Bitcoin (BTC) Whales Continue to Accumulate At Every Dip, Price Surge Ahead?

The world’s largest cryptocurrency Bitcoin (BTC) continues to trade under $26,000 as it enters a phase of strong consolidation. However, on-chain data shows that Bitcoin (BTC) whales continue to accumulate at every dip.

As per the report from Santiment, Bitcoin whales have accumulated close to 60,000 BTC amid the recent price correction of 10% over the past few weeks. The report notes:

“As #altcoin madness has ensued, there quietly is a #bullish divergence between #Bitcoin‘s accumulating whales and falling price. With whale holdings moving up by ~1K $BTC per day while prices fall, there is reason to believe a strong rebound can occur.”

On the other hand, the Bitcoin market dominance has also moved closer to 50%. This happens amid the recent crash in the altcoin prices last week following the high-handed SEC action. For the first time since April 2021, Bitcoin’s (BTC) dominance in the market reached 50%.

Bitcoin dominance usually rises above 50% typically suggesting bear market characteristics as investors move money into safe haven large-cap coins. During the bear market of 2018, the BTC dominance had reached above 50%.

Bitcoin Miners Moving Coins to Exchange

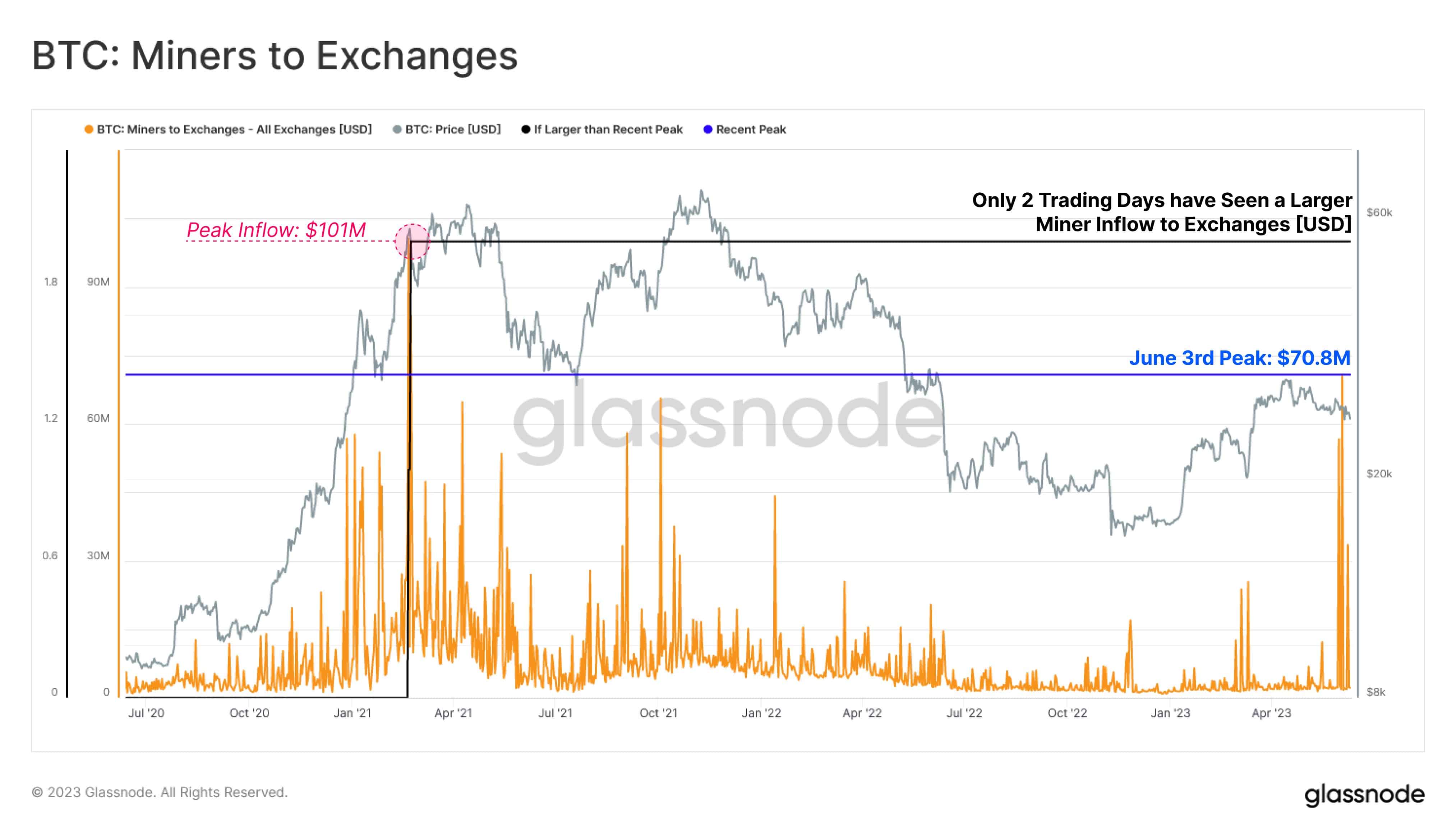

On-chain data also suggests that Bitcoin miners are moving coins on exchanges. Over the past week, Bitcoin miners have been transferring a considerable number of coins to exchanges, reaching a notable inflow of $70.8 million. This stands as the third-largest inflow ever recorded, coming in $30.2 million lower than the highest inflow of $101 million observed during the main bull market in 2021.

However, crypto exchanges like Binance and Coinbase have seen some outflows over the past week. As per data from Nansen, over the last week, there has been a significant outflow of multi-chain assets (excluding Bitcoin) from Binance, amounting to $2.376 billion. Binance US experienced a net outflow of $124 million, while Coinbase saw a net outflow of $1.787 billion, and Coinbase Custody recorded a net outflow of $739 million.

Bitcoin is likely to continue to trade with a support of $25,000 and an upside resistance of $26,100 in the time ahead. Also, the BTC long-term holders continue to hold their supplies and have been indifferent to the recent SEC action.

Ideally with #Bitcoin, you'd want to see a sweep of the lows. #Bitcoin tested the resistance at $26.1K, but couldn't break through it.

CME gap at $26.5K likely to get filled in the next weeks.

Bids at $25K, flip at $26.1K also a continuation trigger. pic.twitter.com/AwbaVBsglT

— Michaël van de Poppe (@CryptoMichNL) June 11, 2023

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?