Bitcoin (BTC) Whale Accumulation Continues, Millionaire-Tier Holds ~50% of Total Supply

Before its recent move above $40,000, Bitcoin (BTC) has been consolidating for a while in the $30K range. While many retail investors remained skeptical over the last few weeks, the BTC whales have been squeezing the supply silently.

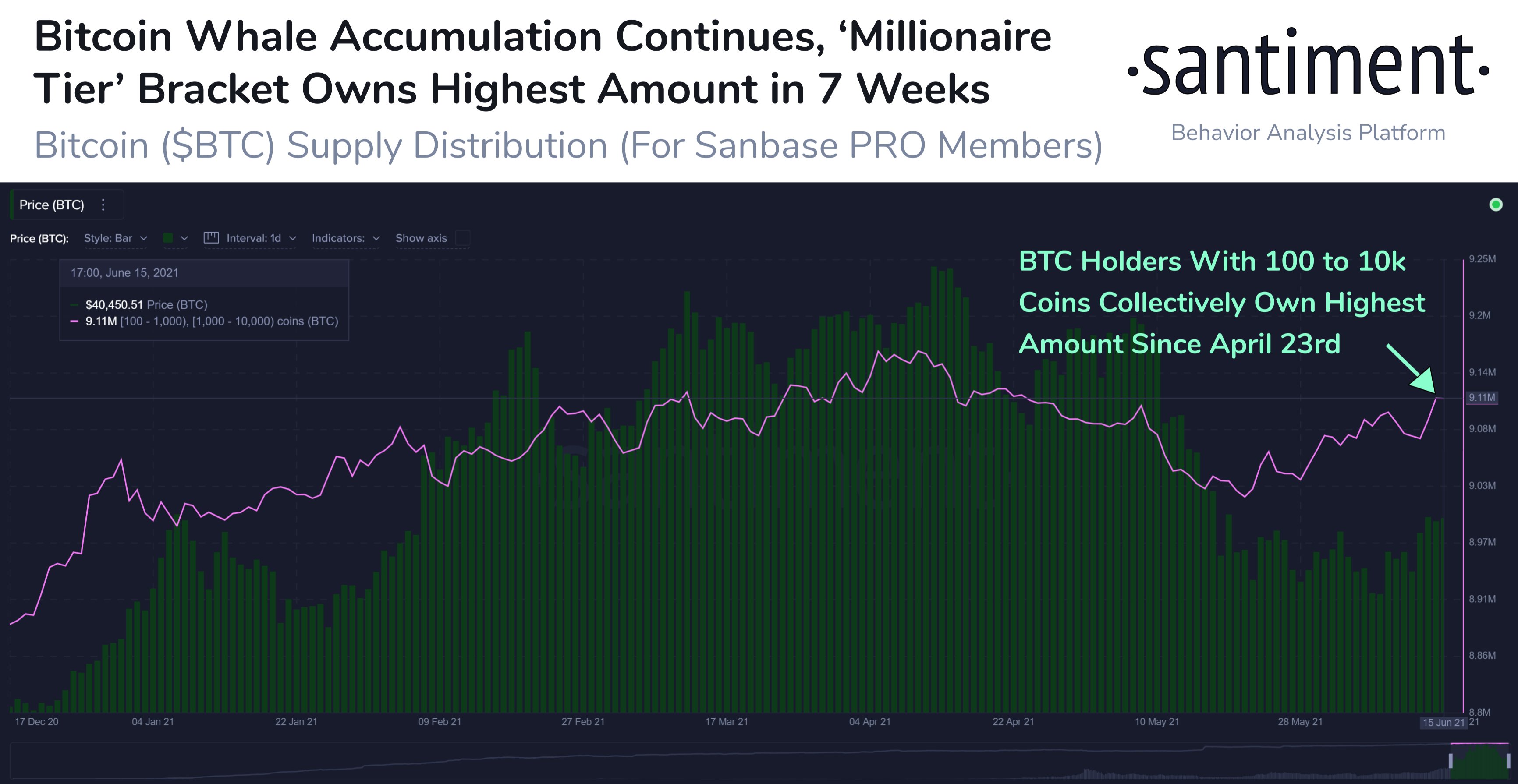

As per data on Santiment, Bitcoin ‘millionaire-tier’ addresses holding between 100-10,000 BTC have added a massive 90,000 Bitcoins just within the last 25 days. The Bitcoin holdings of this category of whales have reached a 7-month high taking the total holdings to 9.11 million. These Bitcoin whales hold around 50% of the total Bitcoin supply worth a massive $370 billion.

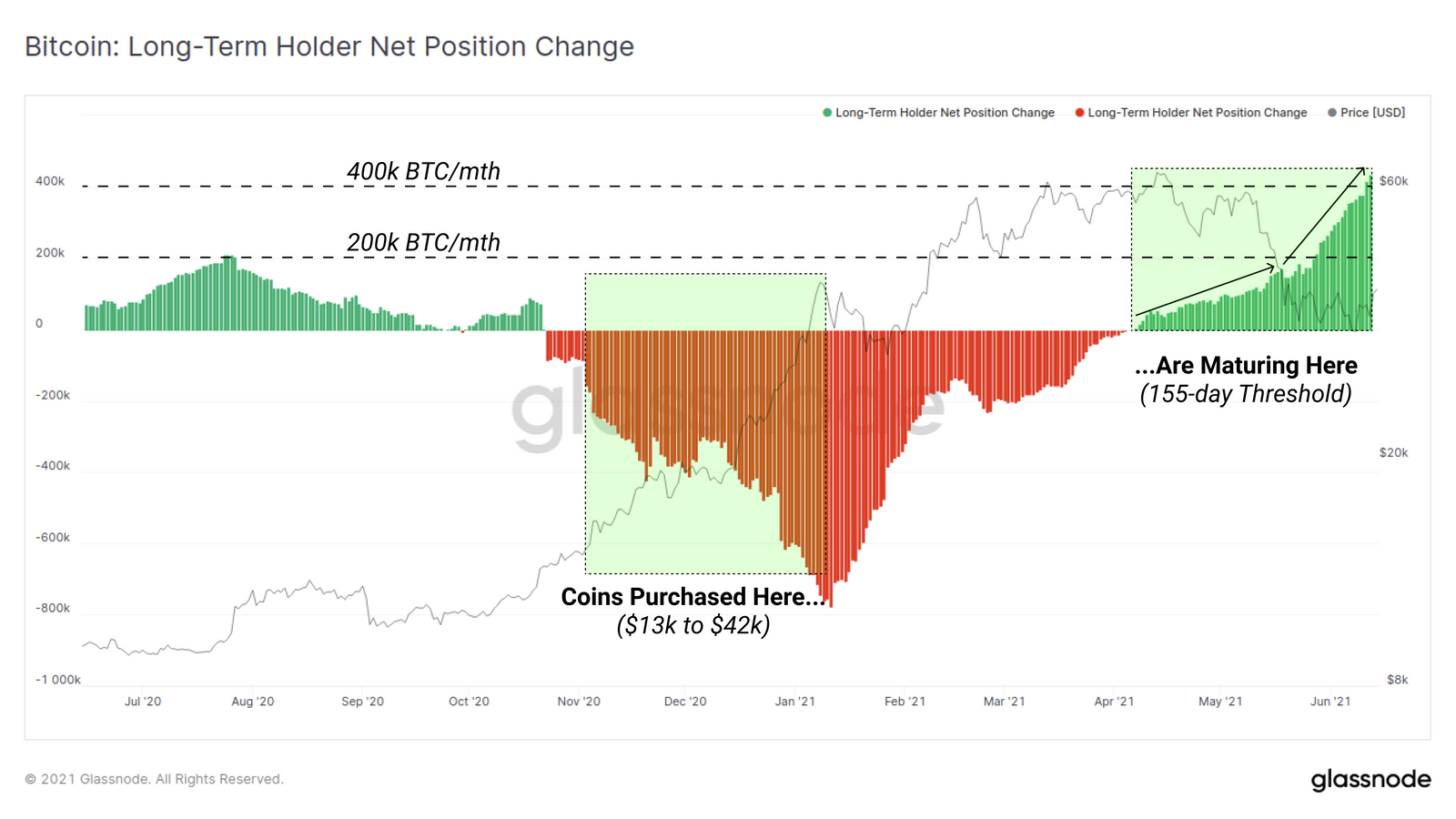

On the other hand, data from Glassnode shows that Long-Term Holders (LTHs) continue to hold their Bitcoin supplies tightly. These long-term holders include buyers who purchased BTC 155 days before or before January 10, 2021. Thus, the rate of coins maturing during this timeframe has accelerated.

It means that large quantities of the BTC with the long-term holders were purchased in the early bull and remained unspent. The existing rate of maturation i.e. LTHs holding for more than 155 days, has shot up 100% to above $400K/month.

Global Economic Macros Supporting Bitcoin Accumulation

Several hedge funds and billionaire investors are increasingly looking at Bitcoin with respect to the current macro-economic outlook. Recently, billionaire Paul Tudor Jones said that he holds 5% of his portfolio in Bitcoin.

The billionaire is keen on further increasing his holdings if the Federal Reserve doesn’t act upon the rising inflation and consumer prices. Tudor Jones said:

“If they treat them with nonchalance, I think it’s just a green light to bet heavily on every inflation trade. If they say, ‘We’re on [the] path, things are good,’ then I would just go all in on the inflation trades. I’d probably buy commodities, buy crypto, buy gold.”

Moreover, as per the recent survey from Intertrsut Global, traditional hedge funds are willing to increase their BTC exposure over the next five years. It looks like the confidence for Bitcoin as a hedge asset among traditional investors is brewing up fast.

Intertrust Global surveyed the CFOs of nearly 100 hedge funds of which 98% showed interest in investing 7.2% of the total assets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs