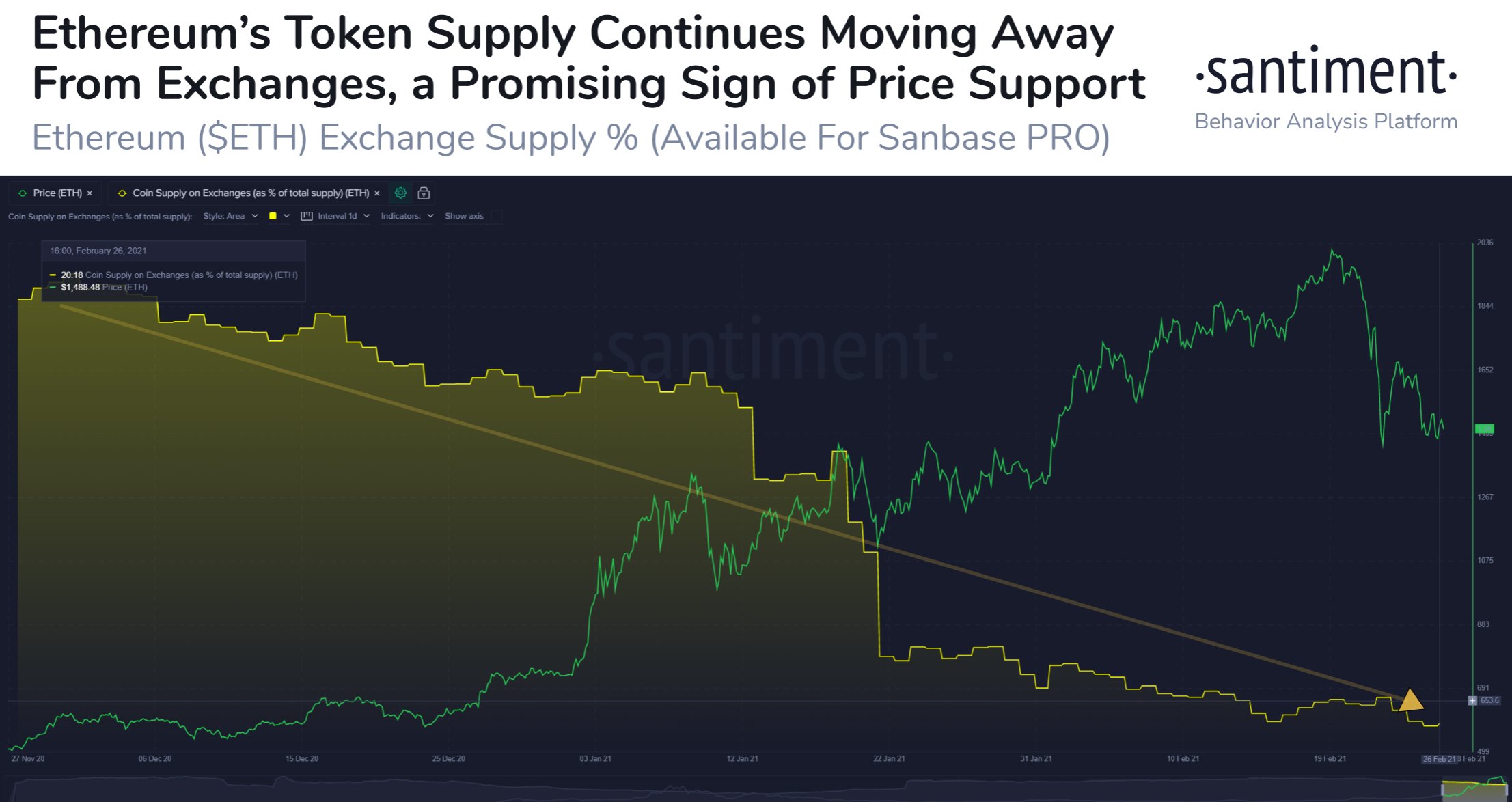

However, the on-chain data for the Ethereum blockchain also supports positive price action in the future. As Santiment reports, the Ethereum token supply continues moving away from exchanges.

Another important piece of data is that the Ethereum average transaction fee has significantly dropped from its all-time high above $37 last Monday.

???? A welcome sight for those who transact with #Ethereum-based assets: average fees have come back to earth after being at an #ATH $37.60 per transaction Monday. As $ETH ranged below $1,500 the past few days, avg. fees have returned to a reasonable $11.69. https://t.co/RytXIUIojJ pic.twitter.com/RHVIeh2EvB

— Santiment (@santimentfeed) February 27, 2021

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs