Bitcoin (BTC) to $53,000 As Exchange Balance Hits 2021-Low, Miners Taking Profits

Bitcoin (BTC) continues to inch further to the north moving closer all the way to $53,000. The world’s largest crypto is heading to $55,000 levels after giving a strong breakout and closing for the last week.

As of press time, Bitcoin (BTC) is trading 2% up at a price of $52,850 and a market cap just short of $1 trillion. Since the July 20 lows of under $30,000, Bitcoin has already gained more than 66% so far.

The recent bitcoin price rally comes as the BTC exchange balances hit a new 2021-low. Citing data from Glassnode, crypto-journalist Colin Wu reports that more than 30,000 bitcoins have moved out of Coinase over the last month. At the same time, the Coinbase balance has touched a new low of 700,000.

The Bitcoin balance of the current exchange hit a new low during the year, about 2.48 million BTC, the most outflow is Coinbase, and only Binance has a large inflow. pic.twitter.com/ec6fkdkV5g

— Wu Blockchain (@WuBlockchain) September 7, 2021

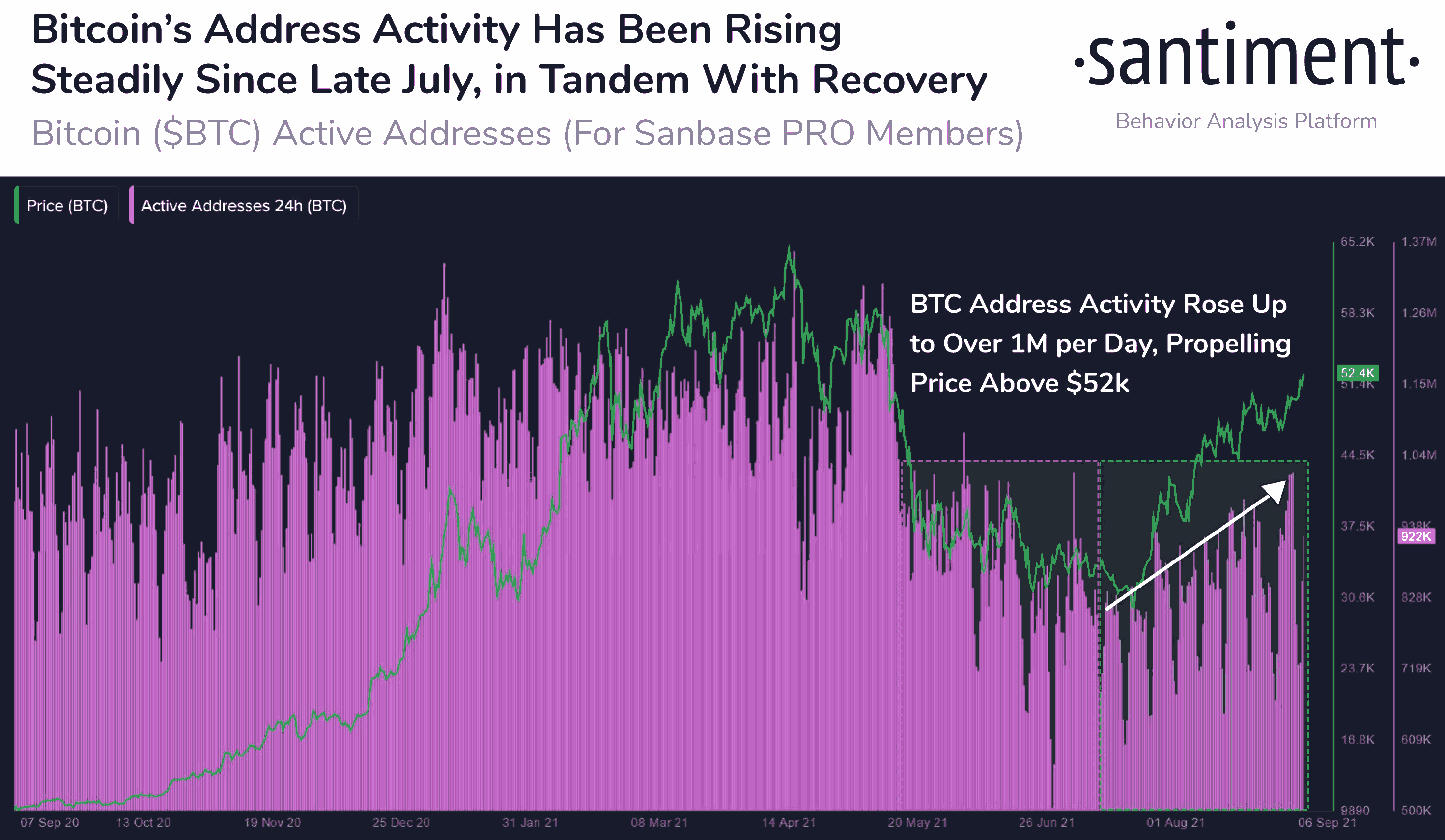

Furthermore, Bitcoin’s price recovery from the July lows comes along with the surge in the unique address activity. As per on-chain data provider Santiment, the daily address activity on the Bitcoin network has surged past 1 million.

Bitcoin Miners Are Selling

In its recent weekly report, Glassnode mentions that the Bitcoin hashrate has continued to surge steadily post the July lows. This happens as miners successfully manage to migrate from China and relocate to other parts of the world thereby getting their mining rigs online once again.

Besides, Glassnode also notes that amid the current global production constraints on ASIC chip manufacture, there isn’t much competition among miners. “As a result, miner USD revenue per hash has now risen back to July 2019 levels of $380k per Exahash, making operational miners exceptionally profitable on a historical basis,” notes Glassnode.

As Bitcoin moves past $50K levels, miners have resolved to profit booking. Over the last week, miners spent a total of 2,900 BTC worth $145 million.

Furthermore, the net miner position change in miner balances for Bitcoin has reached a neutral level. It will be interesting to watch out how far this Bitcoin price can continue and whether if Bitcoin manages to surge past its all-time high of $64,000 ahead this month.

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible