Bitcoin (BTC) To Slip Further Below $29K Today, Where’s The Bottom?

Bitcoin (BTC) is currently forming a bottom for the next bull market. As a result, bears continue to dominate the market, pushing the BTC price below $29,000 in the last 24 hours. Due to unfavorable conditions, traders expecting an end to the bear market may have to wait longer.

Bitcoin is in a bear market. Weak sentiments, a severe fall in the U.S. equity market, and whales’ cool-off are more likely to push prices lower again today. Moreover, the last year’s sell-off on May 19 poses another risk of the Bitcoin (BTC) price falling massively. Unfortunately, the last year’s trend seems to be exactly the same as this year as Bitcoin plunged massively between May 12-19.

Bitcoin (BTC) Faces a Massive Sell-Off Risk

Bitcoin price was expected to dive below the $30,000 this week, as explained in the last report published on May 18. A bottom near $27,500 can be witnessed. Moreover, the price action doesn’t seem to be good after the fall yesterday.

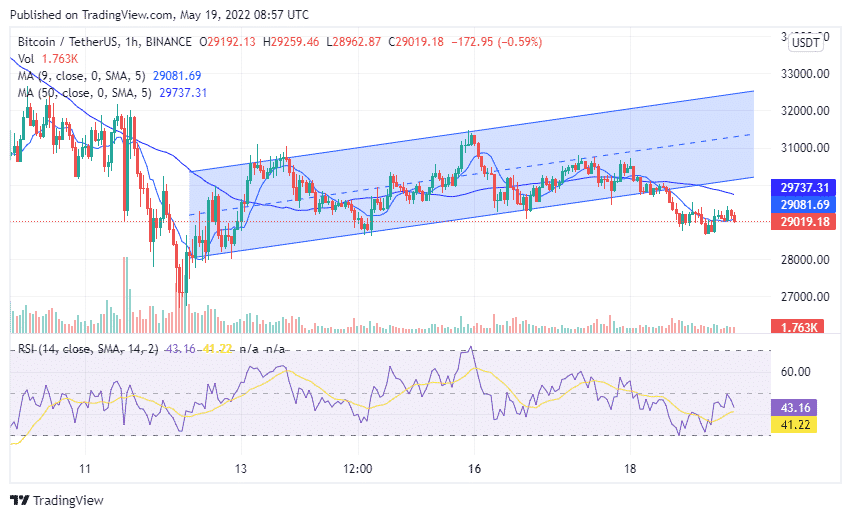

Bitcoin price has broken below the ascending channel in the 1-hour timeframe. Moreover, the 9-DMA and 50-DMA suggest the trend has diverted and a decline could be seen now. The RSI has retraced from the 50 and is currently moving downwards toward 40. Thus, the price action and indicator reveal a decrease in Bitcoin price in the next few hours.

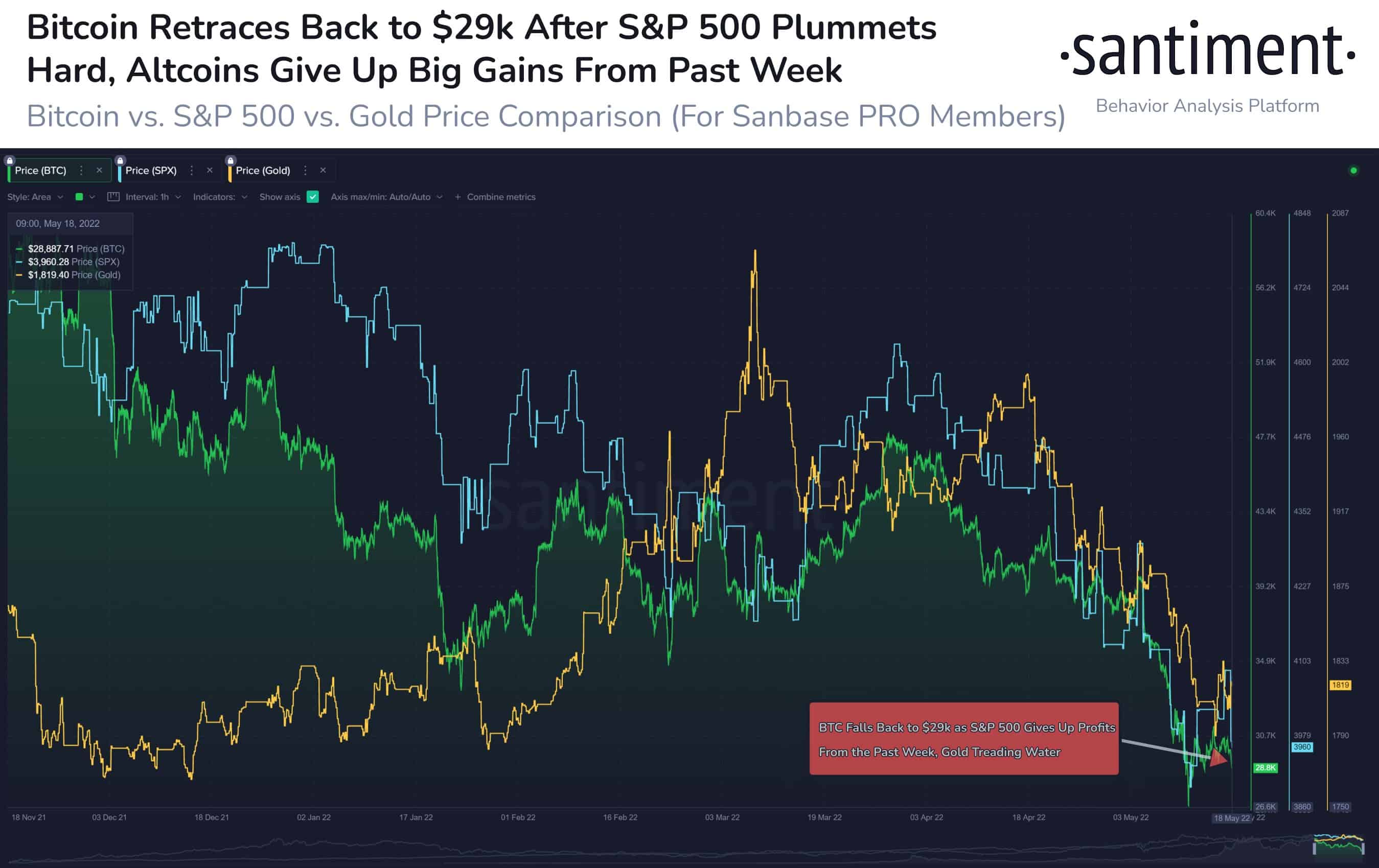

Bitcoin’s data by Santiment reveals weak market sentiment as traders remain uninterested. A more than 3% drop in S&P 500 on May 18 pulled Bitcoin price down with it. In fact, the correlation between Nasdaq-100 and Bitcoin remains tight since the start of 2022, making it a good indicator for predicting the Bitcoin price movement.

At the time of writing, Nasdaq-100 futures and other U.S. index futures are down nearly 1.5%. It indicates the Bitcoin price could possibly decline further. In fact, the Asian and European equity markets are in the red today, falling more than 2%.

Whales on the other hand appear to be waiting for a bottom to continue accumulation. Rekt Capital reported that Bitcoin’s RSI is now reaching the level where long-term investors benefited the most historically.

Bitcoin Price Plunges Below $29,000

Bitcoin price is trading at $28,893, down nearly 4% in the last 24 hours. The market pressure and exchange inflows suggest a decline in price to near the support level of $27,700. Meanwhile, short liquidations are expected in altcoins as traders have dropped into a major shorting trend.

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?